500 Million XRP Removed From Supply Until 2028 – How Will This Affect Price?

XRP price has mounted a notable recovery, climbing above the $2 level amid strengthening momentum across the broader crypto market. Improved risk sentiment has supported the move; however, XRP’s rise is not solely driven by market conditions.

The altcoin’s ability to reclaim $2 has also allowed XRP to briefly flip BNB in market capitalization rankings. This development marks a resurgence in investor interest following weeks of consolidation.

Still, maintaining this position depends on continued structural support rather than short-lived speculative flows.

XRP Holders Show Strength

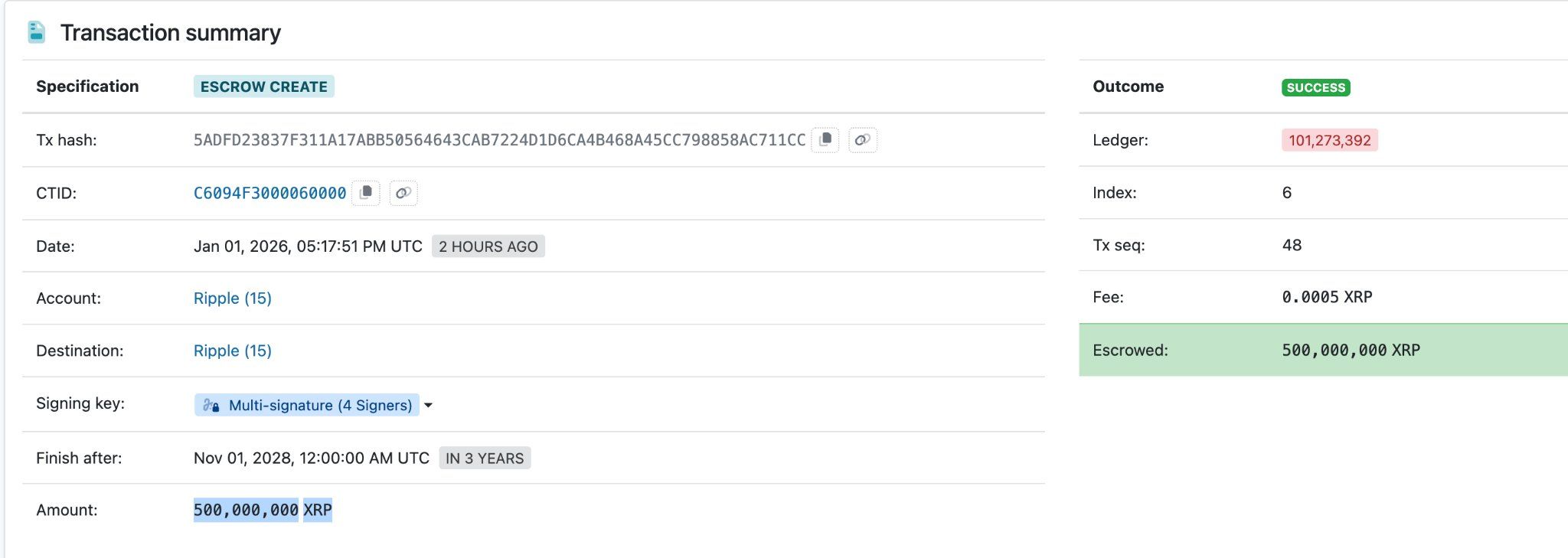

On-chain data highlighted that over 500 million XRP were recently transferred into an escrow mechanism designed to lock supply until 2028. This action removes more than $1 billion worth of XRP from circulation. Such supply reduction alters market conditions by limiting available liquidity during periods of rising demand.

Escrow-based supply locks tend to have a stronger price impact when demand remains stable. XRP benefits from persistent institutional and enterprise-focused interest.

With fewer tokens available for trading, even modest increases in demand can lead to outsized price reactions, creating conditions for a potential supply shock.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

500 Million XRP Escrowed. Source: X Finance Bull

500 Million XRP Escrowed. Source: X Finance Bull

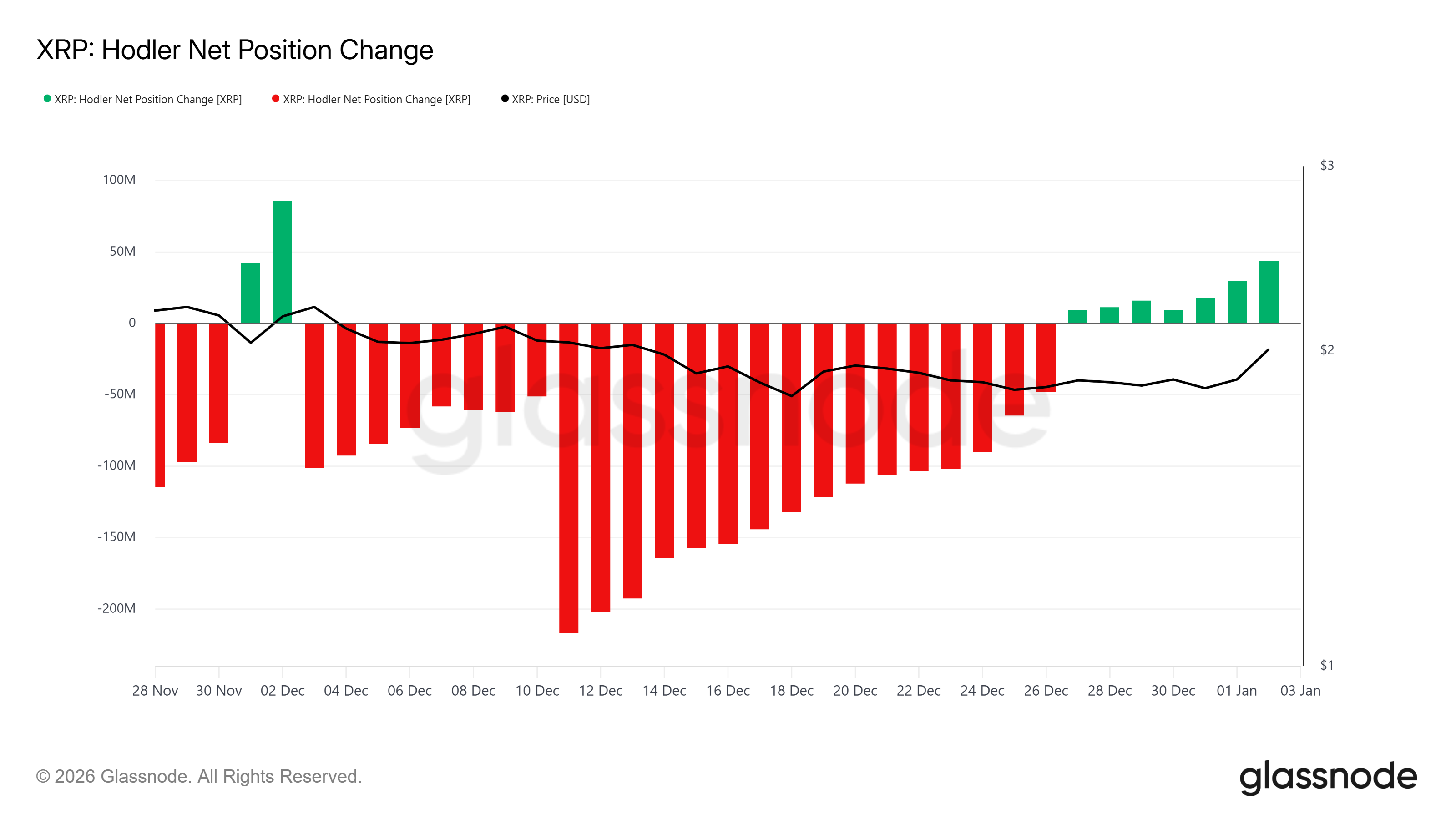

Macro momentum indicators further strengthen the bullish narrative. The HODLer net position change metric shows long-term holders shifting back into accumulation. Over the past week, wallets classified as LTHs have consistently increased their XRP balances.

This accumulation marks a clear reversal from nearly a month of steady selling pressure. Long-term holders typically reduce exposure during uncertainty and re-enter when confidence returns. Their renewed buying suggests belief in XRP’s sustained upside rather than a short-term price spike.

Older wallet activity often provides structural support during rallies. These holders tend to sell less aggressively during pullbacks, reducing downside volatility.

As LTH accumulation increases, price stability improves, allowing XRP to build higher support levels with reduced risk of sharp corrections.

XRP HODLer Net Position Change. Source: Glassnode

XRP HODLer Net Position Change. Source: Glassnode

XRP Price Reaches Critical Level

XRP price is up 6.7% over the last 24 hours, trading near $2.00 at the time of writing. While reclaiming this level is a psychological milestone, confirmation remains essential. XRP must secure $2.00 as support to sustain bullish momentum and avoid a false breakout.

Immediate resistance stands at $2.03. A decisive move above this level, followed by consolidation, would confirm a bullish continuation pattern.

If achieved, XRP could extend gains toward $2.10, where additional liquidity and historical resistance reside.

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingView

However, downside risks remain present. Short-term holders who have waited nearly three weeks for favorable exit conditions may begin profit-taking.

If selling pressure intensifies, XRP could slip back to $1.93. Losing this support would expose the price to $1.86, invalidating the bullish thesis and restoring a neutral-to-bearish outlook.

You May Also Like

The Channel Factories We’ve Been Waiting For

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference