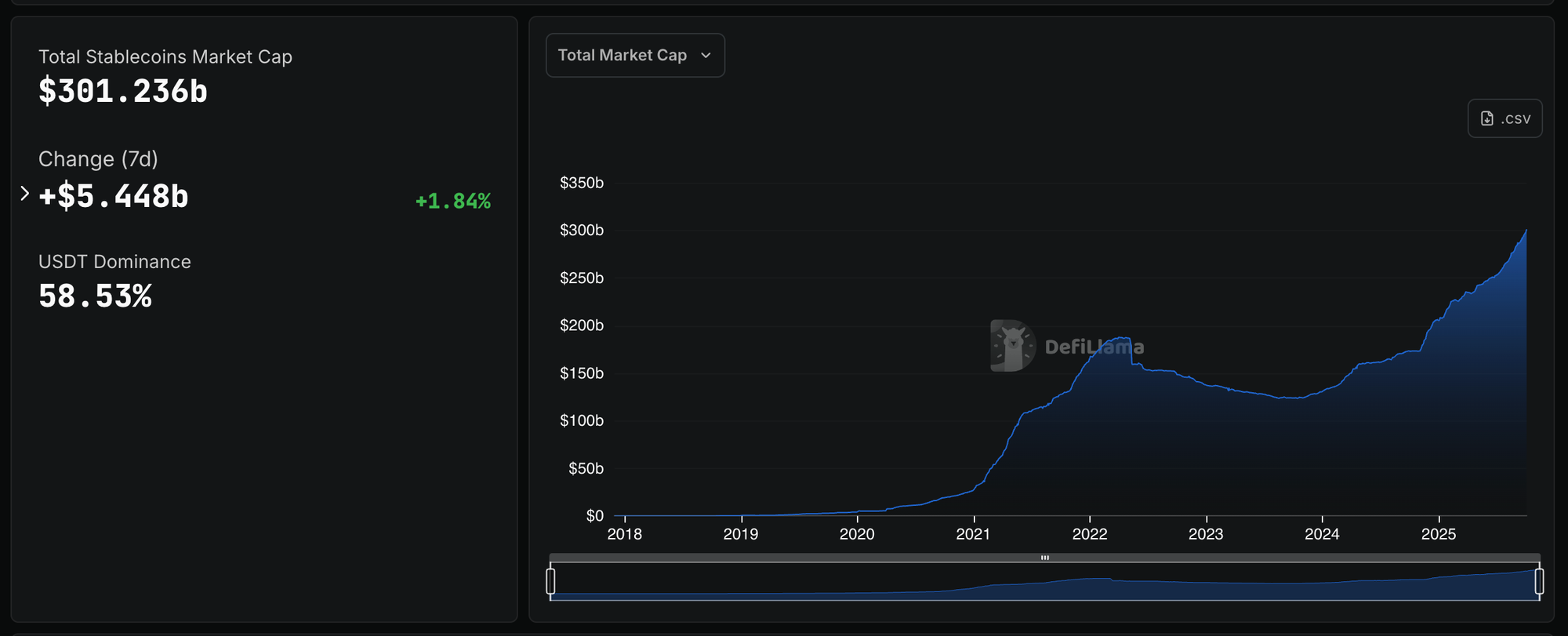

Stablecoins Cross $300 Billion as the Duopoly Begins to Crack

The total stablecoin market capitalization surpassed $300 billion for the first time this week, according to DeFiLlama data. Tether's USDT commands 58.44% of the market at $176.3 billion, Circle's USDC holds over $74 billion, and the third-largest stablecoin, the yield-bearing USDe, Ethena's synthetic dollar, stands at $14.83 billion.

On the surface, it's a straightforward growth story: more capital flowing into crypto's base liquidity layer as institutional adoption accelerates. But the composition of that $300 billion tells a more interesting story: the Tether-Circle duopoly that has defined stablecoin markets for years is starting to fracture.

End of Two-Horse Race

Industry analyst Nic Carter recently declared "the end of the stablecoin duopoly," pointing to two forces reshaping the competitive landscape: yield-bearing stablecoins that offer returns on deposits, and new regulatory frameworks enabling traditional banks to issue their own dollar-pegged tokens.

The emergence of USDe as the third-largest stablecoin illustrates the first dynamic. When users can earn yields on their stablecoin holdings, even smaller issuers can compete for liquidity against entrenched players. It's a fundamental shift in value proposition that stablecoins are no longer just stable but productive assets.

The second force is potentially more disruptive. The GENIUS Act in the United States has opened pathways for regulated financial institutions to launch stablecoins, and major banks are already mobilizing. JP Morgan and Citigroup announced a joint stablecoin venture. In Europe, ING joined UniCredit and seven other banks on a MiCA-compliant euro stablecoin slated for a 2026 launch.

Carter argues that while no single bank could challenge Tether's scale, bank consortia represent credible competition. These aren't crypto-native upstarts—they're institutions with existing customer bases, regulatory relationships, and balance sheets that dwarf current stablecoin issuers.

Banks as Issuers, Not Just Infrastructure

What's striking is how quickly the narrative has shifted from "banks versus crypto" to "banks as stablecoin issuers." Citigroup now projects the stablecoin market will reach $4 trillion by 2030, with a base case of $1.9 trillion. More importantly, Citi's analysts frame stablecoins not as disruptors to banking but as integral to it, working alongside tokenized deposits to modernize payments and capital markets infrastructure.

This view has found political support. Treasury Secretary Scott Bessent has argued that stablecoins strengthen the dollar's global position by improving access to dollar-denominated assets. The Trump administration has explicitly embraced stablecoins as part of its strategy to maintain U.S. dominance in digital assets.

The regulatory shift extends beyond the U.S. Following America's lead, other governments are exploring stablecoin issuance as a tool to expand their currencies' international circulation. What was once a crypto phenomenon is becoming a sovereign currency strategy.

USAT and the Race to Scale

Against this backdrop, Tether CEO Paolo Ardoino's projection that USAT could reach $1 trillion market cap within three to five years takes on additional significance. Speaking at TOKEN2049 Thursday, Ardoino framed the target as realistic given USDT's growth trajectory, with USAT positioned to capitalize on improving U.S. regulatory clarity.

The timing matters. If bank consortia launch in 2026 as planned, and if yield-bearing stablecoins continue gaining share, Tether's window to establish USAT as the dominant U.S. stablecoin may be narrow. The company's distribution play through Rumble's 51 million monthly active users – with a crypto wallet launching later this year – suggests urgency in building market presence before traditional finance competitors scale up.

If the stablecoin market reaches Citi's $4 trillion projection by 2030, multiple trillion-dollar stablecoins become mathematically plausible.

What $300 Billion Really Means

The $300 billion milestone is significant not because it's a round number, but because it represents crypto's maturation into a market that traditional finance can no longer ignore. That capital isn't sitting idle – it's the liquidity layer that enables trading, DeFi protocols, cross-border payments, and increasingly, the bridge between traditional and tokenized assets.

But as that market grows, the competitive dynamics are fundamentally changing. The crypto-native first-movers face incoming competition from institutions with regulatory moats, existing customer relationships, and strategic imperatives to participate in digital dollar infrastructure. Yield is becoming table stakes. Compliance frameworks are converging globally.

The duopoly isn't dead yet. Tether and Circle still command over 80% market share. But the $300 billion market is about to get much more crowded, and significantly more competitive. The question isn't whether stablecoins will continue growing. It's who will control that growth, and whether crypto-native issuers can defend their lead against an incoming wave of institutional capital and traditional finance distribution power.

The next $300 billion will look very different from the first.

Elsewhere

You May Also Like

‘One Battle After Another’ Becomes One Of This Decade’s Best-Reviewed Movies

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council