Best Crypto to Buy Now? Zcash Price Prediction, New Crypto Coins

Zcash delivered a remarkable rally from September to November, skyrocketing from around $40 to nearly $700. After cooling off in the weeks that followed, momentum has begun to return. The asset briefly dipped to about $306 last week but has since recovered, trading close to the $400 level at the time of writing.

The narrative around privacy-focused crypto has regained momentum in today’s institution-driven market. With TradFi gaining exposure through products like the Grayscale Zcash Trust and a potential ETF, many believe Zcash still has considerable untapped demand.

This article explores Zcash price prediction based on insights from crypto analyst Jacob Crypto Bury. His full breakdown is available in the video below or on his YouTube channel. It also highlights two new meme coin presales that could be among the best crypto to buy now.

Zcash Proposes Dynamic Fee Upgrade to Improve Network Stability

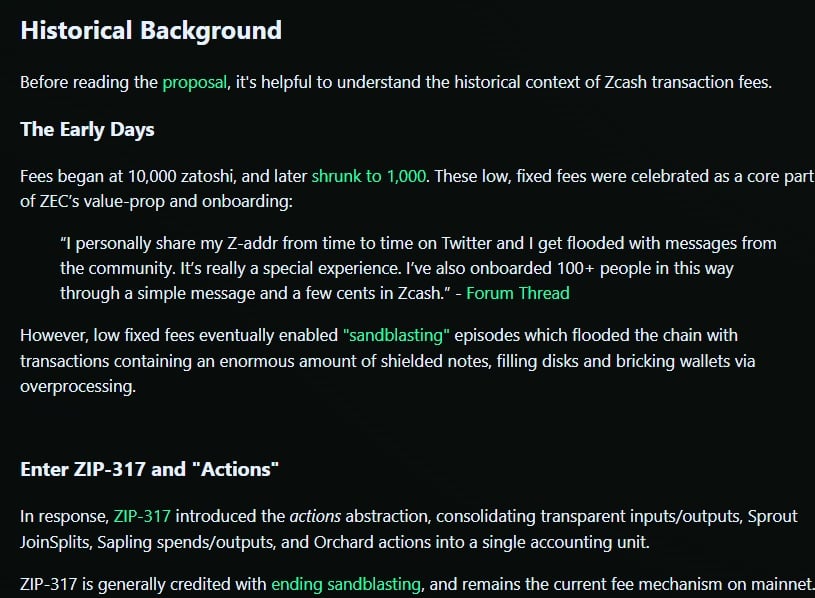

The Zcash team has introduced a proposal to implement dynamic fees that aim to protect users from network issues caused by rising transaction costs as the value of $ZEC increases. In the past, fees were fixed at 10,000 zats and later at 1,000 zats.

This made it easy for malicious actors to overload the blockchain and user wallets with extremely cheap transactions. ZIP-317 attempted to improve the situation by basing fees on actions instead of transaction size.

However, the overall cost stayed too low to prevent abuse. As $ZEC appreciated, even standard transfers became more expensive. Anonymizing large quantities of small payments began to require a significant number of tokens.

The new mechanism suggests calculating the base fee using the median value of actions from the last 50 blocks. It also recommends rounding fees to the nearest tenth degree to enhance privacy and limit transaction analysis.

A priority channel with a fee ten times higher than the base would allow urgent activity to be processed more quickly during congestion. The upgrade is positioned as a forward-looking solution to keep block operations smooth as adoption grows.

Zcash Price Prediction

Zcash’s market performance has struggled recently, trading around $400 after retracing from highs above $700. Even so, technical analysis shows the asset forming a symmetrical triangle pattern, hinting at a potential bullish breakout if momentum aligns with broader market strength.

A Fibonacci target near $457 suggests a possible 6% upside, while support around $400 represents the key level to hold if bearish pressure persists. Much of Zcash’s short-term direction is linked to Bitcoin’s behavior.

Source – Jacob Crypto Bury X

A sustained reversal in Bitcoin could provide the fuel needed for an upward move in Zcash, but the overall market must first confirm stronger bullish structure before confidence returns.

Top Crypto to Buy Now: High-Potential Meme Coin Picks Beyond Zcash

Zcash still shows promise with upcoming network upgrades and technical patterns that could support future growth, making it far from a lost cause. However, many investors are turning their attention to high-potential crypto presales, which often offer larger upside opportunities.

Below are two meme coins that could be among the best crypto to buy now for those seeking growth and excitement in the market. Keeping an eye on both established coins like Zcash and emerging presales can create a balanced strategy for potential gains.

Bitcoin Hyper (HYPER)

The first Zcash alternative is Bitcoin Hyper, one of the most hyped and highly anticipated new cryptos, having already raised nearly $30M during its presale. Positioned as a Bitcoin layer-2 solution, it combines the strengths of Bitcoin and Solana while maintaining compatibility with both networks.

On-chain data indicates a notable movement of Ethereum, XRP, and BNB into Bitcoin Hyper, reflecting strong confidence in its potential. Launching early next year, the token presents an opportunity to participate before it hits exchanges.

Its staking options provide additional incentives for long-term holders, allowing them to earn rewards while supporting network adoption. At the time of writing, over 1.3 billion tokens have already been staked, and 280 investors joined in the last 24 hours.

As one of the few substantial layer-2 projects beyond standard meme coins and new DEX tokens, it stands out in the crowded crypto space. While market conditions may fluctuate, Bitcoin Hyper is seen as a promising candidate for growth and adoption in 2026.

Visit Bitcoin Hyper

Maxi Doge (MAXI)

Maxi Doge is currently gaining attention as a trending meme coin with its presale live at $0.000275 and $4.3M already raised. The token has garnered recognition from reputable crypto publications such as Bitcoinist, Coin Central, and Crypto Daily, highlighting its growing credibility.

Its tokenomics are structured with a 25% Maxi fund, 40% marketing, 15% development, 15% liquidity, and 5% staking allocation. The roadmap and website are designed to appeal to meme coin enthusiasts, emphasizing a culture of extreme trading with high-risk, high-reward potential.

Maxi Doge combines the fun and excitement of the meme coin culture with clear guidelines for participation, making it a promising presale opportunity for investors looking to explore emerging crypto trends.

Visit Maxi Doge

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Why is Bitcoin (BTC) Trading Lower Today?

Which Cryptos Will 100x in 5 Years?