$1 billion fled in a single week, daily active users fell by nearly 60%, Solana faces MEME retreat and inflation variables

Author: Frank, PANews

With $1 billion of pledged funds withdrawn in a single week and daily active users plummeting by nearly 60%, the Solana ecosystem is experiencing its most severe test in the past six months. With more than $600 million of chips dumped from platforms such as Pump.fun, and validators’ confidence in pledge shaken by the SIMD proposal, coupled with the vacuum period after the MEME craze, the SOL token plummeted 57% in 40 days, leading the decline of mainstream currencies.

When the on-chain data changes and the market sell-off form a death cross, how will this public chain giant, once regarded as the "Ethereum killer", survive the double stranglehold of ecological reconstruction and capital flight?

The withdrawal of pledge funds is accelerating: $1 billion of funds fled in a single week

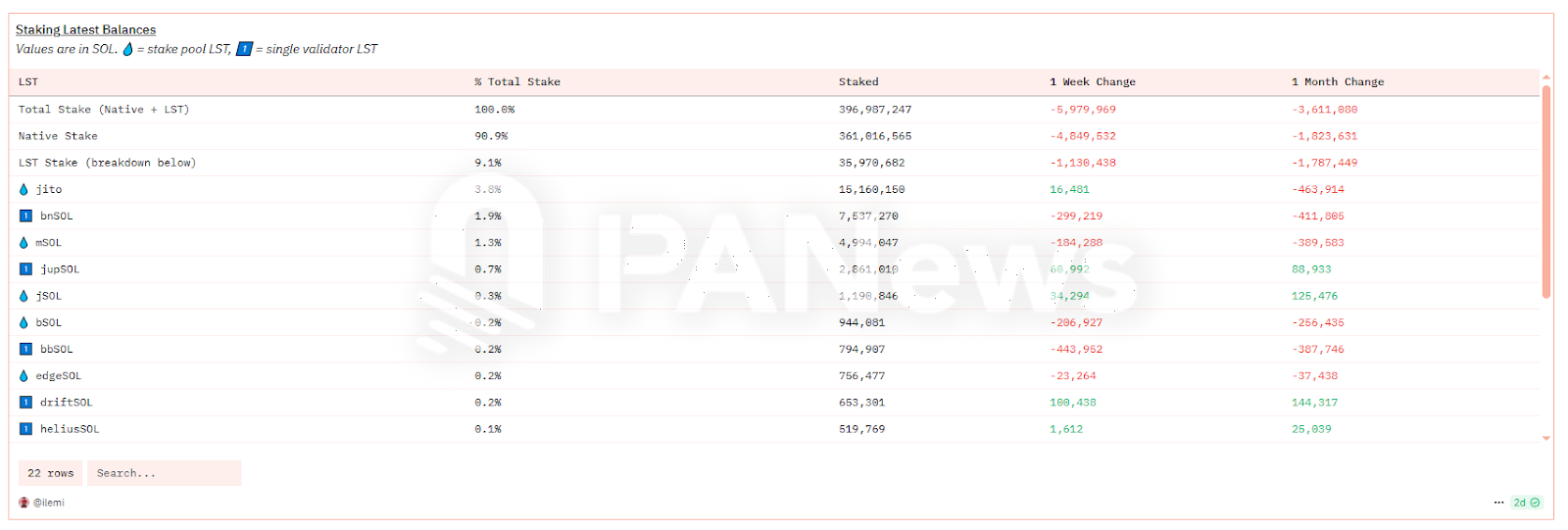

In the past week, the amount of Solana tokens pledged decreased by 5.97 million tokens, and in the past month, it decreased by 3.61 million tokens. This shows that in order to avoid the risk of decline, many large stakers began to withdraw SOL funds in the past week. The weekly decline rate was about 1.5%, and the reduction in pledged funds was about US$1 billion.

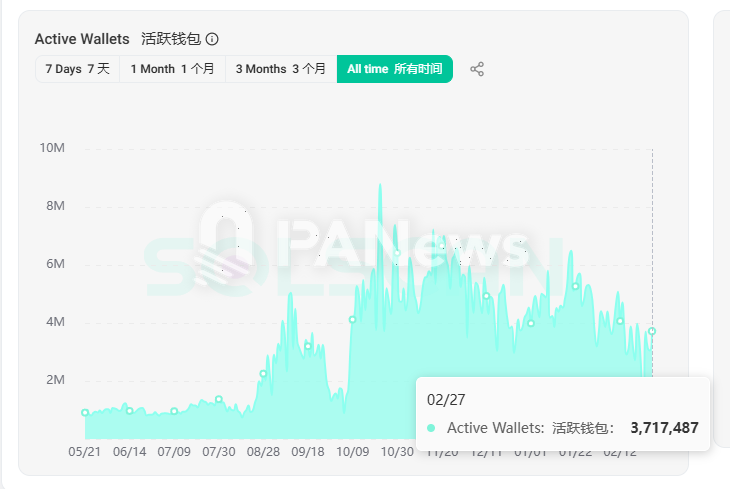

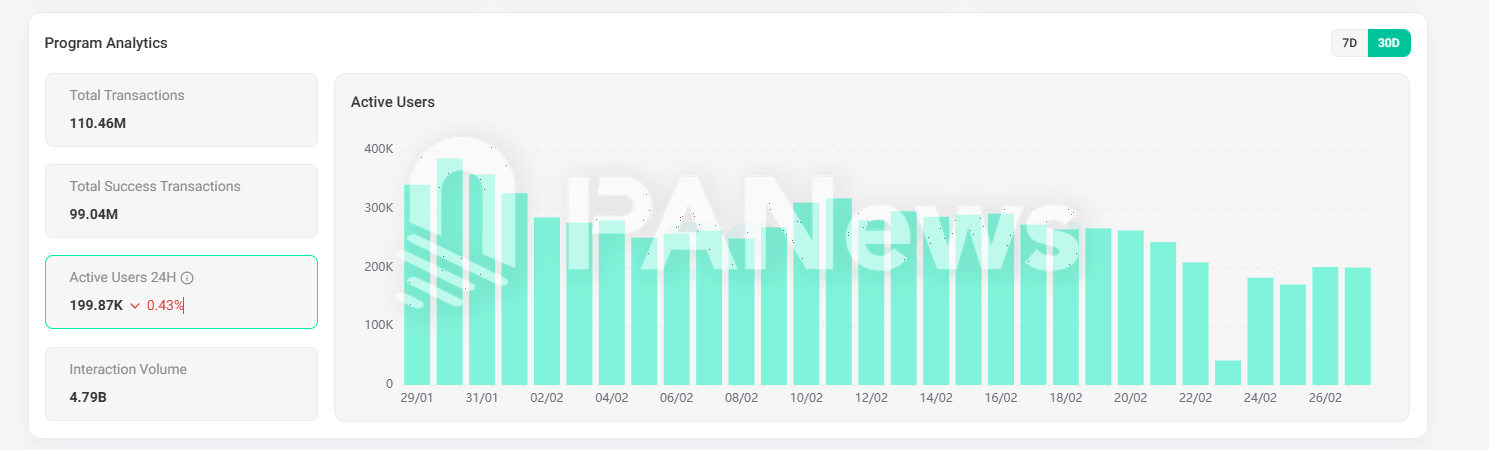

From the perspective of the changes in the Solana network, on February 23, the Solana network underwent drastic changes in the network. The number of active users and new wallets on the same day dropped by about 90%, and then returned to normal levels. This drastic fluctuation is most likely caused by the collective downtime or shutdown of some trading robots on the chain that day, but it also exposed the problem of too high a proportion of robots in the Solana network from this perspective.

Data as of February 28 shows that the current level of active users has also dropped significantly from the peak in October last year. On October 22, the number of daily active addresses reached a peak of 8.78 million, and on February 27, the data dropped to 3.71 million, a decrease of about 58%.

Five whales concentrated their selling: $317 million in chips hit the market

Recently, several large SOL holders chose to sell their tokens or release their pledges. PANews conducted an incomplete statistics based on the information exposed on social media. Five whales sold about 2.09 million SOL in a short period of time, worth about $317 million, with an average selling price of about $151.

Among them, the AMekyY73RJBd4urgZ2HvWV8yFzvk4nRsGmahuJcWiQri address has unstaked a total of 236,000 tokens, and only 60,000 tokens have been sold so far. It is unknown whether the remaining tokens will continue to be sold in the near future.

In addition, Pump.fun is also a major seller on the chain. As of February 28, Pump.fun has sold a total of about 3.02 million SOL tokens, with a total cash amount of about US$610 million. In the past month, Pump.fun has sold a total of 440,000 SOL tokens, worth about US$78.39 million. This has made the already panic market even worse.

However, as the popularity of MEME declined, Pump's data continued to decline. On February 23, the number of active users of Pump.fun dropped to 41,000, and recovered to around 180,000 the next day. The overall data has dropped by more than half in the past month.

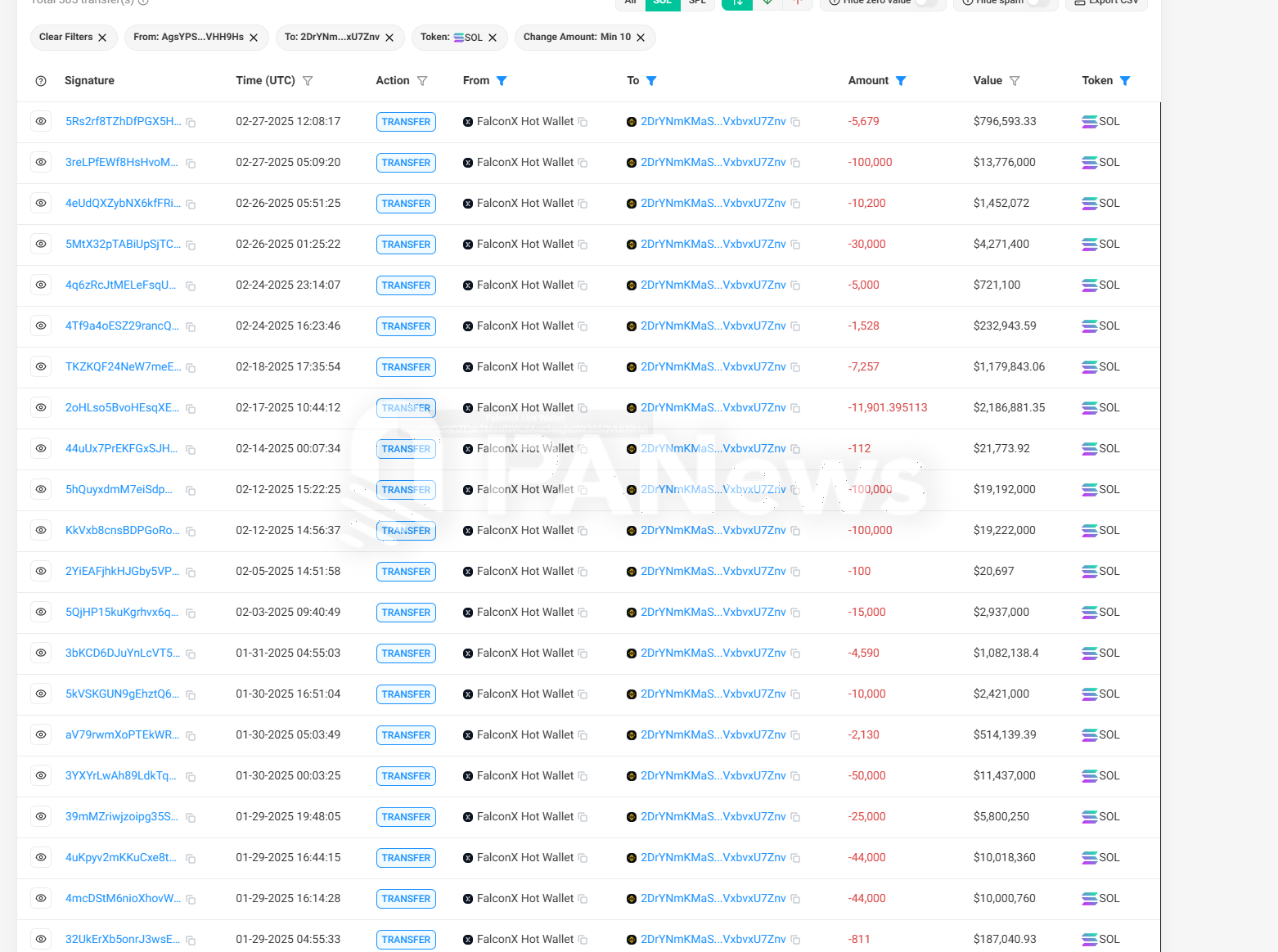

FalconX, a crypto brokerage service provider, is also one of the important channels for big investors to flee. According to PANews statistics, 386,700 SOL tokens were transferred from FalconX to Binance in February, worth about $66 million. However, further research found that big investors seemed to have fled as early as January. In January, 1.37 million SOL tokens were transferred from FalconX to Binance, worth $315 million, with an average transfer price of about $229. This data value is much higher than other months.

Of course, some people left the market while others rushed in. From February 27 to 28, a large investor with the address EhuKBFXyUYgwc4nUMJMQHjY4A7w5nTTrMtY6z4TtZSFK bought 83,000 SOL tokens, spending a total of $10.88 million, with an average entry price of about $134.

SIMD proposal impact: shrinking staking returns cause validators to panic

However, overall, the funds entering the market are still in the minority, and the majority are large sellers. The main reason for this is not only the shock to the financial market caused by changes in the overall macro environment, but also the uncertainty of the Solana ecosystem itself. The recently launched SIMD-0228 proposal proposes to modify the issuance curve of SOL tokens. The premise of reducing the inflation rate is to reduce the staking income. Therefore, for many large validator nodes, this has also become an important factor of uncertainty in the short term. (Related reading: Solana Inflation Revolution: SIMD-0228 Proposal Sparks Community Controversy, 80% of the Increased Issuance Reduces the Risk of "Death Spiral" )

Under internal and external troubles, Solana's ecological data and token market prices are facing double pressure. As of the afternoon of February 28, the price of SOL has fallen by 57% in the past 40 days, becoming the mainstream token with the largest decline in recent times.

At present, new narratives have failed to emerge to lead the industry, and the MEME track has gradually died down. How Solana can maintain its popularity on the chain may become the biggest problem.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

Cashing In On University Patents Means Giving Up On Our Innovation Future