Mastercard and Polygon to Bring Username Addresses to Self Custody Wallets – Recommended Polygon Wallets

Polygon has been seeing some real adoption this year, if we look at RWA.xyz a website that tracks tokenized real-world assets (RWA) on public blockchains, we can see that Polygon actually ranks fifth in terms of total value of assets.

This is only behind the usual suspects, Ethereum, Binance Chain, Solana and Avalanche. Despite it currently being ranked 51st on CoinMarketCap, suggesting that the price of the POL coin is possibly lagging behind where it should be based on its tokenized RWA total value and network adoption.

Earlier this year, Flutterwave, a leading money transfer service in Africa, also chose Polygon for its push into digital asset payments and its launch of a Flutterwave stablecoin to make payments faster across countries in Africa, like Nigeria and 34 other African countries.

Fast forward to today, and now Mastercard and Polygon are working together. The reasons Mastercard chose Polygon are; ease of integration, low fees, reliability and fast transaction speeds.

Mastercard and Polygon have worked together before in 2023 on the Mastercard Music Pass NFT which enabled access to a training program for emerging musical artists.

What Are Mastercard and Polygon Working On Now?

Mastercard is launching a service under its “Crypto Credential” program that will allow users to send and receive crypto to username-style wallet addresses.

So this means instead of sending or receiving crypto to a long string of letters and numbers, in upper case and lower case, 44 characters in length (known as a hexadecimal wallet address) which is practically impossible to remember, instead users would have their own chosen username, for example JohnSmith26.

These username aliases are verified, so they’re tied to a real person and Mastercard is working with a company called Mercuryo to process the know your customer (KYC) checks.

After verification, users can then link their chosen username to their self-custody wallet and then use their username as a wallet address to receive crypto.

The idea behind this is to remove any mistakes that may occur when copying and pasting a long hexadecimal address and to help new crypto users feel more confident sending and receiving crypto. It could function in a similar way to email usernames today.

Moving Toward Self-Custody

Of course, a globally renowned name such as Mastercard will bring a lot of attention toward self-custody wallets. It will also help users trust blockchain payments.

Networks like Polygon are set to benefit from this mainstream adoption. What’s more Polygon are continuing to increase their transaction per second (TPS) speed. Sandeep Nailwal, co-founder and CEO of Polygon, recently stated at Ethereum Devconnect that Polygon expects to have speeds of 5,000 TPS within 6 months, making it faster than Solana.

Recommended Polygon Wallets

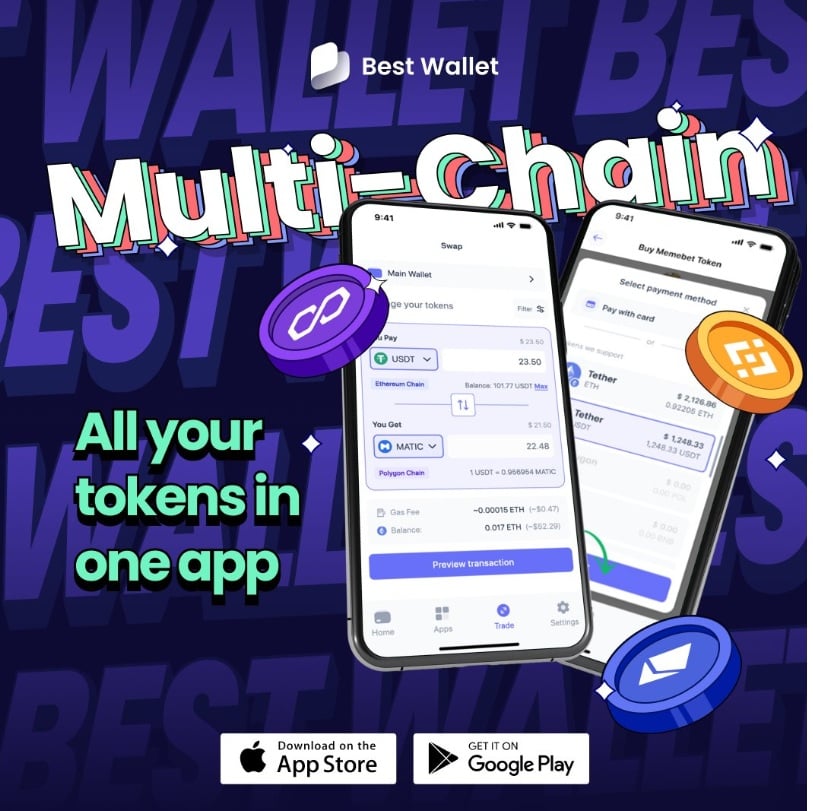

With the continued adoption of Polygon, it’s no surprise that many investors are looking for wallets that support the Polygon blockchain. The most reliable among them is Best Wallet, a top-tier self-custodial brand known for its ease of use, rich selection of features, and solid security system.

The mobile wallet stands out among its peers because it is very simple to navigate and use. That alone makes it more accessible to newcomers in the crypto industry, who might find CEXes overly complex and intimidating.

At the same time, it offers a high number of services, including the ability to buy and swap cryptocurrencies within its app through fiat, explore staking facilities, and access high-potential launches, all without requiring identity verification.

Thankfully, Best Wallet isn’t limited to the Polygon network alone – it’s purpose-built to be a multichain wallet, supporting cryptocurrencies from other major blockchains such as Bitcoin, Ethereum, Solana, Base, and Binance Smart Chain as well. This means Polygon users who want to diversify into assets from other networks can do so without opening additional wallets.

More so, thanks to its self-custodial architecture, users retain full control of their private and public keys, meaning only they can access their cryptocurrencies. The benefits do not stop there! Best Wallet allows every user to stay anonymous while navigating the crypto landscape, which makes it a more preferred option than CEXes that require ID verification even for basic trading.

To top it off, the wallet has integrated Fireblocks, a leading security tool to provide full crypto insurance and eliminate every single point of failure that cyber criminals can exploit. Its token launchpad has also attracted considerable attention, offering investors the opportunity to browse and buy new cryptocurrencies that are still in the early-stage token sale.

Therefore, for users who prioritize convenience, freedom, and functionality, Best Wallet remains one of the best Polygon wallets and trading platforms available. Experts at 99Bitcoins, a popular YouTube channel with over 720k subscribers, claimed that Best Wallet is the most feature-packed wallet in 2025.

Download Best Wallet

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

Cashing In On University Patents Means Giving Up On Our Innovation Future