MicroStrategy changed its name to "Strategy", and its Bitcoin holdings almost doubled in Q4, and it wants to be a Bitcoin "smart leverage"

Author: Weilin, PANews

In the early morning of February 6, Beijing time, MicroStrategy held a conference call for its fourth quarter 2024 earnings and announced a rebranding plan. The company was officially renamed "Strategy" and called itself "the world's first and largest Bitcoin fund management company."

The Q4 financial report showed that the company's net loss was US$670.8 million, and its operating expenses for the quarter (including impairment losses on Bitcoin holdings) reached US$1.103 billion, a year-on-year increase of 693%.

Strategy's Bitcoin holdings have almost doubled in just three months. At the same time, Strategy has formulated KPI indicators, namely annual "BTC Gain" and "BTC $ Gain", and set a target of $10 billion for annual "BTC $ Gain" in 2025. At the meeting, the company's founder and CEO Michael Saylor also revealed a new strategy to attract "a large number of investors".

Q4 earnings report: Bitcoin holdings almost doubled in three months

In the fourth quarter of 2024, Strategy's net loss was $670.8 million, or $3.03 per share. In comparison, the company achieved a profit of $89.1 million, or 50 cents per share, in the same period last year. The loss was mainly caused by $1.01 billion in impairment charges on Bitcoin holdings, a significant increase from the $39.2 million impairment charge in the same period last year.

Operating expenses (including impairment losses on Bitcoin holdings) for the quarter reached $1.103 billion, up 693% year-on-year. As of December 31, 2024, the company had cash and cash equivalents of $38.1 million, down from $46.8 million in the same period last year.

While most investors will focus on Strategy's Bitcoin assets, Strategy also reported earnings from its traditional software business. Total software revenue in the fourth quarter was approximately $121 million, down 3% year-over-year. Total revenue for the full year 2024 was approximately $464 million, down 7% year-over-year.

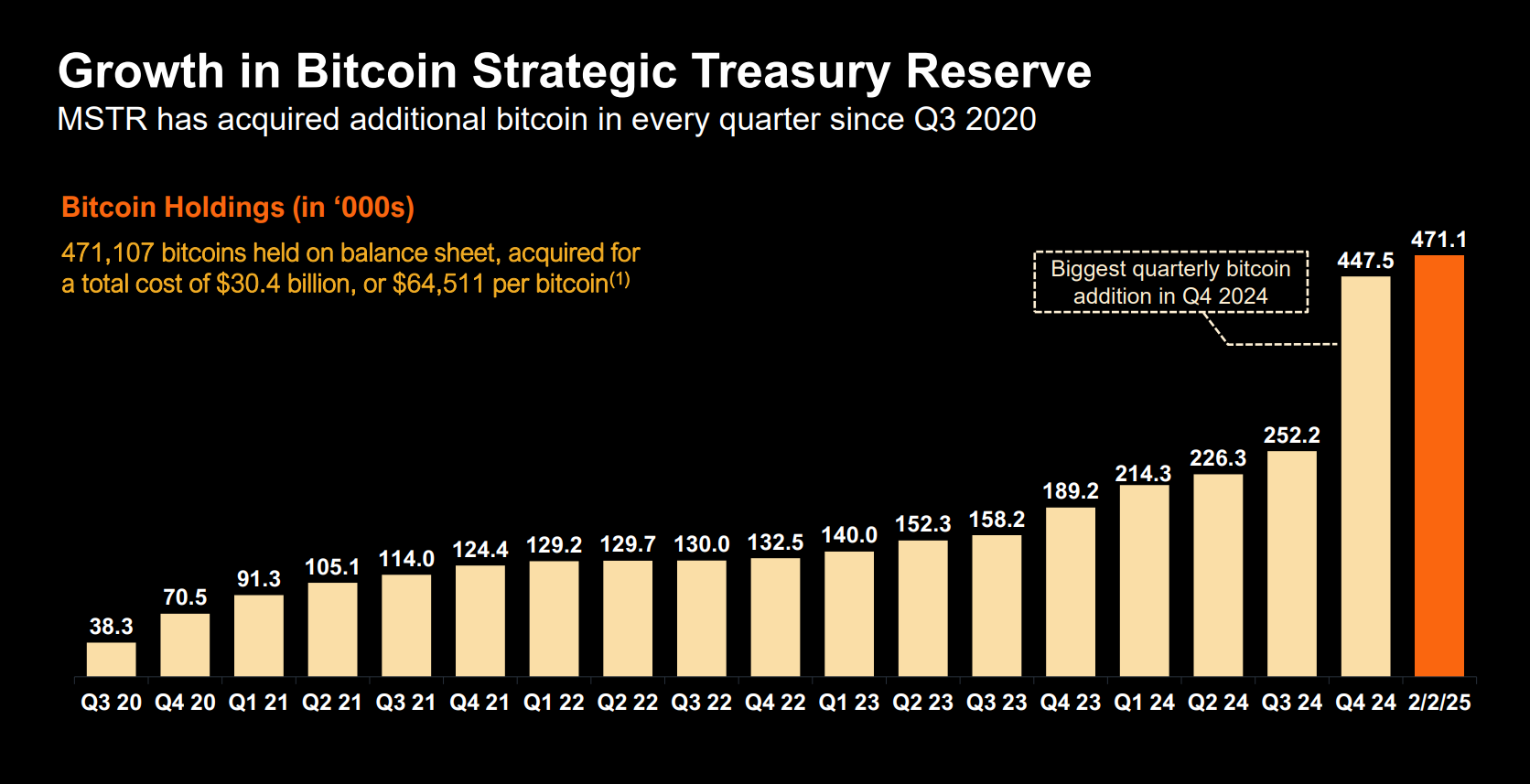

According to the financial report, the most striking thing is that its already huge Bitcoin holdings have almost doubled in just three months. As of January 24, Strategy currently holds 471,107 Bitcoins with a market value of approximately US$44 billion and a total cost of US$30.4 billion. The fourth quarter was the quarter with the largest quarterly increase in the company's Bitcoin holdings, with a total purchase of 218,887 Bitcoins at a cost of US$20.5 billion. In 2024, the company purchased 258,320 Bitcoins at a total purchase cost of US$22.1 billion and an average price of US$85,447.

Strategy has added Bitcoin to its balance sheet every quarter since August 2020, with more than 50 announcements. This time, the company reported a 2024 return of 74.3%, a metric used to assess the performance of strategies investing in Bitcoin.

According to the meeting document, "BTC Yield is a key performance indicator (KPI) that represents the percentage change in the ratio between the number of Bitcoins held by the company and its assumed diluted outstanding shares over the period." Strategy has raised its annual BTC yield target for the next three years from a range of 6%-8% to 15%. The company's BTC yield in the fourth quarter was 2.9%, while the BTC yield in the third quarter was 5.1%.

Strategy also announced another new key performance indicator (KPI), namely annual “BTC Gain” and “BTC$ Gain”, and set an annual “BTC$ Gain” target of $10 billion by 2025.

BTC Gain represents the number of Bitcoins held by the Company at the beginning of a period multiplied by the BTC Yield for that period. BTC $ Gain represents the USD value of the Bitcoin Gain, calculated by multiplying the Bitcoin Gain by the Bitcoin market price on the Coinbase exchange at 4:00 PM EST on the last day of the applicable period.

Bitcoin’s “Smart Leverage”

In order to better reflect its Bitcoin strategy, MicroStrategy announced that the company will now conduct business under the Strategy brand. The announcement stated that Strategy is the world's first and largest Bitcoin reserve company, as well as the largest independent listed business intelligence company, and is one of the components of the Nasdaq 100 Index. The new logo contains a stylized "B" letter, symbolizing the company's Bitcoin strategy and its unique position as a Bitcoin fund management company. The main color of the brand has now been changed to orange, representing energy, wisdom and Bitcoin.

In its third-quarter earnings report released last October, Strategy unveiled its "21/21 Plan," which aims to raise $42 billion in funds over the next three years, including $21 billion from equity financing and another $21 billion from the issuance of fixed-income securities.

Strategy's pace of capital raising and Bitcoin purchases accelerated significantly in the fourth quarter of 2024, with the company raising $15 billion through equity offerings and $3 billion through convertible bonds in less than two months.

"We have completed $20 billion of our $42 billion capital plan, well ahead of our original timeline, while leading the digital transformation of financial market capital," CEO Phong Le said in the announcement. "Looking ahead to the remainder of 2025, we are well positioned to further enhance shareholder value by leveraging strong support from institutional and retail investors for our strategic initiatives."

In addition, at the earnings conference, company founder Michael Saylor pointed out the 45% volatility gap between Bitcoin and traditional markets, and revealed a new strategy to attract "a large number of investors."

“We design our business to preserve volatility,” Saylor said, contrasting Strategy’s approach with traditional corporate treasury operations, which typically try to minimize volatility.

This creates a roughly 45% gap between traditional assets like the SPDR S&P 500 ETF and Invesco QQQ Trust, which have volatility levels between 15-20 and Bitcoin, which has volatility levels between 50-60. The Strategy’s common stock targets volatility even higher than Bitcoin itself, aiming to hit 80-90 volatility levels while maintaining what Saylor calls “intelligent leverage” through a combination of equity issuance and convertible bonds.

“There are a lot of investors who want that volatility. They may not want the extreme leverage of MicroStrategy, or even the raw, unadulterated volatility of IBIT or BTC, but Strike (Strategy’s perpetual preferred stock, STRK) is attracting a new group with different return characteristics and volatility characteristics.”

The Strike preferred stock that Saylor refers to offers an 8% dividend yield and has Bitcoin exposure. On January 27, according to official news, MicroStrategy announced that, subject to market and other conditions, it intends to issue 2,500,000 shares of MicroStrategy Series A perpetual exercise preferred stock. MicroStrategy intends to use the net proceeds from this offering for general corporate purposes, including the purchase of Bitcoin and as working capital.

The shares were then sold at $80 per share, 20% below the market price, effectively pushing the buyer's yield to 10%.

At present, with the rebranding of Strategy and the significant growth of its Bitcoin holdings, the company has demonstrated its ambition to become one of the world's largest Bitcoin reserve companies. In the future, whether Strategy can continue to realize returns from investing in Bitcoin while flexibly making strategic arrangements will be the key to its success.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

Cashing In On University Patents Means Giving Up On Our Innovation Future