How Does Ripple’s XRP Enable The Trillion-Dollar Tokenization Market?

Crypto pundit Pumpius has provided insights into Ripple’s XRP’s role to enable the trillion-dollar tokenization market on the XRP Ledger (XRPL). He also explained how the altcoin and Ripple’s RLUSD stablecoin work hand in hand rather than being competitors on the network.

Ripple XRP’s Role In Enabling Tokenization On The XRPL

In an X post, Pumpius stated that XRP handles cross-border liquidity and deep global routing while Ripple’s RLUSD supports domestic flows, tokenized assets, and institutional balance sheets. This came as he noted that pairing XRP with RLUSD creates a two-asset settlement engine in the push for tokenization on the XRPL.

The crypto pundit further stated that both XRP and Ripple’s RLUSD unlock instant settlement for tokenized assets, atomic swaps, capital-efficient markets, and unified liquidity across the entire XRPL ecosystem. He asserted that without instant, programmable, and compliant settlement, tokenized assets are nothing more than digital placeholders.

Pumpius remarked that this is where Ripple’s RLUSD becomes transformative. He explained that the stablecoin is the operational backbone for real-world assets on the XRP Ledger. The crypto pundit added that it is the first dollar that settles at XRPL speed with institutional-grade transparency and regulatory alignment.

In line with this, Pumpius reiterated that tokenization is useless without settlement. While RLUSD fixes the settlement problem, he stated that XRP amplifies it and that the emerging ZK layer will protect it. Regarding the ZK layer, the pundit stated that as private ZK infrastructure begins to anchor the XRPL identity, privacy and compliance layers will slot into this model, making settlement fast, verifiable, and shielded when needed.

He declared that settlement, privacy, and compliant identity are the final form institutions have been waiting for before they begin tokenizing on the XRP Ledger. Notably, Ripple has already included introducing privacy features on the network into its roadmap.

Ripple CTO Defends XRP And XRPL

In an X post, Ripple CTO David Schwartz defended XRP and the XRPL after the altcoin was described as being “extremely centralized” because it is permissioned. Schwartz rebutted the statement that it was permissioned, noting that no one needs, or could have, any special permission to issue or execute XRPL transactions.

He further stated that XRP is unpermissioned for the same reason Bitcoin is. He added that if anyone were to exercise control over the network in a way that is perceived as unfair, everyone else would change whatever was needed to regain fairness. The Ripple CTO also mentioned that, over more than a decade, no XRP transaction has been censored. At the same time, he claimed that Bitcoin miners routinely delay transactions they disfavor for any reason.

At the time of writing, the XRP price is trading at around $2.05, down in the last 24 hours, according to data from CoinMarketCap.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

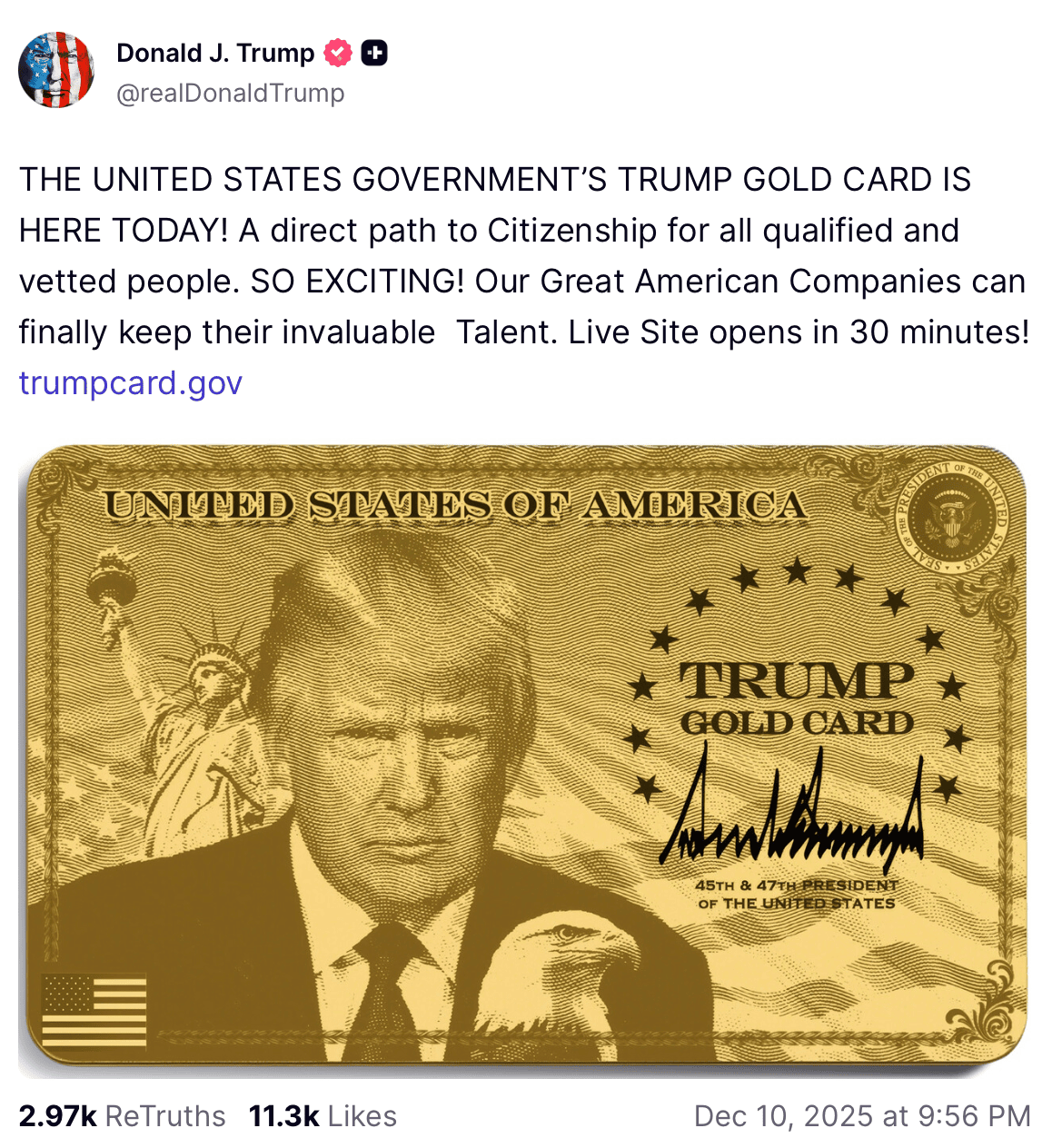

Trump Announced the Launch of the Trump Gold Card