12 Best Crypto to Buy Right Now — Feburary 2026

Are you looking to invest in cryptocurrencies but unsure which one to buy? With so many options available, it can be overwhelming to decide how to invest your money. That’s why we’ve compiled a list of the best crypto to buy now, based on factors such as project developments, price performance, and market capitalization, as well as the overall potential for growth.

In this article, we’ll take a closer look at the most promising cryptocurrencies, including staples such as Bitcoin and Ethereum, and a combination of several other promising crypto projects. We’ll discuss their features, advantages, and potential drawbacks, as well as provide insights into market trends. Whether you’re a seasoned investor or just starting out, this article will help you make an informed decision about the best crypto to buy now.

So, let’s dive in and explore the best cryptocurrencies to invest in February 2026:

- Bitcoin – The world’s oldest and largest crypto

- Hyperliquid – Decentralized perpetuals exchange with an efficient order book

- Ethereum – The leading DeFi and smart contract platform

- XRP – The leading crypto remittance solution

- Dash – A fast, low-fee cryptocurrency for everyday payments

- Monero – A privacy-first cryptocurrency with fully obfuscated transactions

- Zcash – Privacy-focused cryptocurrency

- Uniswap – A pioneering decentralized exchange protocol

- BNB – The native coin of the Binance exchange

- Chainlink – The leading decentralized oracle protocol

- Solana – Smart contracts platform with high speeds and low fees

- Cardano – A peer-reviewed blockchain built for smart contracts and scalable dApps

The best cryptos to buy right now: Discover top investments for February 2026

The following three cryptocurrency projects highlight our investment selection thanks to important developments and upcoming events that make them especially interesting to follow in the near future. These projects are updated each week based on the most recent developments and trends taking place in the crypto market.

1. Bitcoin

Bitcoin (BTC) is the original decentralized digital currency, enabling peer-to-peer transactions without the need for intermediaries such as banks or financial institutions. It was created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. Bitcoin was the first digital currency to eliminate the double spending problem without resorting to any central intermediaries.

Bitcoin transactions are recorded on a public ledger called the blockchain, which is maintained by a network of computers around the world. This means that the transactions are secure and transparent, as anyone can view them, but they are also anonymous, as the identity of the participants in the transaction is not revealed.

Bitcoin is often referred to as “digital gold” or a store of value, as it has a limited supply of 21 million coins, and its value is determined by market demand. Some people also see it as a hedge against inflation or a way to diversify their investment portfolio. It is by far the largest cryptocurrency by market cap in the industry, accounting for the value of more than 50% of all digital assets in circulation combined, making it arguably the most popular crypto to buy.

Why Bitcoin?

Bitcoin fell sharply this week, sliding to $77,983 and posting an 11.26% weekly loss, as macro-driven volatility rippled across risk assets. The sell-off accelerated after US President Donald Trump nominated Kevin Warsh to replace Jerome Powell as Federal Reserve chair, a move markets interpreted as more hawkish on inflation and liquidity. BTC briefly dipped to $75,892, momentarily trading below Strategy’s average cost basis, while gold, silver, and equities also pulled back. Crypto sentiment deteriorated alongside price action, with the Crypto Fear & Greed Index dropping to 14, its lowest level in over a month.

Despite the drawdown, signs of conviction from long-term bulls remain. Strategy’s Michael Saylor hinted at another Bitcoin purchase during the dip, continuing a pattern that has made the firm the largest corporate BTC holder with over 712,000 BTC on its balance sheet. Historically, Strategy has added aggressively during periods of stress rather than strength, reinforcing the view that institutional buyers still see sub-$80,000 levels as accumulation zones. While near-term volatility remains elevated, sustained buying from large holders suggests Bitcoin’s long-term thesis is being tested, not abandoned.

2. Hyperliquid

Hyperliquid is a decentralized perpetual futures exchange built to rival centralized trading platforms in speed, liquidity, and user experience—all while remaining fully on-chain. Unlike traditional DEXs that often struggle with performance bottlenecks, Hyperliquid uses a custom high-performance layer-1 blockchain specifically optimized for trading. This allows it to offer ultra-low latency, high throughput, and a seamless trading experience without relying on external validators or rollups.

One of Hyperliquid’s key innovations is its order book-based model, which is uncommon among decentralized platforms. While many DEXs use automated market makers (AMMs), Hyperliquid implements a central limit order book (CLOB), giving traders more control over order execution and tighter spreads. This design makes it particularly appealing to professional and high-frequency traders who expect the responsiveness of centralized exchanges but want the trustlessness of DeFi. Its deep liquidity pools and tight integration with crypto-native assets further enhance its trading dynamics.

Why Hyperliquid?

Hyperliquid has been one of the strongest and only movers in the market this week, with HYPE up 37.42% to around $30.70, lifting its market cap to roughly $9.28 billion. The rally followed a sharp burst of buying tied to staking activity and balance-sheet accumulation, including flows linked to Hyperliquid Strategies, a publicly listed digital asset treasury firm. Onchain data shows millions of HYPE tokens transferred via custodial services like Anchorage and staked shortly after, materially reducing near-term sell pressure following recent unlocks. That supply squeeze helped push prices higher and triggered more than $30 million in short liquidations, amplifying the move.

Beyond staking dynamics, Hyperliquid’s derivatives ecosystem has also been a key driver. Activity on its HIP-3 framework, which allows permissionless deployment of perpetual markets, surged to new highs as commodities trading exploded. Open interest on HIP-3 markets climbed toward the $800–900 million range, driven largely by gold and silver contracts during the ongoing precious-metals rally. Daily volumes across HIP-3 decentralized exchanges also hit record levels, reinforcing Hyperliquid’s growing relevance in niche but fast-expanding derivatives segments.

That said, the rally has not been accompanied by a dramatic increase in overall perpetual volumes or aggregate open interest compared with major centralized exchanges, suggesting the move may be concentrated rather than broad-based. Recent gains appear closely tied to one-off catalysts such as staking flows, reduced selling from large holders, and renewed speculative interest sparked by bullish research coverage. While Hyperliquid’s long-term fundamentals remain compelling, especially around its permissionless perps model, sustaining upside from here will likely depend on whether user activity and derivatives demand continue to expand beyond the current commodities-led surge.

3. Ethereum

Launched in 2015 by Vitalik Buterin and a team of developers, Ethereum is a decentralized, open-source blockchain platform that allows developers to build decentralized applications (dApps) and smart contracts.

Ethereum has a wide range of use cases beyond just a store of value or medium of exchange. Ethereum’s smart contract functionality allows developers to build dApps that can run without the need for intermediaries, like centralized servers or institutions.

The Ethereum platform has gained widespread adoption and has become the backbone of the decentralized finance (DeFi) industry. DeFi applications built on Ethereum allow users to access financial services without relying on traditional banks or financial institutions. Ethereum’s smart contract functionality has also enabled the creation of non-fungible tokens (NFTs), which have gained popularity in the digital art and gaming worlds.

While Ethereum has a strong community and has been highly influential in the cryptocurrency industry, it also faces challenges, such as scalability issues and high gas fees. These issues have spurred the development of various Layer 2 scaling solutions. In the long run, future updates are supposed to massively increase Ethereum’s throughput bringing the transaction per second (TPS) figure from 15 to 100,000.

Why Ethereum?

Ethereum has been under heavy pressure this week, with ETH down 20.04% to around $2,313, pulling its market cap to roughly $279 billion. Despite the sharp drawdown, many traders argue the move looks more like a deep corrective phase than a structural breakdown. Several analysts continue to point to long-term cycle patterns, Wyckoff-style setups and global liquidity correlations that still leave room for a much higher ETH valuation later in the cycle, with bullish targets clustering in the $10,000–$15,000 range if key resistance levels are eventually reclaimed. Importantly, this correction has come alongside record network usage, not declining activity.

Onchain data continues to lean constructive beneath the price weakness. Ethereum recently posted record daily transactions and a sharp rise in active addresses, while transaction fees have fallen to multi-year lows, improving usability and lowering barriers for users and developers. Low fees combined with high throughput are typically seen as a long-term tailwind, particularly as smart contract deployments and onchain activity remain elevated even during periods of negative sentiment.

30-day performance of top layer-1 blockchains. Source: Nansen.

30-day performance of top layer-1 blockchains. Source: Nansen.

Institutional behavior also remains a key support pillar. BitMine, the largest public Ethereum treasury company, now holds more than 4.2 million ETH, with over 2 million ETH actively staked, translating into an estimated $160+ million in annual staking revenue at current yields. Other treasury firms are following similar strategies, reinforcing ETH’s role as a yield-bearing base asset. At the same time, Ethereum co-founder Vitalik Buterin has earmarked $45 million worth of ETH for privacy and open-source infrastructure initiatives, underlining a continued long-term commitment to the network’s technical and ideological foundations even as prices remain under pressure.

4. XRP

XRP is a digital cryptocurrency that was created by Ripple Labs in 2012. It is used as a means of payment and transfer of value on the Ripple payment protocol, which is designed to enable fast and secure transactions between financial institutions as well as individuals.

XRP is unique in that it is not based on the blockchain technology used by many other cryptocurrencies. Instead, it uses a distributed consensus ledger called the XRP Ledger, which is maintained by a network of validators. This allows for faster transaction processing times and lower fees compared to traditional payment methods.

XRP has been popular among cryptocurrency traders and investors due to its high liquidity and clear potential for broader adoption, especially as a remittance solution. However, it has also been the subject of controversy and legal action, with US regulators alleging that it is a security and should thus be subjected to securities regulations. This has somewhat hindered the potential of XRP as an investment, and handcuffed Ripple’s growth as a company.

Why XRP?

XRP is trading at $1.90, down 3.94% on the week, with a market cap of $115.53 billion, as the token remains stuck in a fragile range following its steep decline from the $3.66 peak set in mid-2025. But despite weak price action, derivatives data suggests XRP may be building the kind of setup that has historically preceded sharp rebounds. The key signal this week comes from Binance funding rates, which have stayed mostly negative for nearly two months. That indicates leveraged traders are heavily positioned for downside and are paying to maintain short exposure. This matters because crowded shorts often create a built-in reversal mechanism: if price begins moving up, forced liquidations can flip into sudden buying pressure, triggering a squeeze.

Binance funding rates stayed negative, showing crowded shorts that may fuel a squeeze if XRP rebounds. Source: CryptoQuant

Binance funding rates stayed negative, showing crowded shorts that may fuel a squeeze if XRP rebounds. Source: CryptoQuant

CryptoQuant analyst Darkfost framed it as “latent buy pressure,” noting that similar negative funding periods preceded major XRP rebounds in previous cycles. The idea is that heavy short positioning adds short-term pressure, but it also loads the market with potential fuel if price stabilizes and turns higher. XRP’s ability to hold the $1.80–$2.00 zone is critical here. That range has acted as a major pivot level in past phases, including the launchpad for XRP’s explosive rally earlier in 2025. If bulls can reclaim $2 as support and push back toward key resistance levels, the squeeze scenario becomes more realistic.

XRP continues trading inside a wide multi-year range, with $1.80–$2.00 acting as a key support zone. Source: TradingView / Bitcoinwallah

XRP continues trading inside a wide multi-year range, with $1.80–$2.00 acting as a key support zone. Source: TradingView / Bitcoinwallah

However, onchain data also highlights a key risk: the $2 zone has repeatedly acted as a “pain point” where holders exit rather than accumulate. Glassnode data shows that retests of the $2 area have historically coincided with large realized losses, suggesting some investors were using rebounds as chances to reduce exposure. That implies XRP will likely face selling friction near the psychological $2 level, even if price stabilizes first. Technically, the next major bullish trigger sits around the 50-week EMA near $2.22, while the downside risk remains significant if XRP loses the $1.80 support and slips toward the 200-week EMA around $1.40. In short, XRP looks like a coin with compressed positioning: downside is still possible, but if price holds the range and momentum improves, the short-heavy structure could quickly flip into a violent relief move.

5. Dash

Dash is a cryptocurrency originally created to support fast, low-cost digital payments, with privacy as an optional feature. Launched in 2014 under the name “XCoin” (later rebranded to “Darkcoin” before becoming Dash), it was designed as a fork of Litecoin with a stronger focus on day-to-day usability. Dash offers features like InstantSend for near-instant confirmations and PrivateSend, a coin-mixing mechanism that helps obscure transaction history, giving users more discretion than standard transparent blockchains.

Unlike Bitcoin, Dash operates with a two-tier network that includes both miners and masternodes, which help power governance, privacy functions, and network services. Dash uses a Proof-of-Work consensus model (X11 algorithm) alongside a treasury system that funds development and marketing through on-chain governance votes. While Dash isn’t fully anonymous by default, its blend of speed, usability, and optional privacy tools has helped it remain one of the longest-running payment-focused cryptocurrencies, even as privacy narratives periodically return to the spotlight.

Why Dash?

Dash is trading around $79.61, up an eye-catching 110.67% over the past seven days, with its market cap now sitting near $999M, as the privacy coin narrative pulled more capital into the sector. The rally was largely driven by rotation away from Zcash after its governance turmoil, while Monero took the lead and Dash emerged as a higher-beta catch-up trade.

Dash spikes over 100% in a week as privacy coins rally and capital rotates away from Zcash. Source: CoinCodex

Dash spikes over 100% in a week as privacy coins rally and capital rotates away from Zcash. Source: CoinCodex

DASH also benefited from renewed attention on privacy following the rollout of the EU’s DAC8 reporting directive, plus a new partnership with Alchemy Pay that expands fiat on- and off-ramp access across a wide set of countries.

From a technical standpoint, Dash is now testing a major long-term resistance zone that has capped rallies for years. Analysts warn that this area has historically been followed by sharp pullbacks when rallies failed to break through decisively, meaning the move could still turn volatile if momentum fades. On the flip side, a clean breakout and sustained hold above resistance could shift the structure in DASH’s favor and keep the upside case alive, with some targets pointing toward the $125 area if the trend continues.

DASH approaches multi-year resistance, with traders watching for either a breakout or a sharp cooldown. Source: TradingView / bitcoinwallah

DASH approaches multi-year resistance, with traders watching for either a breakout or a sharp cooldown. Source: TradingView / bitcoinwallah

More broadly, Dash is also part of a wider privacy coin resurgence happening even as the rest of the crypto market remains choppy. Some analysts describe this as “defensive” positioning, driven by rising on-chain surveillance and regulatory pressure, which is making privacy-focused assets attractive as a hedge rather than just a speculative bet. With the sector back in focus, Dash is one of the most aggressive movers, but after such a steep weekly rally, it’s also one of the names where traders are watching closely for signs of overheating.

6. Monero

Monero is a privacy-focused cryptocurrency designed to offer anonymous and untraceable transactions. Launched in 2014 as a fork of Bytecoin, Monero was introduced through a whitepaper written by the pseudonymous “Nicolas van Saberhagen.” Unlike Bitcoin or Ethereum, Monero conceals sender and receiver identities, as well as transaction amounts, through advanced cryptographic techniques such as stealth addresses and ring signatures. This strong focus on privacy has made Monero a favorite among users seeking true financial confidentiality.

Monero runs on a Proof-of-Work (PoW) consensus mechanism and is deliberately resistant to ASIC mining to support decentralization. It can be mined efficiently using consumer-grade hardware, and its privacy-preserving features also improve fungibility—individual XMR coins are indistinguishable from one another and can’t be blacklisted. Despite its strong standing within the crypto community, Monero has been the subject of regulatory scrutiny due to concerns over its potential use in illicit activities. Nonetheless, it remains the most widely adopted privacy coin in the market today.

Why Monero?

Monero surged to its highest level since 2021 this week, reclaiming the spotlight among privacy-focused cryptocurrencies as XMR briefly pushed past $590 and entered fresh price discovery. The rally coincided with renewed interest in privacy assets and a sharp contrast with governance turmoil at rival Zcash, where internal disputes triggered developer resignations and a steep sell-off. With ZEC faltering, traders appeared to rotate toward Monero as the more stable and decentralized privacy exposure, lifting XMR back toward levels not seen in nearly five years.

XMR/USD chart showing the breakout above $500. Source: CoinCodex

XMR/USD chart showing the breakout above $500. Source: CoinCodex

Beyond relative strength against peers, Monero’s move also reflects a broader shift in sentiment around financial privacy. Institutional commentary from firms such as Grayscale and Coinbase has increasingly highlighted privacy as a structural theme for 2026, driven by tighter compliance rules, onchain transparency concerns, and growing demand for confidential transactions. While Monero faced scrutiny in 2025 following a large block reorganization and ongoing debates around mining concentration, those concerns have faded from price action as the network continued to operate without lasting disruption. As Zcash’s roadmap faces uncertainty, Monero has regained its position as the largest privacy coin by market capitalization.

Monero price comparison versus Zcash. Source: CoinCodex

Monero price comparison versus Zcash. Source: CoinCodex

From a technical perspective, XMR is now testing a historically critical zone. Previous attempts to break above the $500–$520 range have failed multiple times over the past decade, often followed by sharp corrections once momentum stalled. That history suggests near-term volatility remains likely unless Monero can decisively hold above former resistance. A confirmed breakout would invalidate the bearish fractal and open the door to higher targets around $750, based on long-term Fibonacci extensions. While pullbacks cannot be ruled out after such a steep rally, Monero’s reclaiming of its privacy crown and entry into price discovery place it among the more closely watched large-cap setups heading into 2026.

XMR/USD chart highlighting prior failed breakouts and resistance zone. Source: TradingView

XMR/USD chart highlighting prior failed breakouts and resistance zone. Source: TradingView

7. Zcash

ZCash (ZEC) is a privacy-focused cryptocurrency that was launched in 2016 by Zooko Wilcox-O’Hearn. It is a fork of Bitcoin, designed to enhance privacy and anonymity for its users. Unlike Bitcoin, where transaction details (such as sender, recipient, and amount) are publicly visible, ZCash allows users to choose between two types of transactions: transparent and shielded.

Transparent transactions work similarly to Bitcoin, where all transaction details are recorded on the blockchain and visible to everyone. However, shielded transactions use a cryptographic technology called zk-SNARKs to allow fully private transactions. In shielded transactions, the details are encrypted, meaning that only the parties involved have access to the information, while the validity of the transaction is still verifiable by the network.

ZCash is particularly valued by those who prioritize financial privacy and security, as it offers optional anonymity in a way that few other cryptocurrencies do.

Why Zcash?

Grayscale has taken steps to convert its long-standing Zcash Trust into a spot ETF by submitting an S-3 Zcash has extended its rally this week, trading near $521 and posting a 17% gain over the past seven days, as technical momentum and renewed interest in privacy-focused assets converge. Analysts point to a bullish ascending triangle formation on lower timeframes, a pattern that has been building for several weeks and typically precedes upside continuation. According to chart analysis shared by Ali Charts, a confirmed breakout above the former resistance zone could open the door to a 35% move, with measured targets clustering around the $650 level.

Momentum indicators have supported the constructive setup. The MACD has remained positive for multiple weeks, while shorter-term moving averages continue to trend above longer-term averages, signaling sustained buyer control. Analysts note that price compression near resistance often reflects accumulation rather than distribution, particularly when supported by improving volume and broader sector strength. With ZEC already reclaiming key levels, traders are watching closely for follow-through confirmation.

Beyond price action, onchain data highlights a deeper structural shift underway. According to recent metrics, Zcash’s shielded supply has stabilized at roughly 23% of total circulating ZEC, up sharply from around 8% at the start of 2025. Rather than fading as hype cooled, privacy usage has held firm, suggesting adoption is driven by practical demand instead of short-lived speculation. Large holders have also increased their ZEC balances during recent pullbacks, pointing to continued accumulation by long-term participants.

Zcash’s shielded supply has stabilized near 23%, indicating sustained adoption of privacy-preserving transactions. Source: The Block

Zcash’s shielded supply has stabilized near 23%, indicating sustained adoption of privacy-preserving transactions. Source: The Block

The broader privacy narrative continues to gain relevance as crypto moves toward more real-world payment and settlement use cases. Public blockchains expose wallet balances and transaction histories by default, creating friction for everyday users and businesses. As stablecoins and onchain payments scale, privacy solutions like Zcash are increasingly viewed as necessary infrastructure rather than niche features. With improving technicals, steady onchain adoption, and a renewed focus on privacy across the sector, Zcash is emerging as one of the more notable large-cap performers heading into 2026.

8. Uniswap

Uniswap is a decentralized cryptocurrency exchange that pioneered and helped popularize the automated market maker (AMM) model. This innovative approach eliminates the need for traditional order books, enabling users to swap tokens directly on the blockchain in a streamlined, intermediary-free manner.

The Uniswap protocol operates in a fully decentralized way, allowing anyone to create liquidity pools for any token. As a result, newly launched crypto assets are often traded on Uniswap before becoming available on centralized exchanges.

Uniswap’s model has since been adopted by numerous decentralized exchanges across various blockchain networks. Despite this, Uniswap continues to lead the decentralized exchange space in terms of trading volume.

Governance of Uniswap is handled by holders of the UNI token, who can propose and vote on protocol changes. UNI was initially distributed to past users of the protocol through an airdrop in 2020, and the token can now be bought and sold on many decentralized and centralized trading platforms.

Why Uniswap?

UNI has recently outperformed the broader market, rising 16.5% over the past seven days while many other leading crypto assets moved sideways. This rally appears to be fundamentally driven, as

Uniswap founder Hayden Adams has advanced the long-anticipated UNIfication proposal to a final on-chain governance vote, a move that could significantly reshape how value accrues to UNI holders.

The proposal seeks to enable protocol fees on Uniswap v2 and selected v3 pools on Ethereum, directing a portion of trading fees into an automated UNI burn mechanism. After years of delays due to regulatory uncertainty, proponents argue that the environment has changed, allowing the protocol to finally implement a fee structure that directly links token value to usage.

A key component of the plan is a one-time burn of 100 million UNI from the treasury, intended to account for the value that might have accrued if protocol fees had been active since the beginning. Going forward, fees would be rolled out gradually to limit disruption for liquidity providers, with governance maintaining flexibility to adjust parameters as needed.

The proposal also broadens value capture beyond Ethereum mainnet by funneling Unichain sequencer fees into the same burn process, tying UNI supply reduction to activity on Uniswap’s Layer 2 network, which already handles significant trading volume.

Beyond token economics, UNIfication aims to unify governance, development, and operations under a single structure. Uniswap Labs would eliminate interface, wallet, and API fees, operate using governance-approved funding, and enter legally binding agreements to align its actions with the interests of UNI holders.

If the proposal passes, UNI would evolve from a purely governance-focused token into one with direct, usage-based value accrual, bringing renewed attention to the asset as the vote progresses.

9. BNB

BNB (formerly Binance Coin) is a cryptocurrency created by the popular cryptocurrency exchange Binance. Binance is the largest cryptocurrency exchange in the world, allowing users to buy, sell, and trade a wide range of digital assets.

BNB was initially one of the ERC-20 tokens on the Ethereum blockchain but has since migrated to its own blockchain, known as BNB Chain. BNB is used as a utility token within the Binance ecosystem and has a variety of use cases. For example, users can use BNB to pay for transaction fees on the Binance exchange, receive discounts on trading fees, participate in token sales on Binance Launchpad, and purchase goods and services from merchants that accept BNB as payment.

One of the unique features of BNB is that it has a deflationary model. Binance uses a part of its profits each quarter to buy back and burn BNB tokens, reducing the total supply of the token over time. This mechanism is designed to create scarcity and increase the value of BNB over time, with the end goal of reducing the circulating supply of BNB from the initial 200 million to 100 million BNB.

Why BNB?

BNB reclaimed $900 this week after bouncing sharply from the $800–$820 demand zone, with multiple bullish technical structures now aligning behind a potential push back toward $1,000 in December. A double-bottom pattern on the 4H chart, combined with a clean breakout from a multi-week falling wedge, signals fading seller momentum and renewed appetite from dip-buyers. Liquidation heatmaps reveal over $112 million in short liquidations clustered near $1,020, suggesting a move toward that level could accelerate quickly if BNB breaks and holds above $900–$920.

BNB’s double-bottom and wedge breakout point toward a $1,000+ target. Source: Bitcoinwallah / TradingView

BNB’s double-bottom and wedge breakout point toward a $1,000+ target. Source: Bitcoinwallah / TradingView

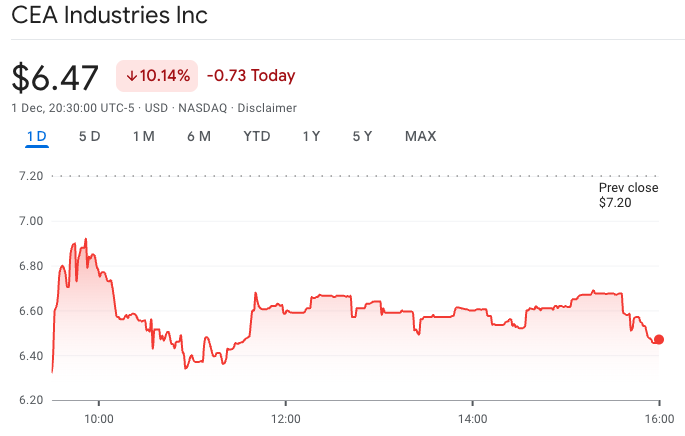

However, BNB’s narrative this week also revolved around turbulence in the corporate treasury sector. CZ’s YZi Labs launched a formal attempt to overhaul the board of CEA Industries — the largest public BNB-holding company — accusing management of destroying shareholder value after the stock plunged 89% from its July peak. YZi aims to reverse recent bylaw changes, expand the board, and install its own nominees, arguing that CEA has failed to execute on its strategy of becoming the leading BNB treasury company. CEA responded by reaffirming its commitment to the BNB strategy while opening a dialogue with YZi to resolve concerns.

CEA stock collapses as YZi Labs pushes for a board takeover. Source: Google Finance

CEA stock collapses as YZi Labs pushes for a board takeover. Source: Google Finance

CEA stock collapses as YZi Labs pushes for a board takeover. Source: Google FinanceDespite governance drama and broader market pressure, BNB has held up better than many large-cap assets this quarter, outperforming even as it trades well below its mid-October all-time high of $1,367. CEA’s reported holdings of 515,054 BNB at an average entry of $851 place its treasury slightly underwater, yet BNB itself remains up 17.8% year-to-date, reinforcing its relative strength during the latest downturn. If bullish technicals continue to hold — and especially if liquidation clusters begin to trigger — analysts say BNB could feasibly revisit the $1,020–$1,115 range before year-end.

10. Chainlink

Chainlink is a decentralized oracle network designed to provide blockchains with secure, reliable data from external sources. It addresses the long-standing “oracle problem” by safely connecting on-chain systems with off-chain information, enabling many applications that wouldn’t be possible using blockchain data alone.

Already the dominant oracle provider in decentralized finance (DeFi), Chainlink is also gaining traction in NFT projects and crypto gaming. For example, a DeFi protocol can pull price feeds from centralized exchanges through Chainlink to power its smart contracts, while NFT platforms often rely on Chainlink’s verifiable randomness to ensure fair minting processes and transparent distribution.

Why Chainlink?

Chainlink rallied 15% this week to $14.10, boosted by a major interoperability milestone: Solana and Coinbase’s Base have been connected using Chainlink’s Cross-Chain Interoperability Protocol (CCIP). The new bridge allows seamless asset transfers between Solana and the Base L2 ecosystem, giving developers the ability to integrate SPL tokens directly into Base applications. This marks one of the first production-ready bridges linking an EVM chain to Solana’s non-EVM architecture, reinforcing Chainlink’s role as the industry’s dominant cross-chain infrastructure provider. Despite the breakthrough, LINK traded slightly lower on the day, mirroring broader altcoin weakness.

Chainlink also secured a significant step in institutional adoption as Grayscale’s spot LINK ETF debuted in the U.S., attracting $41 million in first-day inflows and posting “solid” trading volume, according to ETF analysts. While not a blockbuster launch like XRP’s, the ETF already manages $64 million in assets, showing that investor appetite is extending beyond Bitcoin and Ethereum into high-utility altcoins. Analysts noted the debut signals growing demand for regulated exposure to “long-tail assets,” especially those underpinning real-world tokenization infrastructure — a trend that plays directly into Chainlink’s strengths.

Still, the LINK token remains down 73% from its all-time high, and the ETF launch alone has not reversed its long-term downtrend. But Chainlink’s strategic importance continues to grow: its oracle networks and CCIP are now core infrastructure for DeFi, tokenization protocols, and cross-chain applications across the industry. With Solana, Base, and multiple ETF providers integrating or backing the network, LINK’s recent strength suggests investors are beginning to reprice Chainlink as a foundational layer for the next phase of multi-chain development.

11. Solana

Solana is a smart contract platform known for its distinctive architecture, enabling it to handle thousands of transactions per second while maintaining very low costs. It accomplishes this by using a combination of a unique Proof-of-History algorithm and a Proof-of-Stake consensus mechanism. SOL, the native cryptocurrency of the platform, is one of the cheapest to transfer, with users typically paying less than $0.001 per transaction.

Founded in 2018 by Anatoly Yakovenko, Solana’s mainnet went live in March 2020 and experienced a surge in adoption throughout 2021. Despite a significant drop in value during the 2022 bear market, Solana remains one of the most robust ecosystems in the cryptocurrency space and continues to be seen as a potential candidate for significant future growth.

Why Solana?

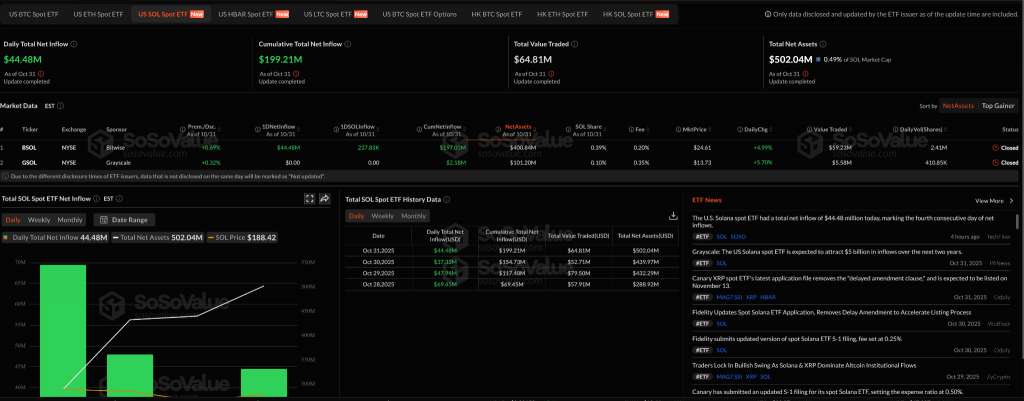

Solana dropped 12.3% this week to $175.79, bringing its market capitalization to $97.07 billion, even as it saw continued demand from institutional investors. According to SoSoValue, spot Solana ETFs recorded $44.5 million in inflows on Friday, marking their fourth consecutive day of gains and bringing total assets to more than $500 million. The Bitwise Solana ETF (BSOL) led the trend, boosted by a 7% staking yield and growing attention from investors rotating capital out of Bitcoin and Ether funds. Kronos Research’s Vincent Liu described the move as a “capital rotation” phase, as traders seek exposure to newer narratives and staking opportunities while major assets consolidate.

Solana ETF inflows. Source: SoSoValue

Solana ETF inflows. Source: SoSoValue

Institutional optimism around Solana remains strong. Bitwise CIO Matt Hougan said Solana offers investors “two ways to win” — by betting on both the expansion of the stablecoin and tokenization markets and Solana’s rising share of those sectors. He expects the blockchain to become a preferred network for stablecoin settlements and tokenized assets, citing its speed, cost-efficiency, and developer-driven ecosystem. Hougan also pointed to growing adoption, including Western Union’s decision to build a stablecoin settlement system on Solana, as proof of the network’s traction with traditional financial players.

Still, analysts note that Solana’s price decline reflects profit-taking after months of strong gains rather than fundamental weakness. Ethereum continues to dominate by overall network value, with over $85 billion in TVL and $163 billion in stablecoins, while Solana trails with $11.3 billion in TVL and $14.9 billion in stablecoins. Yet, the ongoing ETF inflows, institutional partnerships, and staking-driven demand suggest that Solana’s long-term outlook remains intact — even as short-term volatility pressures price action in the near term.

12. Cardano

Cardano is a decentralized proof-of-stake blockchain platform that aims to offer a more sustainable and scalable infrastructure for smart contracts and decentralized applications (dApps). It was launched in 2017 by Input Output (IOHK), co-founded by Charles Hoskinson, one of the original creators of Ethereum. Cardano stands out for its strong academic roots, with its protocol development guided by peer-reviewed research and formal verification methods.

Unlike proof-of-work systems like Bitcoin, Cardano uses a unique proof-of-stake consensus mechanism called Ouroboros, which allows it to achieve network security and decentralization with significantly lower energy consumption. ADA, the native cryptocurrency of Cardano, is used for staking, paying transaction fees, and participating in governance.

Cardano’s development is organized into multiple phases, focusing on areas such as decentralization, scalability, and interoperability. Its layered architecture separates settlement and computation, making it easier to upgrade and maintain. The platform supports smart contracts through its Plutus framework and is actively expanding its DeFi and NFT ecosystems.

Why Cardano?

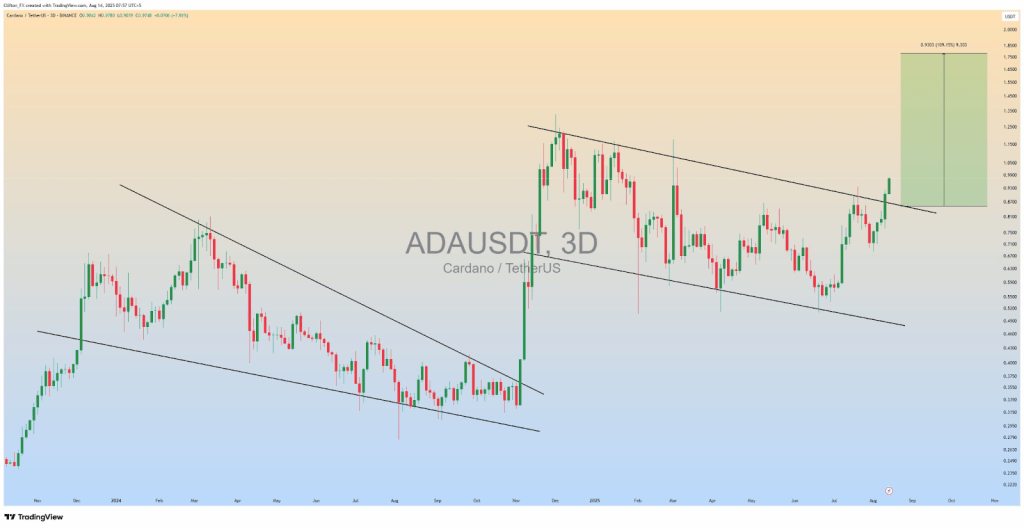

Cardano surged nearly 11% over the past week, briefly breaking above $0.97 and reaching a five-month high. The move comes amid strong altcoin momentum, with ADA outperforming much of the market as capital rotated out of Bitcoin and Ethereum following their respective highs. ADA has traded in a tight range recently, but technical analysts are eyeing a confirmed breakout above resistance as a setup for an extended rally.

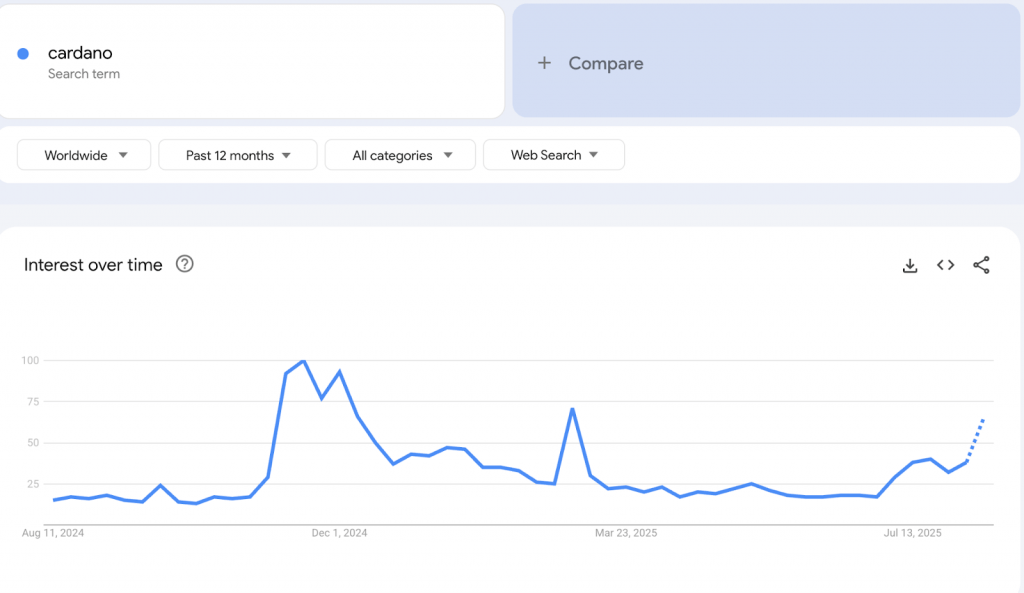

Chart watchers have flagged a multi-month bull flag breakout pattern on Cardano’s three-day chart. If the move holds, projections by Clifton Fx suggest the token could gain as much as 150% in the coming weeks, potentially targeting the $1.60–$1.75 range. Trader sentiment is being reinforced by on-chain data showing over 15 billion ADA — roughly 45% of total supply — has remained unmoved for more than a year, signaling long-term conviction. Retail interest is also on the rise, with Google Trends data showing “Cardano” searches at a five-month high.

Cardano’s latest rally also comes after Grayscale registered a “Grayscale Cardano Trust ETF” entity in Delaware — a move that typically precedes an S-1 filing with the SEC. While no official filing has yet been submitted, such developments hint at increasing institutional attention toward ADA. If approved, a Cardano ETF could help boost demand further, particularly among U.S.-based investors.

Adding to the week’s activity was the Glacier Drop airdrop, which distributed NIGHT tokens across eight chains including Cardano. Despite initial technical hurdles for Ledger users, the issue was quickly resolved, allowing Cardano to reclaim a spot in the top 10 cryptos by market cap and surpass Tron. ADA is now one of the biggest gainers both daily and weekly, with analysts watching closely for a potential run toward the $1.30–$1.60 region if momentum continues.

Best cryptocurrencies to buy at a glance

| Native Asset | Launched In | Description | Market Cap* | |

| Bitcoin | BTC | 2009 | A P2P open-source digital currency | $1.86 tln |

| Hyperliquid | HYPE | 2024 | Decentralized perpetuals exchange with an efficient order book | $7.17 bln |

| Ethereum | ETH | 2015 | The leading DeFi and smart contract platform | $388 bln |

| Dash | DASH | 2014 | A fast, low-fee cryptocurrency for everyday payments | $981 mln |

| Monero | XMR | 2014 | A privacy-first cryptocurrency with fully obfuscated transactions | $11.46 bln |

| XRP | XRP | 2012 | The leading crypto remittance solution | $120 bln |

| Zcash | ZEC | 2016 | Privacy-focused cryptocurrency | $6.08 bln |

| Uniswap | UNI | 2020 | A pioneering decentralized exchange protocol | $3.16 bln |

| BNB | BNB | 2017 | The native coin of the Binance exchange | $126 bln |

| Chainlink | LINK | 2017 | The leading decentralized oracle protocol | $9.04 bln |

| Solana | SOL | 2020 | Smart contracts platform with high speeds and low fees | $75.6 bln |

| Cardano | ADA | 2017 | Peer-reviewed blockchain built for smart contracts | $13.2 bln |

Best crypto to buy for beginners

If you are just starting out in crypto, it is advisable to stick to cryptocurrency projects that are less prone to volatility and are generally more established. While this approach does have a downside, as it becomes much more difficult to expect triple-digit or larger gains, the major upside is that you are not exposed to projects that have a chance of failing and, thus, losing your entire investment.

In order to identify projects that are stable and thus feature low volatility, you can start by following the parameters listed below:

- The crypto asset has a market capitalization that places it into the cryptocurrency top 100 (roughly $500 million as of winter of 2026)

- The crypto asset is available for trading on the best crypto exchange platforms and can be exchanged for fiat currencies

- The crypto asset boasts healthy liquidity ($100M/day and more), which allows you to execute buy and sell orders quickly and without slippage

- The crypto asset is part of a reputable crypto project with clear goals, a realistic roadmap, and products and services that look to address real-world problems

Some of the best cryptos to buy for beginners are those that follow the above criteria and have earned their standing in the crypto market due to robust security, popular products and services, and clear growth potential. Some beginner-friendly crypto investments are:

- Bitcoin

- Ethereum

- Litecoin

- Cardano

- BNB

It is worth noting that cryptocurrency investments are inherently risky, even if you stick to the biggest and most reputable projects. The reason for this is simple – the crypto sector is relatively new, and the landscape might look completely different in the future.

Best crypto for long-term

When deciding which cryptocurrency to buy for the long term, it’s important to consider projects that are well-established, have a strong community, are highly liquid, have a large market cap, and have a clear reason for existing (such as solving a real-life problem, introducing new functionality, etc.). Without these characteristics, a project might fail to survive in the long term, rendering it a bad long-term investment.

It is worth noting that, typically, most long-term crypto investors are looking for projects that have the potential to generate decent returns but also provide a degree of investment stability. Roughly speaking, only the largest cryptocurrencies fit the bill, as others have a low market cap and liquidity that doesn’t bode well for a long-term commitment (unless you’re prepared to take on more risk).

In addition to Bitcoin and Ethereum, there are a number of other cryptocurrencies that fit the criteria of being low-risk, long-term crypto investments.

If you are planning to hold onto your digital assets for a longer period of time, it is best to take care of crypto custody yourself. Holding large amounts of crypto on an exchange can be risky, as we’ve seen over the years with the collapse of high-profile exchanges like Mt. Gox and FTX. Use one of the reputable crypto hardware wallets to store your crypto. Ledger hardware wallets, for instance, allow you to manage your crypto holdings easily and provide a much higher degree of security than crypto exchanges or even software crypto wallets.

Best place to buy crypto

One crucial aspect to consider when choosing which platform to use to buy crypto is the range of cryptocurrencies and trading pairs available. Since different exchanges support varying digital assets, it’s important to choose a platform that accommodates the specific cryptocurrencies you intend to trade.

Additionally, assessing an exchange’s liquidity and trading volume is essential. Higher liquidity generally results in improved price stability and faster trade executions. Furthermore, it is prudent to examine the fees charged by the exchange, encompassing deposit, withdrawal, and trading fees. Comparing fee structures across different exchanges can help you identify the most cost-effective option that aligns with your trading style. With that said, here are some of the best exchanges on the market right now:

- Binance – The best cryptocurrency exchange overall

- KuCoin – The best exchange for altcoin trading

- Kraken – A centralized exchange with the best security

By diligently considering these factors, you can make an informed decision and select a cryptocurrency exchange that meets your requirements for security, variety, liquidity, and affordability.

How we choose the best cryptocurrencies to buy

At CoinCheckup, we provide real-time prices for over 22,000 cryptocurrencies, with the list growing by dozens each day. As you can imagine, making a selection of a dozen top cryptocurrencies to buy out of such an immense dataset can be difficult and will for sure lead to some projects that should be featured being omitted. To minimize the chance of that happening, we follow certain guidelines when trying to identify the best cryptocurrencies to invest in.

Availability

One of the most important factors for any cryptocurrency investment is the crypto asset’s availability, meaning how easy it is to buy and sell it across various cryptocurrency exchanges. We tend to stay away from assets that are not available on major exchanges and require complex procedures to obtain.

Market Capitalization

Another important metric for identifying whether a crypto project is worth covering its market cap. A high market cap means that the project has reached a certain level of adoption from users, making it less risky to invest in.

Growth Potential

While this metric is mostly subjective, it is still an important metric on which we curate our selection. We won’t feature projects that we think are stagnating or have no real upside in the future.

Purpose and Use Case

We consider the purpose and use case of cryptocurrency, particularly in a real-world setting. Some cryptocurrencies focus on specific industries or applications, such as decentralized finance, gaming, or supply chain management.

Team and Development

The team and people involved in the project can tell you a lot about the potential of a particular cryptocurrency project. We examine the team’s experience, expertise, and track record and evaluate the development activity and updates to ensure the project is actively maintained and evolving.

The bottom line: What crypto should you buy right now?

The decision of which crypto to buy now is dependent on your own risk profile and investment goals. For some, investing in a crypto asset with a proven track record like Bitcoin is the only type of exposure to crypto they are willing to take on.

Meanwhile, those with a higher risk tolerance might see Bitcoin as too stable, looking instead toward newer and smaller projects that carry a higher degree of upside.

If you are looking for more investment ideas, check out our crypto price predictions section.

You May Also Like

Trump MAGA statue has strange crypto backstory

Tokyo’s Metaplanet Launches Miami Subsidiary to Amplify Bitcoin Income