IMF Bets on El Salvador's Economic Turnaround, But Clashes on Bitcoin Strategy

The International Monetary Fund (IMF) announced on Tuesday that discussions about El Salvador’s Bitcoin initiative are ongoing, with a focus on enhancing transparency, safeguarding public assets, and mitigating risks.

The global body is presently in advanced stages of negotiations to sell the Chivo crypto wallet, which is run by the El Salvador government. Multiple accusations of fraud, identity theft, and technical difficulties led to the suspension of accounts at the first government wallet devoted to Bitcoin.

A prominent member of the Chivo wallet team stated last year that the government should reconsider its support for the app "because of the controversy it has sparked since its inception."

Despite diplomatic tensions caused by El Salvador's acceptance of Bitcoin, the country was able to secure a $1.4 billion loan from the IMF last year.

Stacy Herbert, who served as the director of the National Bitcoin Office in El Salvador at that time, mentioned the Chivo wallet. However, she noted that a variety of private Bitcoin wallets will continue to be available for use in El Salvador.

Ongoing conversations between the IMF and El Salvador about Bitcoin Continue.

IMF Appreciates El Salvador's Growth

El Salvador has been praised by the International Body for its consistent economic growth.

President Nayib Bukele and the IMF have been working closely to implement the $1.4 billion Extended Fund Facility program, which was approved earlier this year.

The IMF reports that El Salvador's economy has been growing faster than anticipated.

The IMF predicted that by this year, the country will have achieved real GDP growth of 4% thanks to strong investments, increased investor confidence, and record-breaking remittances.

In response to the IMF's post on social platform X, El Salvador's president acknowledged the solid growth and the commitment to fiscal discipline.

The IMF stressed in their Tuesday statement that there will be discussions with El Salvador on Bitcoin about topics like transparency and risk reduction.

The latest update outlines the advancements made in the second evaluation of El Salvador’s 40-month bailout.

Is Salvador Continuing to Defy IMF on BTC?

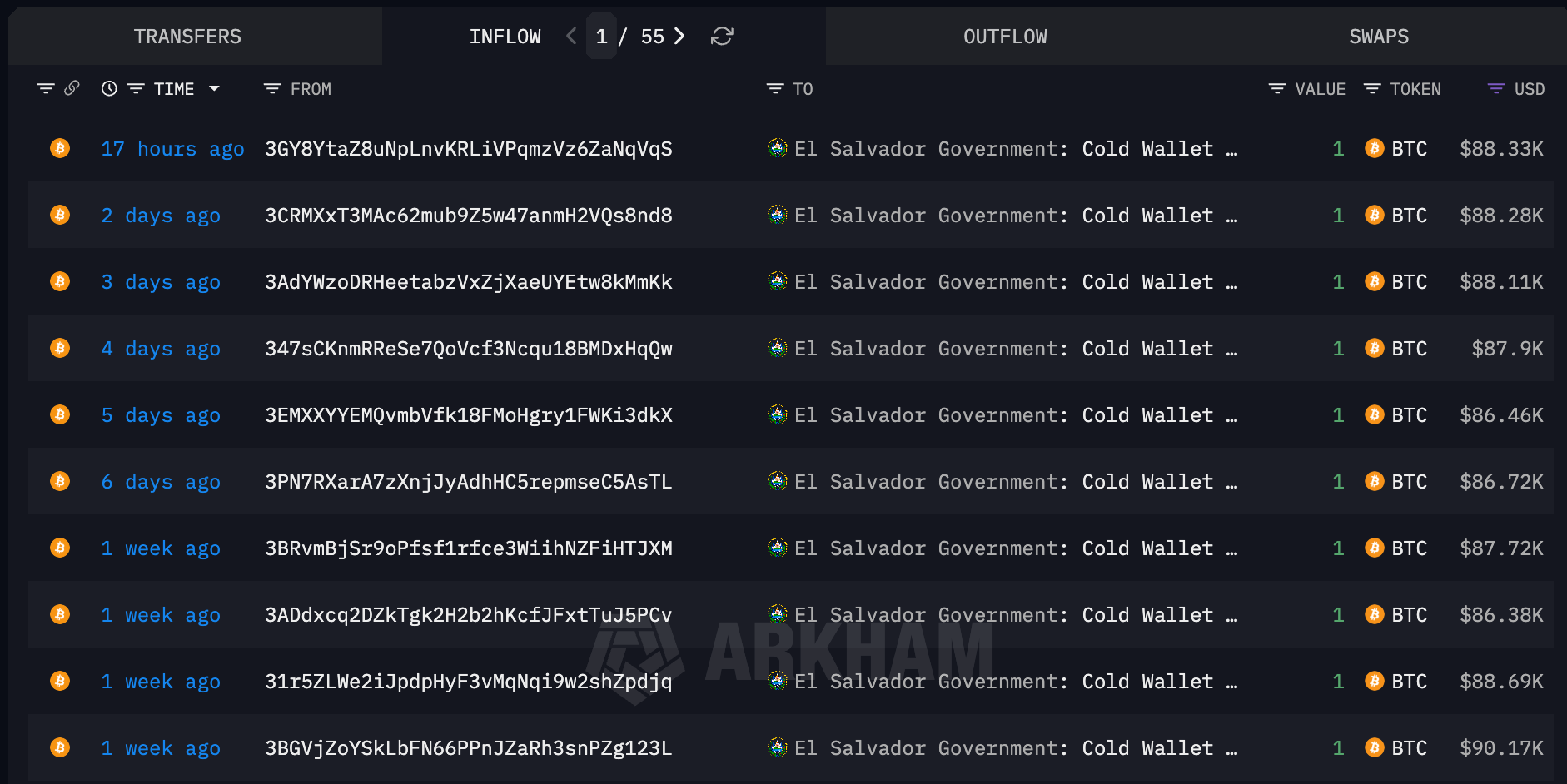

Despite a significant market selloff, El Salvador bolstered its policy of crypto accumulation last month, increasing government holdings by 1,098 BTC, worth nearly $100 million.

Even though there have been huge swings in the market, the country has maintained its strategy of buying 1 BTC every day. Regarding El Salvador's BTC accumulation, the IMF stated in May that "efforts will continue" to curb the country's BTC hoarding. In violation of the conditions outlined in the agreement with the IMF, El Salvador keeps buying additional bitcoin.

El Salvador and the international body have agreed to cease the country's Bitcoin acquisition strategy, according to the EFF program. Also, El Salvador will be selling its Chivo wallet infrastructure and letting the private sector run its own Bitcoin operations.

According to Arkham's onchain data analysis, El Salvador continues its consistent daily acquisition of Bitcoin.

El Salvador has been accumulated approximately 7,508 BTCs as of the latest update from Arkham, in light of the stringent actions imposed by the IMF regarding the nation's Bitcoin initiative.

The general optimistic view of Bitcoin has been bolstered by El Salvador's unwavering support for it.

Bukele has kept up cordial relations with US President Trump, which has helped move the country's plan to use Bitcoin forward.

If current patterns in the gold and silver markets continue, the price of Bitcoin will likely follow suit.

El Salvador has a good chance of successfully managing its public debt in the future years due to the fact that it stands to gain a lot from the appreciation of Bitcoin, given the finite supply and the growing worldwide interest in the cryptocurrency.

Podcast

Decentralization and Privacy: Insights from TEN Protocol's Cais Manai

In this episode of Blockcast, host Takatoshi Shibayama sits down with Cais Manai, co-founder of TEN Protocol, to delve into the intricacies of blockchain privacy and decentralization. Cais shares his journey from discovering Bitcoin in 2012 to co-founding TEN Protocol, a project focused on integrating privacy into Ethereum's Layer 2 solutions.

Tune in at blockcast.blockhead.co or on Spotify, Apple, Amazon Music, or any major podcast platform.

Blockhead is a media partner for Consensus Hong Kong 2026. Readers can save 20% on tickets using exclusive code BLOCKDESK at this link.

You May Also Like

Bitcoin Has Taken Gold’s Role In Today’s World, Eric Trump Says

Fed Makes First Rate Cut of the Year, Lowers Rates by 25 Bps