Cardano Founder Reacts As NIGHT Token Crashes From $150 To $0.02

Cardano founder Charles Hoskinson has hailed the launch of Midnight and its native token NIGHT as the strongest in the network’s history, arguing that it proves Cardano can now host and distribute multi-billion-dollar assets at scale.

NIGHT Token Plunges After Midnight Launch

In his December 10 livestream “Midnight Launch AAR,” Hoskinson opened with the volatile price action that dominated social media. NIGHT initially spiked to what he called an “insane” level: “It launched at almost a $150, which is just insane […] it just went way, way, way up.” Once trading opened on Binance Alpha, the move reversed violently. “As soon as it got on Binance Alpha – oh god, why, why, oh why – all the way down to two cents. They dumped on us. That’s what they do. That’s what the DGENs over in that market do.”

He framed this as typical exchange-distribution dynamics, not a structural failure: recipients with no real connection to the ecosystem “regardless of the price, they just dump the token. They probably didn’t even know what NIGHT was.”

According to Hoskinson, such launches usually endure 48–72 hours of “high volatility” before a stable range emerges. He reiterated that he had expected NIGHT to trade in a “5 cents to 15 cents” band and said it was sitting around 6–6.5 cents with a fully diluted valuation of roughly $1.5 billion and around $150 million in trading volume. For a brand-new Cardano-native asset in current conditions, he called that “a really solid launch.”

What made the debut historically significant in his view was the combination of tier-one listings and on-chain metrics. “This is the first time in history that Cardano right out the gate can launch a $1.5 billion product, be listed on Binance Alpha and Kraken and OKX and everybody else at the start,” he said, stressing that much of the required infrastructure “wasn’t there” and had to be built during the run-up.

Cardano’s Best Launch Ever

On Cardano itself, he highlighted that Midnight immediately became the dominant token by trading activity. Citing TapTools, he said NIGHT was “sitting [at] an overwhelming level of volume, and it’s actually greater than the volume of every other Cardano native token combined,” adding that its FDV is “worth more than all the other CNTs combined as well.”

For the first time, he argued, DEXs such as Minswap and SundaeSwap carried a “meaningful percentage of trading volume […] with respect to large exchanges,” helping “prime the pump on Cardano DEXes” and pull more stablecoins into the ecosystem.

Distribution was another focal point. Hoskinson praised the Glacier Drop mechanism and its gradual “thawing,” saying it creates “a nice steady emission and a nice steady flow for the system as opposed to a jagged thing where the insiders all dump.”

He contrasted Midnight’s retail-heavy, exchange-plus-airdrop distribution with VC-led launches elsewhere: “This is the first time since Bitcoin that a launch has been done the way that Midnight did it. It was complete retail, completely fair, and none of those damn VCs got their grubby hands on it. Instead, it went right to you, the people.”

He tied that to a broader “return to first principles,” arguing that 2026 should reward projects with fair launches and fixed-supply, deflationary monetary policies: “There’s a fixed supply NIGHT, by the way […] it’s going to be a good year for everybody who’s betting on you, the consumer, and not betting on the banks.”

Looking forward, Hoskinson positioned Midnight as Cardano’s first “partner chain” and the “tip of the spear” for a hybrid DApp model spanning multiple ecosystems: “You talk about Midnight Cardano, Midnight Ethereum, Midnight Solana, Midnight Avalanche, Midnight Binance.” He said that after the first four phases of the roadmap, “every two months a new ecosystem gets activated,” with recurring feature drops “every six to eight weeks.”

He also cast Midnight as a competitive wedge for Cardano DApps. With tier-one integrations and privacy-preserving capabilities, he argued, “we have privacy before [Ethereum and Solana] do,” giving Cardano–Midnight hybrid apps a differentiator that can help grow TVL, MAU and transaction volume.

Hoskinson insisted that the launch pressure-tested and validated the base protocol: “Cardano network handled it. The exchanges handled it. And Midnight is here to stay.” The ambition from here is explicit. “We’re going to march Midnight up as an ecosystem to that $10 billion mark. That’s the goal. Let’s keep going. Let’s get her done,” he said, adding that “these are the best numbers we’ve ever seen in the history of Cardano” – and, in his view, only the beginning.

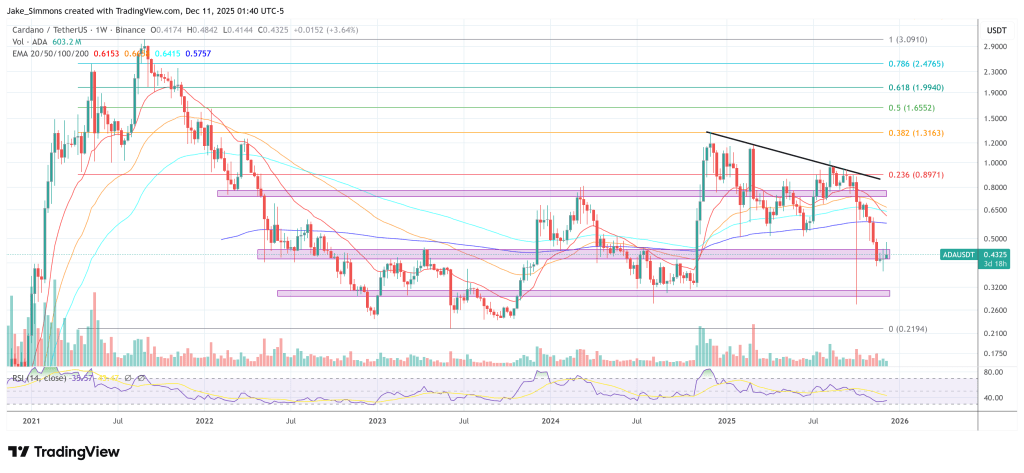

At press time, ADA traded at $0.4325.

You May Also Like

Where Next for Bitcoin? The Bull and Bear Case

The million-dollar winner of the X Creators Contest has been exposed for involvement in a Memecoin scam.