Leading TradFi Derivatives Marketplace CME Group Expands Crypto Offerings to 24/7

The CME Group, a leading derivatives marketplace in traditional finance (TradFi), announced the expansion of its crypto offerings—in particular, futures and options—to around-the-clock trading, working 24 hours a day, seven days a week.

According to a press release published on October 2, this offering is planned to start by early 2026, depending on regulatory review by the proper government agencies. Operations happening at times when TradFi markets are closed will come with a trade date of the following business day, with clearing, settlement, and regulatory reporting processed the following business day as well.

Tim McCourt, Global Head of Equities, FX, and Alternative Products at CME Group, explained the change is due to the growth of client demand for around-the-clock cryptocurrency trading, requiring market participants to adjust their risks accordingly. “Ensuring that our regulated cryptocurrency markets are always on will enable clients to trade with confidence at any time,” McCourt concluded.

CME Group has the world’s highest notional value in some products, ranking among the top 10 in others, and is also the third-largest marketplace by number of contracts available for trading. On September 18, crypto notional open interest at the CME Group reached a record $39 billion, and in August the platform saw a daily average of 335,200 open contracts.

Cryptocurrency offerings by the group started with Bitcoin BTC $120 134 24h volatility: 2.5% Market cap: $2.40 T Vol. 24h: $67.31 B on December 18, 2017, with Ethereum ETH $4 485 24h volatility: 4.0% Market cap: $542.63 B Vol. 24h: $44.52 B following through only on February 8, 2021. Solana and XRP futures were added on March 17 and May 19 of 2025, respectively.

Crypto Derivatives and Futures Trading

The cryptocurrency derivatives market, however, goes beyond the CME Group, having most of its activities happening on crypto-native centralized platforms or, as a growing trend, on decentralized exchanges like Hyperliquid and Aster.

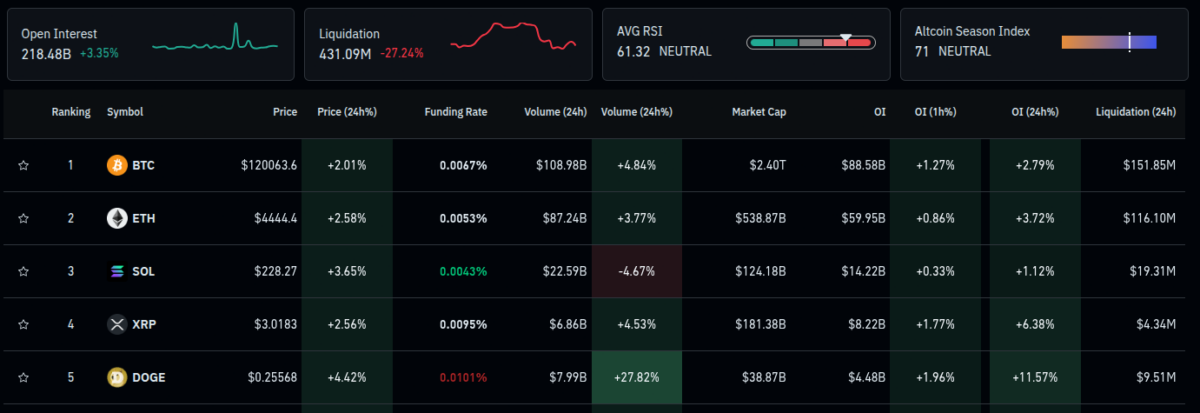

According to CoinGlass data at the time of writing, total open interest stands at $218.48 billion, up 3.35% in the last 24 hours. The top cryptocurrencies by open interest are BTC, ETH, SOL, XRP, and DOGE DOGE $0.26 24h volatility: 4.8% Market cap: $39.04 B Vol. 24h: $3.19 B , with $88.58 billion, $59.95 billion, $14.22 billion, $8.22 billion, and $4.48 billion, respectively.Reintentar

Crypto derivatives market data and open interest as of October 2, 2025 | Source: CoinGlass

The CME Group is also not the only TradFi company expanding its crypto offerings or pushing regulators to a more crypto-friendly environment. Nasdaq submitted an SEC filing on September 8 to allow trading of tokenized equities and ETPs on its exchange, potentially reducing settlement times and market friction through blockchain integration, Coinspeaker reported. As things develop, other institutions are likely to join the movement if worldwide regulators continue to ease the pressure and to embrace innovation.

nextThe post Leading TradFi Derivatives Marketplace CME Group Expands Crypto Offerings to 24/7 appeared first on Coinspeaker.

You May Also Like

BitMine Expands Treasury Holdings with $140 Million Ethereum Acquisition

Hyper Foundation Proposes Validator Vote to Burn Assistance Fund Tokens