Best Altcoins to Buy For 2026 – ASTER, BNB, KAS and Two New Crypto Coins

Crypto markets have experienced a rough week, reflecting broader economic pressures and bearish momentum. Bitcoin slipped toward the mid-$80,000 range while Ethereum, XRP, and Solana also saw notable declines.

Several key macro events, including the recent jobs report and upcoming CPI release, have heightened market uncertainty. Investor caution is evident as market participants brace for the Bank of Japan’s interest rate decision this Friday.

The combination of global economic data and potential liquidity events is creating significant short-term volatility. Despite this, certain projects continue to attract attention due to strong fundamentals and community support.

Analysts suggest that select tokens may offer resilience during these fluctuations. This makes it important for traders to identify the best altcoins to buy now. Focusing on tokens with solid use cases and growing adoption can provide strategic opportunities.

Top Altcoins to Buy as the Market Shifts Away From Hype-Driven Tokens

As 2026 approaches, attention is narrowing toward altcoins that are actively building core blockchain infrastructure rather than relying on hype-driven cycles.

Below are five of the best altcoins to buy, positioned as serious contenders for long-term adoption in the next market phase.

Aster (ASTER)

Aster is a promising addition to the crypto space, emerging as a decentralized exchange with strong growth potential. The platform supports spot, perpetual, and advanced leveraged trading, offering unique features that many other DEXs lack.

Built on the BNB Chain ecosystem, Aster has already attracted significant attention, with total trading volume reaching $3.5 trillion and over 7.5 million users engaged. Its total value locked stands at $1.12 billion, highlighting both liquidity and adoption.

The project’s upcoming layer 1 blockchain aims to deliver high-speed transactions, privacy, and ultra-throughput, potentially processing over 150,000 transactions per second. With backing from prominent figures in the Binance ecosystem, Aster has positioned itself as a high-potential altcoin.

From a risk-to-reward standpoint, the current price point offers an attractive entry for investors seeking growth. This makes $ASTER one of the best altcoins to buy now for those looking to capitalize on the next phase of DeFi innovation.

Source – Roshawn Silva YouTube Channel

BNB (BNB)

BNB is a prominent altcoin that continues to demonstrate remarkable resilience and growth within the crypto market. As the native token of the BNB Chain ecosystem, it supports transaction fees, staking, and governance, making it a multifaceted digital asset with real-world utility.

Over the past year, BNB has maintained a strong performance, remaining up despite market volatility. Its ecosystem has seen increasing adoption through DeFi protocols, NFT projects, and a surge in meme coin activity, driving higher demand for the token.

Ongoing token burns reduce circulating supply, creating a deflationary effect that supports long-term value appreciation. These factors position $BNB as a strategic holding for investors seeking reliable growth.

Kaspa (KAS)

Kaspa is a strong addition to any portfolio alongside other utility-focused altcoins. At the time of writing, $KAS is trading at $0.0423 with a market capitalization of around $1.1 billion, and the token is down roughly 13% over the past seven days, presenting a potential accumulation phase.

Its proof-of-work mechanism uses the GhostDAG consensus, enabling rapid block rates and effective solo mining even at lower hash rates. With a maximum supply of 28.7 billion coins and an annual halving emission schedule, Kaspa draws comparisons to Bitcoin in terms of security and scarcity.

Following future upgrades, the introduction of smart contracts and DeFi tools could drive increased adoption and market demand. The community remains highly engaged and bullish, reflecting strong confidence in the project’s long-term growth.

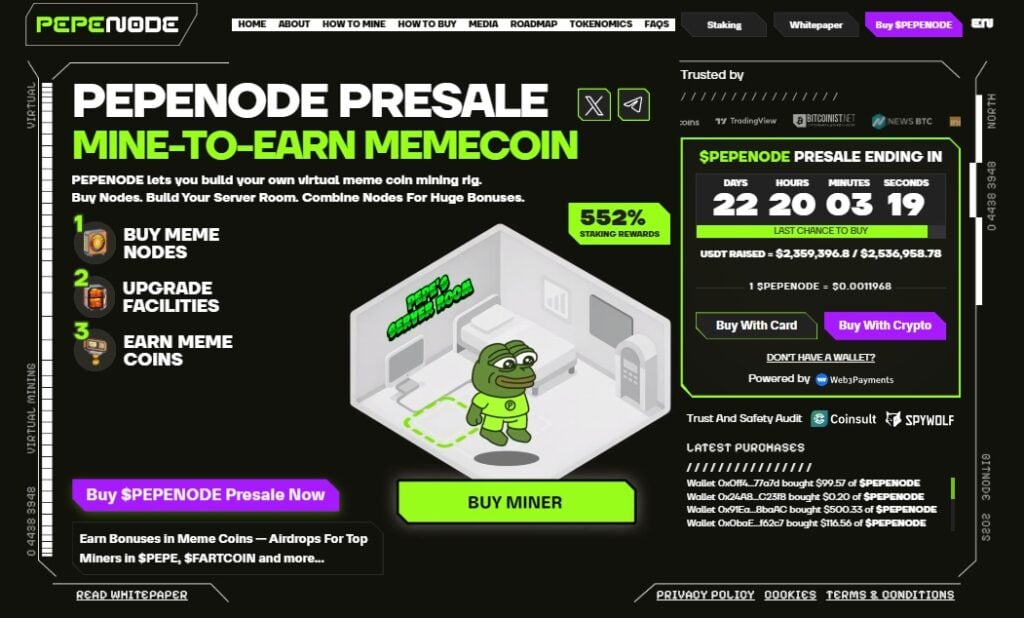

Pepenode (PEPENODE)

Pepenode is presented as a crypto presale built around an inventive mine-to-earn concept that blends meme culture with blockchain mining mechanics. The project has already raised around $2.3 million despite cautious market conditions.

Its appeal lies in targeting retail participants who are naturally drawn to meme-driven narratives paired with interactive utility. Pepenode’s structure relies on widely used Web3 presale infrastructure, which explains similarities in layout and dashboards compared with other launches.

The idea of mining meme coins introduces a fresh angle that differentiates Pepenode from more conventional presales. With 22 days remaining in the presale, investors still have an opportunity to purchase $PEPENODE at $0.0011968 per token, with staking APYs reaching up to 550%.

Taken together, its fundraising progress, distinctive concept, and retail appeal place Pepenode among the more closely watched presales in the current market cycle and one of the best altcoins to buy now.

Visit Pepenode

Bitcoin Hyper (HYPER)

Bitcoin Hyper is presented as a project designed to restore strong transactional utility to the Bitcoin ecosystem during periods of heightened market attention. Even after a modest pullback from recent highs, accumulation activity has remained steady, reflecting confidence rather than hesitation.

Bitcoin Hyper has already raised close to $30 million in its presale, an impressive milestone that highlights sustained interest despite broader market volatility. The project positions itself as a Layer 2 solution that enhances Bitcoin’s usability by enabling near-instant transaction finality.

Source – Cryptonews YouTube Channel

By bridging assets from Bitcoin to Bitcoin Hyper, users gain speed while retaining validation and security on Bitcoin’s base layer. This approach allows Bitcoin to function beyond a store of value and closer to a practical settlement network.

Strong presale momentum, growing social engagement, and consistent inflows suggest expanding adoption. Together, these elements position Bitcoin Hyper as a compelling infrastructure upgrade aligned with Bitcoin’s long-term evolution.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Vincent Deluard: Inflationary pressures mirror the late 90s, the gig economy’s tax impact is significant, and stocks may thrive amid fiscal stimulus

Will the Fed’s Big Rate Decision Ignite the Next Leg of the Crypto Rally?