The TechBeat: How a Demo Page for my Abandoned Open Source SDK Accidentally Found Product Market Fit (12/15/2025)

How are you, hacker? 🪐Want to know what's trending right now?: The Techbeat by HackerNoon has got you covered with fresh content from our trending stories of the day! Set email preference here. ## Exploiting EIP-7702 Delegation in the Ethernaut Cashback Challenge — A Step-by-Step Writeup  By @hacker39947670 [ 18 Min read ] How to exploit EIP-7702 delegation flaws: A deep dive into the Ethernaut Cashback challenge with bytecode hacks and storage attacks Read More.

By @hacker39947670 [ 18 Min read ] How to exploit EIP-7702 delegation flaws: A deep dive into the Ethernaut Cashback challenge with bytecode hacks and storage attacks Read More.

Code Review Anti-Patterns: How to Stop Nitpicking Syntax and Start Improving Architecture

By @nikitakothari [ 5 Min read ] Code reviews are pricey. Let machines catch style issues so humans can focus on what matters: security, scalability, and architecture. Read More.

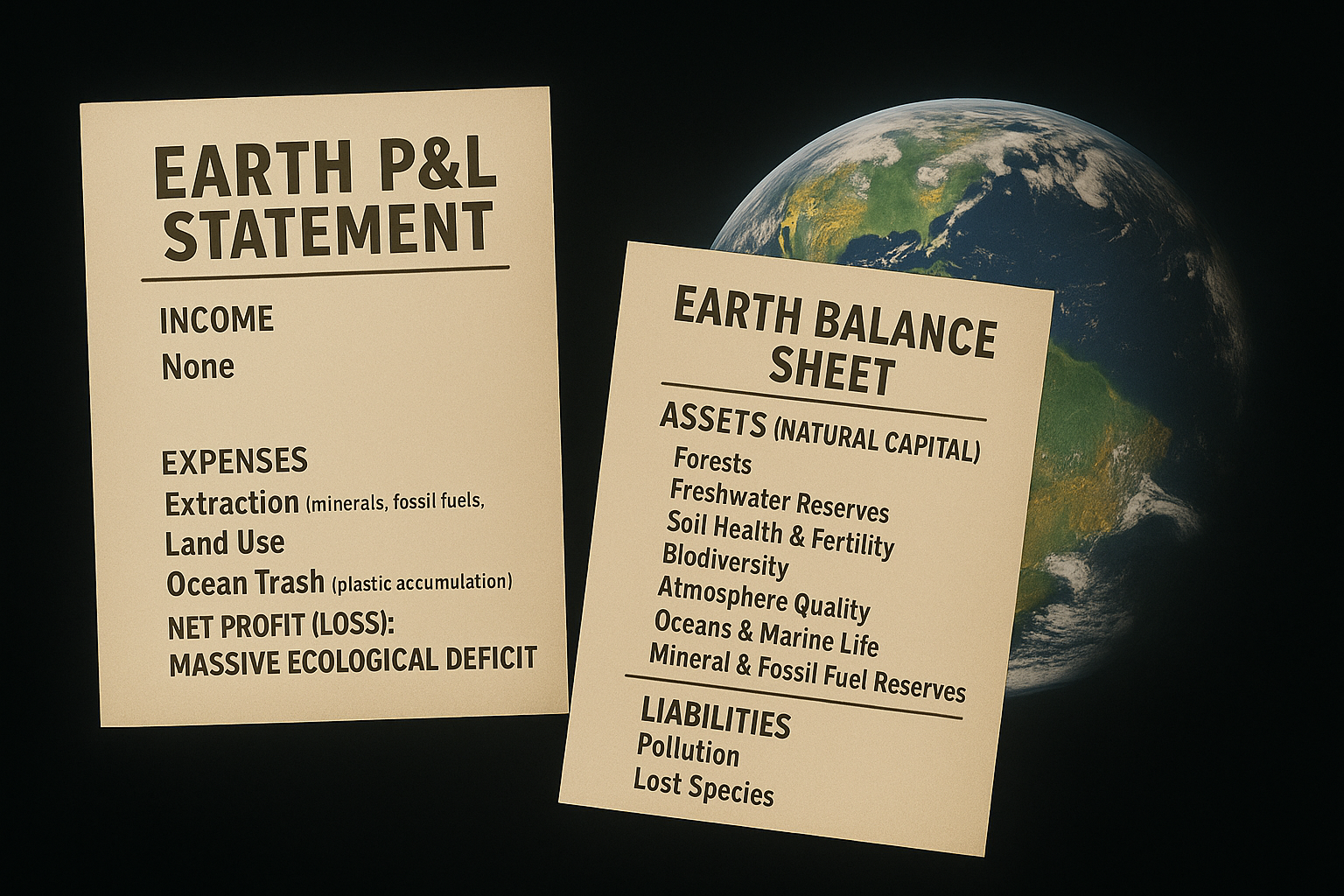

The Invisible Line Item: Why Pollution Is Missing From Every Balance Sheet

By @chris127 [ 12 Min read ] For centuries, pollution has been the missing line item of our accounting. First from ignorance. Then from choice. Now, from necessity. We must account for it! Read More.

Earth Cleaning Technologies: The Current R&D Status and Why We're Still Losing the Race

By @chris127 [ 7 Min read ] Imagine if you could reverse decades of pollution. Remove tons of CO₂, Clean oceans, restore forests at scale. The good news? We can! The bad news? We don’t! Read More.

Before Bitcoin: The Forgotten P2P Dreams that Sparked Crypto

By @obyte [ 5 Min read ] Before crypto, pioneers dreamed of decentralized money and fair sharing. Their wild ideas shaped today’s digital freedom. Go explore how it all began! Read More.

Leader or No Leader, That is the Question

By @chris127 [ 9 Min read ] For most of human history, leaders were necessary. We needed them to coordinate, decide, organize and share their vision. But technology is changing this. Read More.

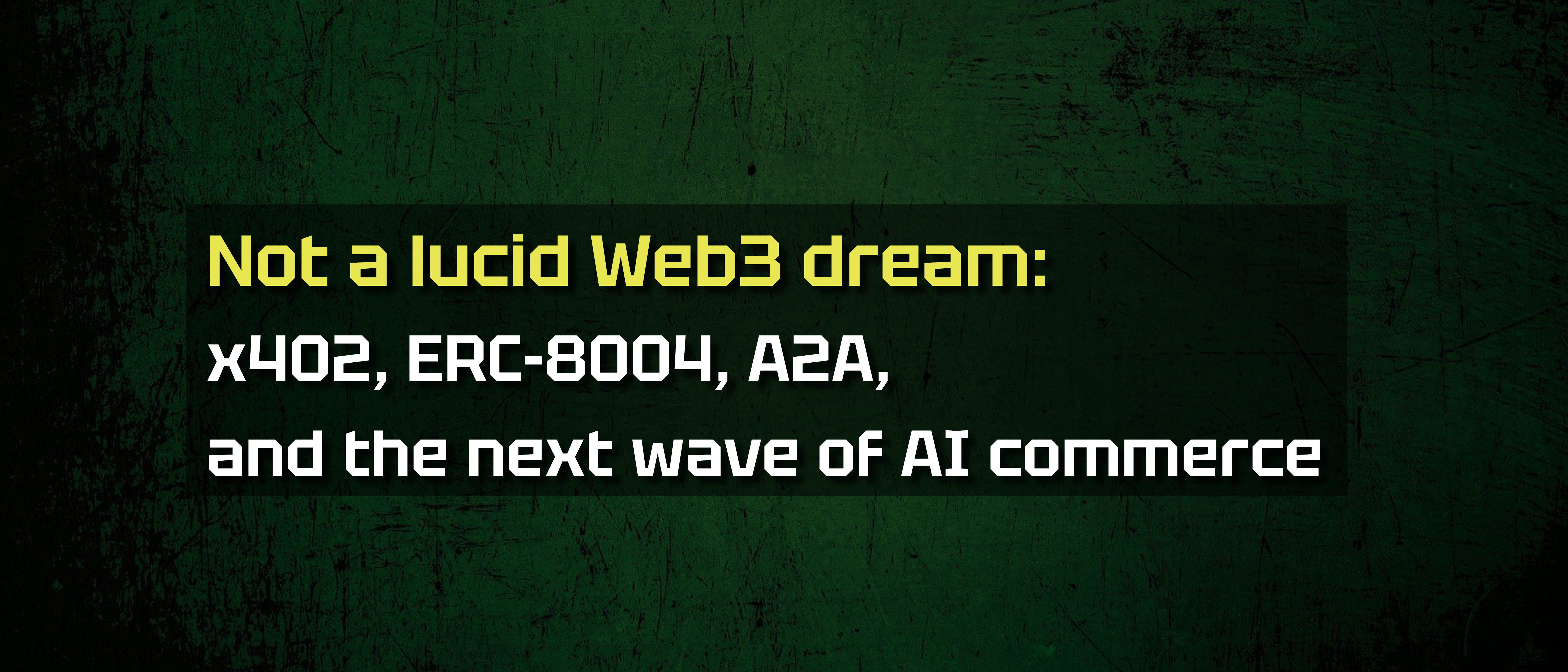

Not a Lucid Web3 Dream Anymore: x402, ERC-8004, A2A, and The Next Wave of AI Commerce

By @mickeymaler [ 30 Min read ] Explains how x402, ERC-8004, and agent discovery turn APIs and AI agents into usage-based micro businesses. Web3's future is in Agents doing the work for you. Read More.

Cantor8: Building The Future of Canton Network

By @cantor8 [ 4 Min read ] Cantor8 is at the forefront of the surging growth of the Canton Network ecosystem. Endorsed by The Canton Foundation itself, the company is founded by a Cambrid Read More.

Hard Problems Are Easier, Once You Think Like This

By @praisejamesx [ 7 Min read ] Stop being overwhelmed. Learn the neuroscience of mastery: how all genius works by compressing complexity into simple, automatic structures. Read More.

How I Found Sim Racing at Age 60

By @wicked-racing [ 5 Min read ] How a 60-year-old former wannabe rally driver has found new youth through sim racing and the new available technology. Read More.

Flight Recorder: A New Go Execution Tracer

By @Go [ 11 Min read ] Flight recording is now available in Go 1.25, and it’s a powerful new tool in the Go diagnostics toolbox. Read More.

Everyone's Using the Wrong Algebra in AI

By @josecrespophd [ 9 Min read ] From Tesla phantom braking to LLM hallucinations, the root bug is first-order math. We explain how dual/jet numbers unlock scalable second-order AI. Read More.

Model.fit is More Complex Than it Looks

By @loneas [ 9 Min read ] Deep dive into why model.fit beats naive normal equations in linear regression, with SVD, conditioning and floating-point pitfalls explained. Read More.

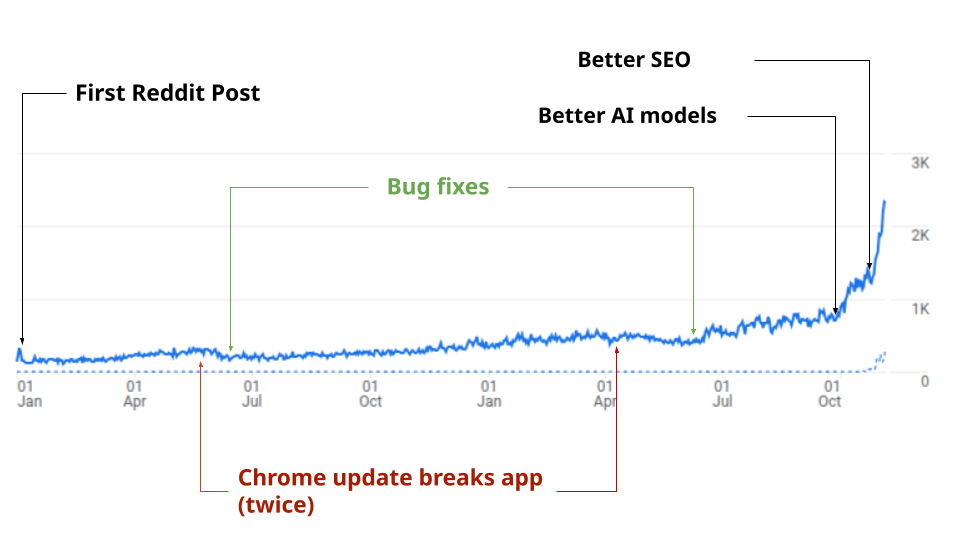

How a Demo Page for my Abandoned Open Source SDK Accidentally Found Product Market Fit

By @sb2702 [ 10 Min read ] How a free browser based video upscaling tool I built as a demo for an open source project accidentally found product market fit, growing to 70k MAU. Read More.

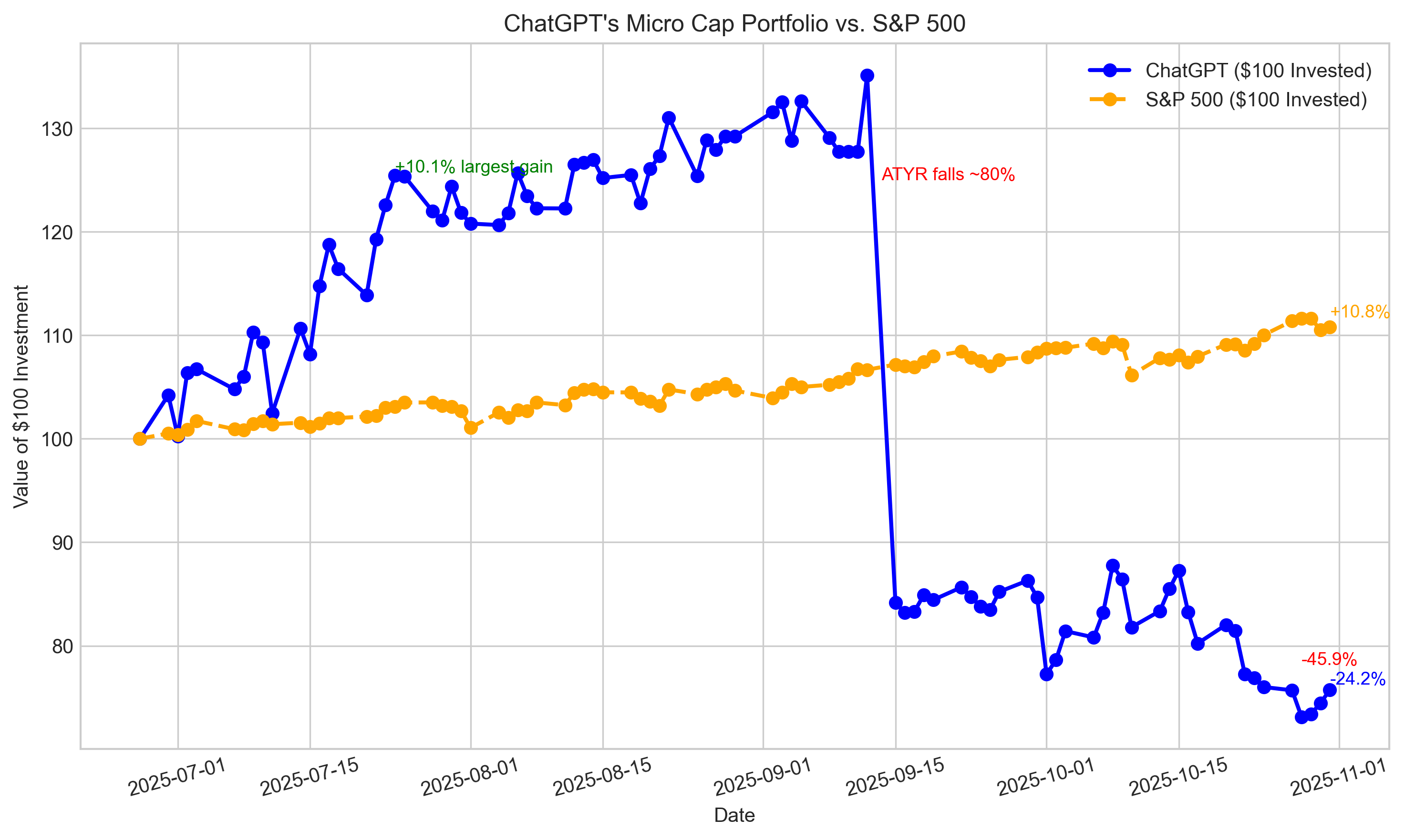

Can ChatGPT Outperform the Market? Week 18

By @nathanbsmith729 [ 7 Min read ] Monday marked a new max drawdown of -45.85%. Read More.

Blazor vs React: Why This .NET Architect Finally Picked a Side

By @mashrulhaque [ 24 Min read ] A seasoned .NET architect compares Blazor and React, from npm security risks to .NET 10 performance, and explains when each framework makes sense. Read More.

Why I’m Tired of Productivity Wellness (And What It’s Doing to Our Minds)

By @riedriftlens [ 4 Min read ] A founder’s critique of the productivity-wellness industry—from gamified focus apps to self-optimization culture—and why our minds crave clarity, not performanc Read More.

Code Smell 316 - The Syntax Police Review Anti-Pattern

By @mcsee [ 3 Min read ] Syntax-focused code reviews hide architecture flaws, waste human attention, and lower quality. Automating style checks lets teams review what truly matters. Read More.

Can Your AI Actually Use a Computer? A 2025 Map of Computer‑Use Benchmarks

By @ashtonchew12 [ 10 Min read ] A 2025 map of computer use agent benchmarks, from ScreenSpot to Mind2Web, REAL, OSWorld and CUB, and how harness design now rivals model quality. Read More.

Agentic UX Over "Chat": How to Design Multi-Agent Systems People Actually Trust

By @designchurchill [ 9 Min read ] Principles for designing agentic UX: verification, transparency, handoffs, and moving beyond chat interfaces. Read More. 🧑💻 What happened in your world this week? It's been said that writing can help consolidate technical knowledge, establish credibility, and contribute to emerging community standards. Feeling stuck? We got you covered ⬇️⬇️⬇️ ANSWER THESE GREATEST INTERVIEW QUESTIONS OF ALL TIME We hope you enjoy this worth of free reading material. Feel free to forward this email to a nerdy friend who'll love you for it. See you on Planet Internet! With love, The HackerNoon Team ✌️

You May Also Like

![[OPINION] US National Security Strategy 2025: An iconoclastic document](https://www.rappler.com/tachyon/2025/12/AMERICANS-ARE-BACK-DEC-12-2025.jpg?resize=75%2C75&crop_strategy=attention)

[OPINION] US National Security Strategy 2025: An iconoclastic document

Crucial US Stock Market Update: What Wednesday’s Mixed Close Reveals