ADA Price at a Crossroads: Why 2025 Isn’t a Repeat of Cardano’s 2022 Collapse

The post ADA Price at a Crossroads: Why 2025 Isn’t a Repeat of Cardano’s 2022 Collapse appeared first on Coinpedia Fintech News

The ADA price is under renewed scrutiny as a weekly indicator revives memories of Cardano’s 2022 collapse, per an popular chartist. However, while technical signals are triggering fear, the broader context in 2025 suggests a very different environment. This one seems to be shaped by deeper utility, stronger governance, and a more mature ecosystem. Why it feels this way, please continue reading to know more in detail.

ADA Price and the 2022 Supertrend Comparison

Recent discussions around the ADA price chart focus on a weekly supertrend signal that last appeared in 2022, just before an 80% correction. This was shared by popular chartist and analyst Ali Martinez on X, that doesn’t sound wrong when looking only at price action and chart.

But when we expand our view. Then, it suggests that back then in 2022, Cardano was still struggling to convert research into real adoption. As a result, technical weakness quickly cascaded into a deep structural breakdown.

In contrast, the current ADA price USD behavior reflects a market struggling with uncertainty rather than just outright collapse. While fear remains elevated witnessing such a big collapse, but the conditions that amplified downside risk in 2022 are not fully present today.

Ecosystem Expansion Changes the ADA Crypto Narrative

One of the biggest differences lies in Cardano’s evolving utility. In 2025, ADA crypto is no longer a single-chain smart contract experiment. Instead, it is actively working to integrate Bitcoin liquidity into its DeFi ecosystem through trustless bridges and partnerships, allowing BTC holders to deploy capital while retaining Bitcoin exposure.

This structural shift reduces the probability of a straight-line repeat of 2022. Unlike before, ADA now supports a broader economic layer that was previously absent.

Usage Metrics Provide Context Beyond Price

Beyond price action, transactional data offers additional clarity. Over the past 90 days, Cardano’s transactional volume has remained relatively stable. If activity were collapsing, this consistency would not exist. This usage stability reinforces why Cardano remains among the top blockchain networks by relevance, with continued institutional interest.

The recent, Educational initiatives also play a role. Cardano foundation’s’s emphasis on research-driven development, secure proof-of-stake, and the eUTxO model has been highlighted publicly, signaling an effort to improve transparency and ecosystem literacy.

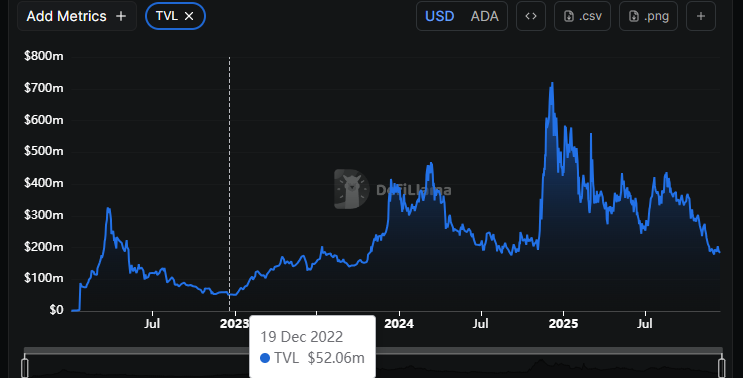

TVL Decline Still Weighs on ADA Price

That said, verbally it’s okay but charts shows that challenges still remain. According to DeFi metrics, Cardano’s total value locked has fallen sharply from a peak near $693 million in late 2024 to roughly $182 million in December 2025. This decline is significant and cannot be ignored when assessing ADA price prediction models.

However, perspective matters. During the 2022 crash, TVL dropped to nearly $52 million. Even after the current drawdown, Cardano still holds nearly four times that level, indicating survival rather than abandonment.

Governance Developments Add Structural Support to ADA Price

More to that, the Recent governance actions approved in December introduce another differentiating factor. These measures aim to support Cardano’s next growth phase and long-term economic sustainability. While governance upgrades do not immediately move charts, they influence long-range assumptions.

As the ADA price remains sensitive to technical signals, its broader trajectory increasingly depends on whether ecosystem growth, governance execution, and usage stability can offset short-term market fear.

You May Also Like

BitGo expands its presence in Europe

XRP price weakens at critical level, raising risk of deeper pullback

Copy linkX (Twitter)LinkedInFacebookEmail