Libeara has launched a tokenized gold fund developed by FundBridge Capital in Singapore, signaling the growth of digital-asset frameworks towards institutional clients who desire regulated exposure to real-world assets.

The project, which is supported by Standard Chartered SC Ventures, presents a blockchain-based solution that provides monitoring of the spot price of gold without any physical gold storage.

Tokenized structure mirrors gold while removing physical storage

The new product, called MG 999, uses blockchain technology to replicate the market price of gold. According to information shared with Nikkei and statements from FundBridge, the structure eliminates the traditional vaulting and logistics requirements associated with physical metal while maintaining exposure to gold’s price movements.

Each token is intended to reflect real-time market conditions and is housed within a regulated fund framework.

FundBridge CEO Sue Lynn Lim stated that the company paid attention to ensuring that MG 999 would comply with regulatory requirements related to fund governance and incorporate digital infrastructure.

She clarified that the company cooperates with its partners to establish a framework that bridges the gap between conventional supervision and a blockchain-based framework. The fund does not hold any physical bullion; instead, it utilizes a synthetic mechanism that tracks the performance of the metal.

The product enhances Standard Chartered’s exposure in the tokenization industry. The majority shareholder in Zodia Custody and Zodia Markets, both of which focus on institutional digital-asset offerings, is also SC Ventures, which supports Libeara.

The introduction is preceded by the involvement of Standard Chartered in a physically supported gold fund in Singapore, where the bank acts as the custodian of bullion at the Le Freeport plant at Changi Airport.

Investor demand and market conditions frame the launch

The MG 999 rollout occurs at a time when global demand for gold is on the rise. Based on the information presented, central banks have accumulated more gold due to concerns about the U.S. dollar and the evolving geopolitical landscape.

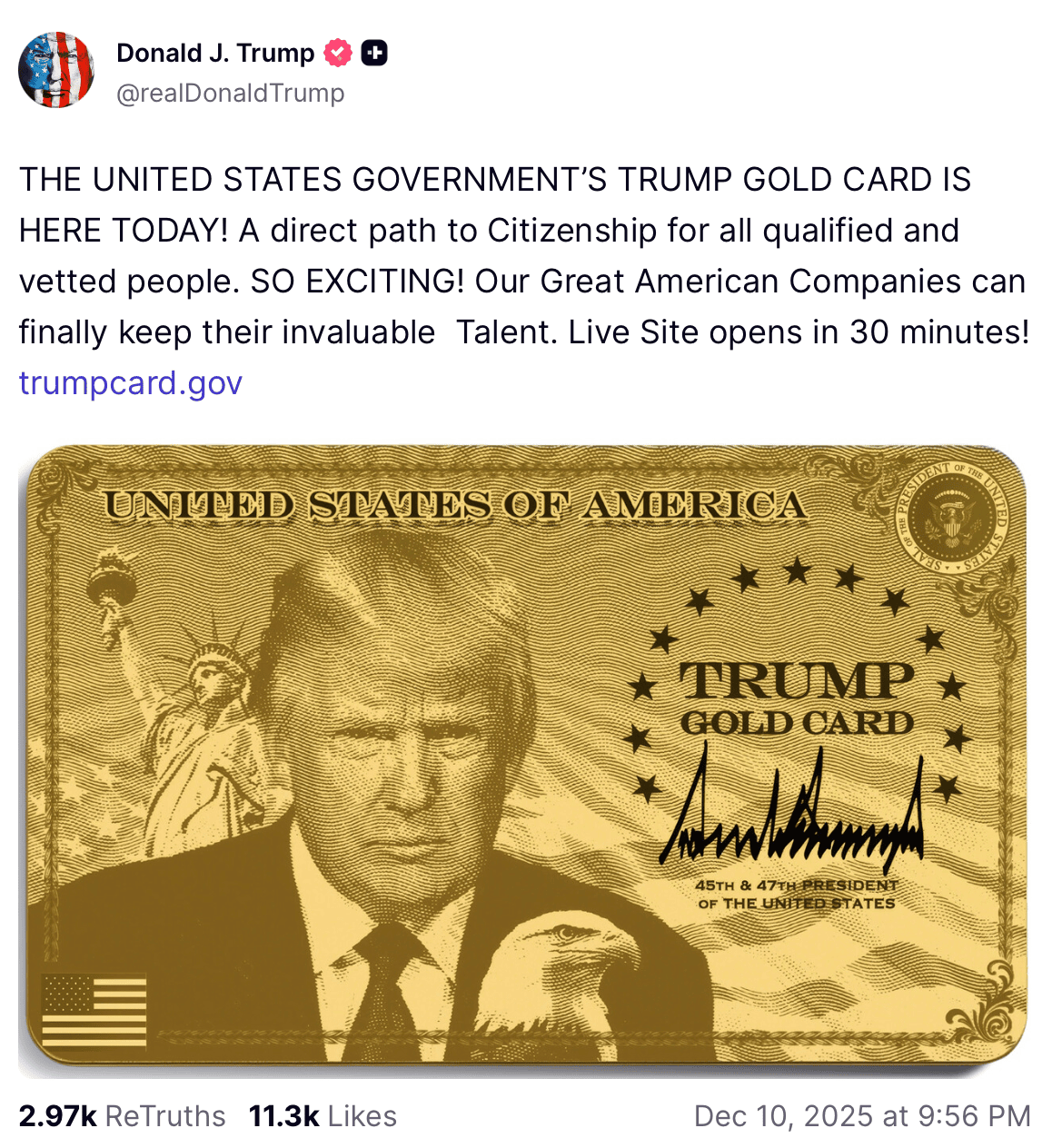

The uncertainty in financial terms has also led institutions to turn to other asset structures, such as commodity-based structures. Tariff policies introduced by President Donald Trump were cited as one of the reasons for the shift toward gold-backed products.

Besides monitoring market performance, MG 999 has also added lending capabilities to the Singapore jewelry industry. The first borrower under the structure has been identified as Mustafa Gold, who is a local retailer.

The design enables retailers to receive credit against their inventory of gold jewelry while still having the items on display. The tokens were described as complex by Mustafa founder Mustaq Ahmad, who gave the framework as an opportunity to work with working capital tools using digital assets.

Institutions advance blockchain use for real-world assets

According to FundBridge, MG 999 eliminates vaulting and logistics expenses while maintaining gold-linked price exposure. The company indicated that the fund would be set to meet the requirements of a regulated market segment and, at the same time, expose real-world assets to blockchain railways.

Libeara and FundBridge will continue to serve institutional clients seeking digital solutions to access commodity-linked products.

Want your project in front of crypto’s top minds? Feature it in our next industry report, where data meets impact.

Source: https://www.cryptopolitan.com/libeara-partners-fundbridge-to-launch-gold/