- LINK getting stronger

- Is selling pressure getting worse?

According to on-chain data, 11 recently established wallets have taken out a total of 1.567 million LINK, or about $19.8 million, from Binance over the last three days. The timing and composition of these withdrawals are more significant than their total amount.

LINK getting stronger

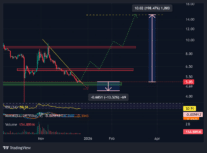

In terms of market structure, LINK is in the middle of a healing phase. The 200-day moving average serves as a ceiling, and the price is still below all significant moving averages. Recent upturns have been brief and shallow, and momentum is weak.

LINK/USDT Chart by TradingViewDuring uptrends, big players typically do not remove liquidity from exchanges. They act in this way when downside risk seems more asymmetrical, sentiment is indifferent and prices are compressed. Exchange outflows lower the sell-side supply that is readily available. Although it alters the balance, that does not ensure profit. It takes less incremental demand to significantly affect price when there are fewer tokens on exchanges.

It is also significant that these wallets are brand new. This resembles fresh cold storage placement more than internal reorganization. The goal seems defensive rather than speculative, regardless of whether this is long-term accumulation, OTC settlement or institutional custody. Funds are being taken out of venues intended for sales rather than being rotated in an attempt to increase yield.

Is selling pressure getting worse?

LINK’s price chart supports this interpretation in an indirect way. The intensity of selling pressure has decreased despite LINK reaching lower highs. Recent lows are being defended without panic-driven liquidation, and volume on downward moves is diminishing. Although it is consistent with distribution coming to an end and accumulation quietly starting in the background, it is not yet bullish.

Narrative alignment is another important factor. Chainlink sits at the intersection of real-world assets, tokenization and cross-chain infrastructure. Even while price weakens, its relevance within the broader crypto stack has not diminished. During drawdowns, smart capital typically separates price from utility, which is when accumulation typically occurs.

Source: https://u.today/binance-sees-enormous-chainlink-link-withdrawal