Trust Wallet Enters Prediction Markets Race With New Trading Feature

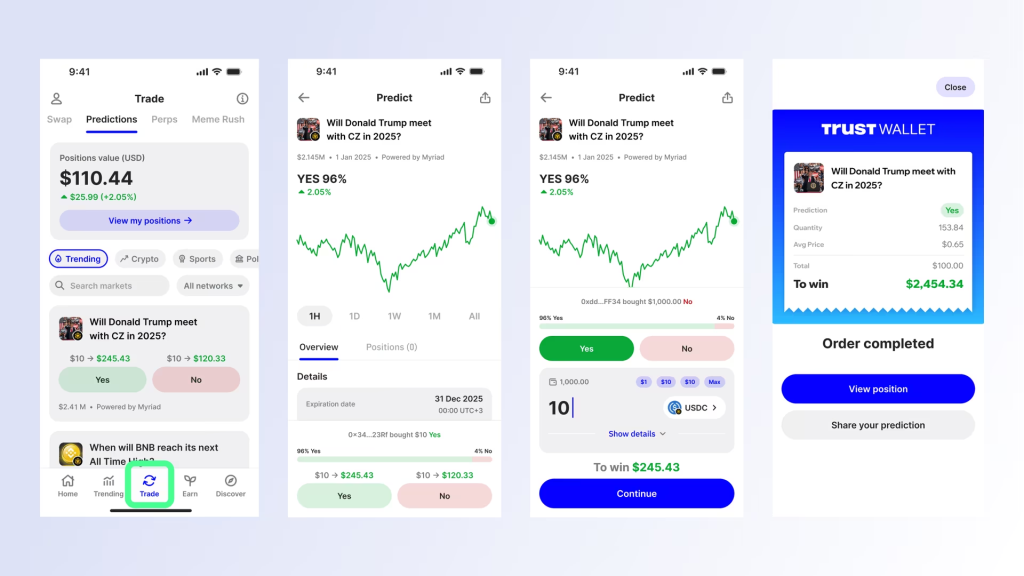

Trust Wallet has launched a prediction markets feature that lets its 200 million users trade real-world event outcomes directly from their wallets without leaving the app.

The wallet-native tool went live on December 2 on Myriad on BNB Chain, with integrations with Polymarket and Kalshi to follow soon.

The move positions Trust Wallet inside a rapidly expanding sector where platforms like Kalshi recently raised $1 billion at an $11 billion valuation, and Polymarket dominates with $248 million in total value locked.

Trust Wallet users can now browse curated events spanning crypto milestones, politics, sports, and global trends, then take YES or NO positions on outcomes tracked fully on-chain in self-custody.

Wallet-Native Trading Removes Platform Friction

Trust Wallet’s Predictions tab appears on the Swaps page, eliminating the need for separate apps or accounts.

Users select events, choose outcome positions, and hold tokenized shares entirely on-chain through vendor smart contracts.

Real-time pricing and sentiment data are surfaced directly in the interface, while event resolution is handled by integrated partners rather than Trust Wallet itself.

Source: Trust Wallet

Source: Trust Wallet

Myriad operates on BNB Chain for non-US regions, Polymarket runs via Swap.xyz on Polygon, and Kalshi offers regulated markets on Solana for US and global users.

Access varies by jurisdiction, with automatic geofencing applied based on each vendor’s compliance requirements.

The wallet handles regional restrictions automatically, routing eligible participants to appropriate markets while blocking others.

The integration consolidates multiple prediction platforms into a single interface, allowing users to explore markets from different providers without switching between websites or managing separate accounts.

Each position sits on-chain in the user’s own wallet, maintaining full transparency and self-custodial control aligned with Web3 principles.

Prediction Markets Show Strong Growth Despite Early Risks

Prediction markets have generated $3.7 billion in trading volume as of November, according to Dune data, with Opinion leading at $1.5 billion, Kalshi at $1.2 billion, and Polymarket at $952 million.

Total value locked across the sector reached $337 million in November, up sharply from earlier in the year as users discovered they could profit in stablecoins regardless of broader crypto market conditions.

The sector’s appeal centers on outcome-based returns that remain independent of crypto market fluctuations.

Most bets are placed in stablecoins, with results determined solely by whether predictions prove correct.

This structure has attracted participants who consistently earn even during market downturns, though questions about insider-like behavior and wallet patterns persist across platforms.

The sector’s booming growth has attracted big players as well.

Last month, Coinbase confirmed plans to launch its own prediction platform via Kalshi. At the same time, Robinhood and Susquehanna agreed to acquire 90% of LedgerX to operate a dedicated prediction futures exchange launching in 2026.

Robinhood said customers traded 9 billion contracts across more than 1 million accounts in the first year, making prediction markets its fastest-growing product by revenue.

Gemini also filed with the CFTC to become a designated contract market, and Crypto.com launched a prediction product with Trump Media.

In fact, Google Finance announced it will integrate Kalshi and Polymarket data directly into search results, bringing crowd-priced odds on future events alongside traditional market data.

Intercontinental Exchange, owner of the New York Stock Exchange, also agreed in October to invest up to $2 billion in Polymarket.

Trust Wallet Expands Financial Services Beyond Trading

Trust Wallet CEO Eowyn Chen previously outlined plans to transform the wallet into a Web3 neobank offering self-custody, asset exposure, DeFi access, staking, and identity management in one globally accessible app.

The company partnered with Ondo Finance in September to launch tokenized stocks and ETFs, giving users exposure to US equities without traditional brokerage accounts.

Chen said RWAs provide access to financial products previously unavailable to users in emerging markets, allowing participation without sacrificing custody or relying on centralized platforms.

So far, Trust Wallet has integrated the 1inch Swap API to consolidate prices from decentralized exchanges across Ethereum, BNB Chain, Polygon, and Solana.

You May Also Like

CME Group to Launch Solana and XRP Futures Options

Trump swears he'll donate winnings in $10 billion lawsuit against his own IRS