Stablecoins Will Push ‘Consumer Hostile’ Banks To Raise Yields, Stripe CEO Says

Banks will be forced to offer customers better yields in order to stay competitive as stablecoins begin to boom, according to Stripe CEO Patrick Collison.

Replying to a post on X about the rise of yield-bearing stablecoins, Collison noted that the average interest rate for savings accounts is 0.40% in the US and 0.25% in the EU.

“Depositors are going to, and should, earn something closer to a market return on their capital,” Collison said. “The business imperative here is clear — cheap deposits are great, but being so consumer-hostile feels to me like a losing position.”

His remarks follow Stripe’s launch of “Open Issuance” on Sept. 30, a new product by Bridge that enables companies to launch and manage their own stablecoins with minimal friction.

GENIUS Act Prohibits Direct Stablecoin Yields, But Banking Groups See Loopholes

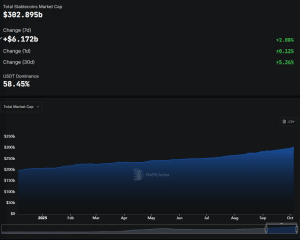

The stablecoin market has blossomed in recent months, with the capitalization for the sector recently soaring to a new record high above $300 billion. This is as more institutions begin to explore offering their own tokenized offerings to clients.

The stablecoin market’s growth accelerated after crypto-friendly US President Donald Trump signed the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act into law in July, creating a federal framework for stablecoins in the US.

Following the bill’s signing, the capitalization of the stablecoin market has soared from around $253 billion to approximately $302.89 billion, data from DefiLlama shows.

Stablecoin market cap (Source: DefiLlama)

The GENIUS Act currently prohibits stablecoin issuers from offering users yields directly. However, banking groups have pointed out that there are loopholes that don’t explicitly restrict stablecoin issuers from offering yields through third party providers.

“Some lobbies are currently pushing, post-GENIUS, to further restrict any kinds of rewards associated with stablecoin deposits,” according to Collison.

Coinbase CEO Brian Armstrong posted a video on X on Sept. 29 after meeting with various lawmakers and industry executives, noting that banks are trying to push back on stablecoins, particularly potential yields that they could offer.

“Banks want to ban rewards to maintain their monopoly, and we’re making sure the Senate knows bailing out the big banks at the expense of the American consumer is not ok,” he wrote on X.

“All Currency” Will Become Stablecoins By 2030

Despite the pushback from banks, crypto executives see stablecoins as the next big thing, and have even gone as far as to predict that stablecoins will consume legacy fiat payments.

Among those executives is Tether co-founder Reeve Collins, who said during the Token2049 conference in Singapore that “all currency will be a stablecoin.”

“A stablecoin simply is a dollar, euro, yen, or, you know, a traditional currency running on a blockchain rail by 2030,” he added.

“Every large institution, every bank, everyone wants to create their own stablecoin, because it’s lucrative and it’s just a better way to transact,” Collins said.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

The United Nations launches the "Global Dialogue on Artificial Intelligence Governance" mechanism