Solana Mobile to Launch SKR Native Token in January

Solana Mobile confirmed it will launch SKR, a governance token for its Seeker smartphone ecosystem, in January 2026, with a total supply of 10 billion tokens distributed across airdrops, partnerships, and community initiatives.

The company positioned the token as a mechanism to decentralize platform ownership and align incentives across device holders, developers, and network validators known as Guardians.

The announcement comes amid a hardware security controversy, as Ledger researchers disclosed an unfixable vulnerability in the MediaTek Dimensity 7300 chip used in Seeker devices that could enable a complete device takeover and private key theft through physical access.

Token Distribution Targets Early Adopters

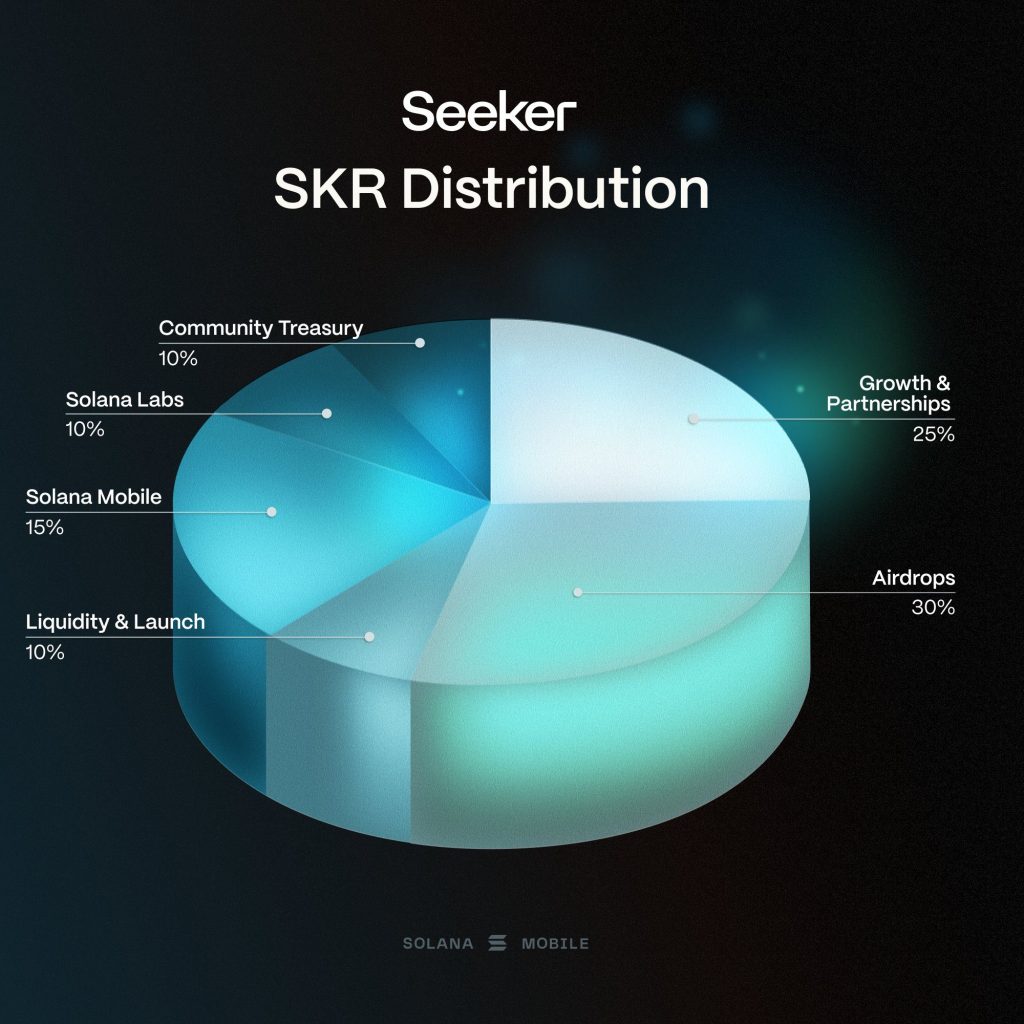

SKR’s 10 billion token supply allocates 30% to airdrops targeting Seeker and original Saga phone holders, while 25% supports growth initiatives and partnerships with ecosystem participants.

Another 10% funds are used for initial liquidity and launch operations, with an additional 10% reserved for community treasury governance.

Solana Mobile receives 15% of the supply, and Solana Labs holds the remaining 10%.

The token employs linear inflation, starting at 10% in year one and declining by 25% annually until stabilizing at a 2% terminal rate.

Source: X/@solanamobile

Source: X/@solanamobile

Solana Mobile said this structure incentivizes early participants who stake tokens to secure the network and support platform development during critical growth phases.

Guardians, who are validators responsible for device authentication, dApp review, and community standards enforcement, will include Solana Mobile at launch, with committed partners Helius, DoubleZero, Triton, Jito, and Anza joining throughout 2026.

Users can stake SKR to Guardians, back builders, secure devices, and curate the dApp Store, with ecosystem value flowing back to active participants.

Security Flaw Shadows Launch Momentum

Hours before the token announcement, Ledger disclosed a critical hardware vulnerability in the MediaTek Dimensity 7300 chip powering Seeker devices and other smartphones across multiple manufacturers.

Security researchers Charles Christen and Léo Benito successfully executed electromagnetic fault injection attacks during the chip’s boot phase, gaining what they described as “full and absolute control” of compromised handsets.

The attack bypasses memory protections and overwrites security controls embedded in the system-on-chip, enabling the extraction of cryptographic keys and sensitive data.

While individual attack success rates range from 0.1% to 1%, Ledger estimates that repeated attempts can compromise a device within minutes for attackers with physical device access.

Ledger disclosed the flaw to MediaTek in early May after beginning tests in February, prompting the chipmaker to notify affected device vendors.

MediaTek responded that the Dimensity 7300 was designed for consumer smartphones rather than secure financial infrastructure, stating that manufacturers handling sensitive cryptographic material should implement specific physical attack protections.

The company added that the vulnerability falls outside the chip’s original design scope, leaving affected devices permanently exposed since no software patch can resolve hardware-level flaws.

Mixed Sentiment on Token Utility

Social media commentary revealed divided perspectives on SKR’s value proposition and long-term viability.

Critics questioned the token’s fundamental utility, noting the lack of clarity regarding revenue sharing or governance rights beyond platform coordination.

One observer described the launch as “backwards,” arguing that without defined revenue entitlements, SKR functions essentially as a meme coin rather than a legitimate governance infrastructure.

Others outlined airdrop farming strategies, recommending daily device usage, wallet swaps, validator staking, dApp interactions, and the deployment of the DePIN application to maximize allocation from the 30% airdrop pool.

Tech creator Ashen noted the 10 billion supply represents unusually “high inflation” compared to standard 1 billion token launches. “Solana REALLY loves inflation lmfaoo,” he said.

However, he expressed cautious optimism given the Solana team’s backing and the substantial 30% airdrop allocation for approximately 100,000 Seeker holders.

Market observers also cited Solana’s broader ecosystem momentum, including recent partnerships like the KRW-pegged stablecoin collaboration with Korean infrastructure firm Wavebridge, and institutional validation evidenced by continued ETF inflows despite recent market volatility.

Solana Foundation President Lily Liu recently emphasized at Binance Blockchain Week that stablecoin market capitalization has surged 50% this year, and positioned the blockchain as infrastructure for global improvements in capital efficiency.

You May Also Like

What Does Market Cap Really Mean in Crypto — and Why Australians Care

The Manchester City Donnarumma Doubters Have Missed Something Huge