World Liberty Finance Launches WLFI Markets Crypto Lending Platform

World Liberty Finance has launched WLFI Markets, a crypto borrowing and lending service powered by the decentralized Dolomite protocol.

The new service allows users to lend and borrow in USD1, World Liberty’s dollar-backed stablecoin with support for additional collateral assets including WLFI, ETH ETH $3 099 24h volatility: 0.7% Market cap: $374.03 B Vol. 24h: $21.89 B , USDC, USDT, and cbBTC.

According to a press release, WLFI Markets lending services are active via web application as of Jan. 12 with additional support, including a mobile app and additional features expected to roll out over the next 18 months.

WLFI Pivots to Consumer-facing Application Services

The launch of WLFI Markets signals World Liberty’s first foray into user-facing applications. The firm’s prior focus, since it was launched by a group led by Eric Trump and Donald Trump Jr. in 2024, has been the development and issuance of its USD1 dollar-backed stablecoin and WLFI utility token.

With Markets, World Liberty is poised to take advantage of the firm’s successful entry into the stablecoin arena. As Coinspeaker reported on Jan. 8, 2026, USD1’s market capitalization has surged from $128 million to more than $3.37 billion in the past year.

According to a post on X.com from World Liberty Financial, WLFI Markets is intended to be a unified WLFI interface to a range of products and services that will expand over time with more third party application, network, and product integrations planned.

The firm also applied for a national banking charter on Jan. 7, reportedly having submitted its application to the Office of the Comptroller (OCC) to establish the World Liberty Trust Company (WLTC).

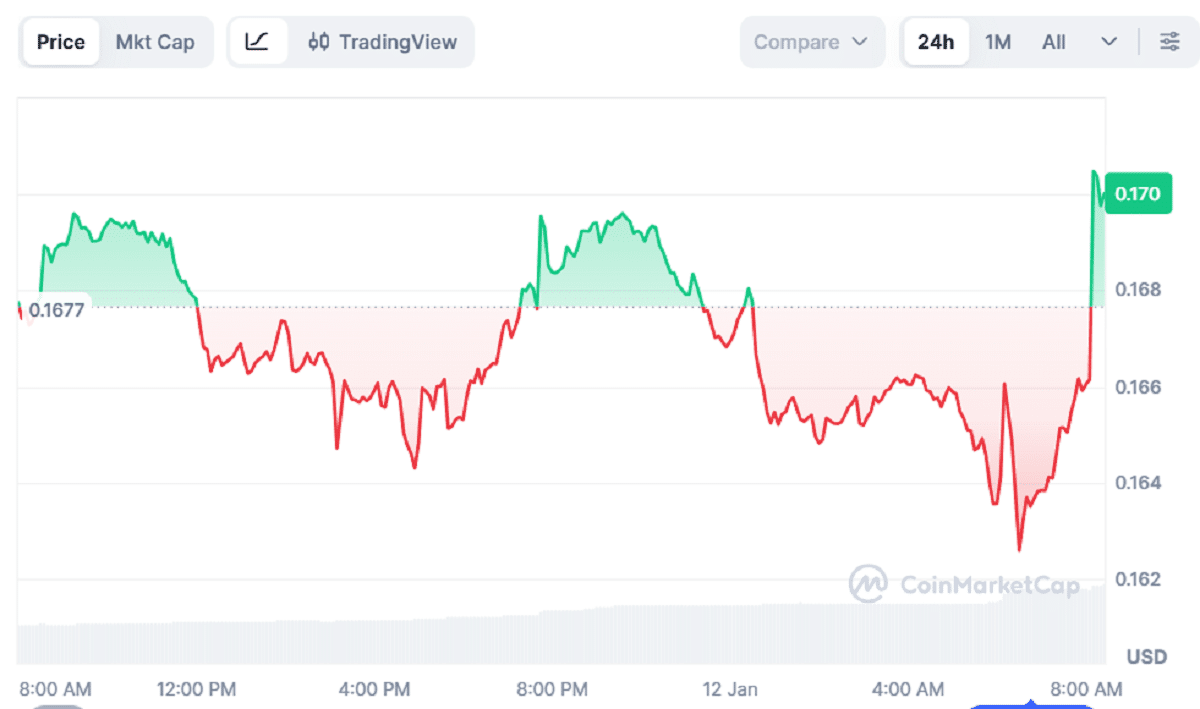

WLFI token’s price shot up from $0.1659 to $0.1704 as news of the WLFI Market launch broke before settling back to $0.1680 as the trading day began in US timezones. As of the time of this article’s publication, WLFI is down 0.43% over the past 24 hours.

WLFI Token remains largely unchanged over 24 hours despite the launch of its new Market service | Source: CoinMarketCap

The post World Liberty Finance Launches WLFI Markets Crypto Lending Platform appeared first on Coinspeaker.

You May Also Like

SEC Backs Nasdaq, CBOE, NYSE Push to Simplify Crypto ETF Rules

United Kingdom CFTC GBP NC Net Positions declined to £-42.4K from previous £-25.8K