Crucial Base Layer 2: Vitalik Buterin Hails Coinbase’s Network as Ethereum-Aligned

BitcoinWorld

Crucial Base Layer 2: Vitalik Buterin Hails Coinbase’s Network as Ethereum-Aligned

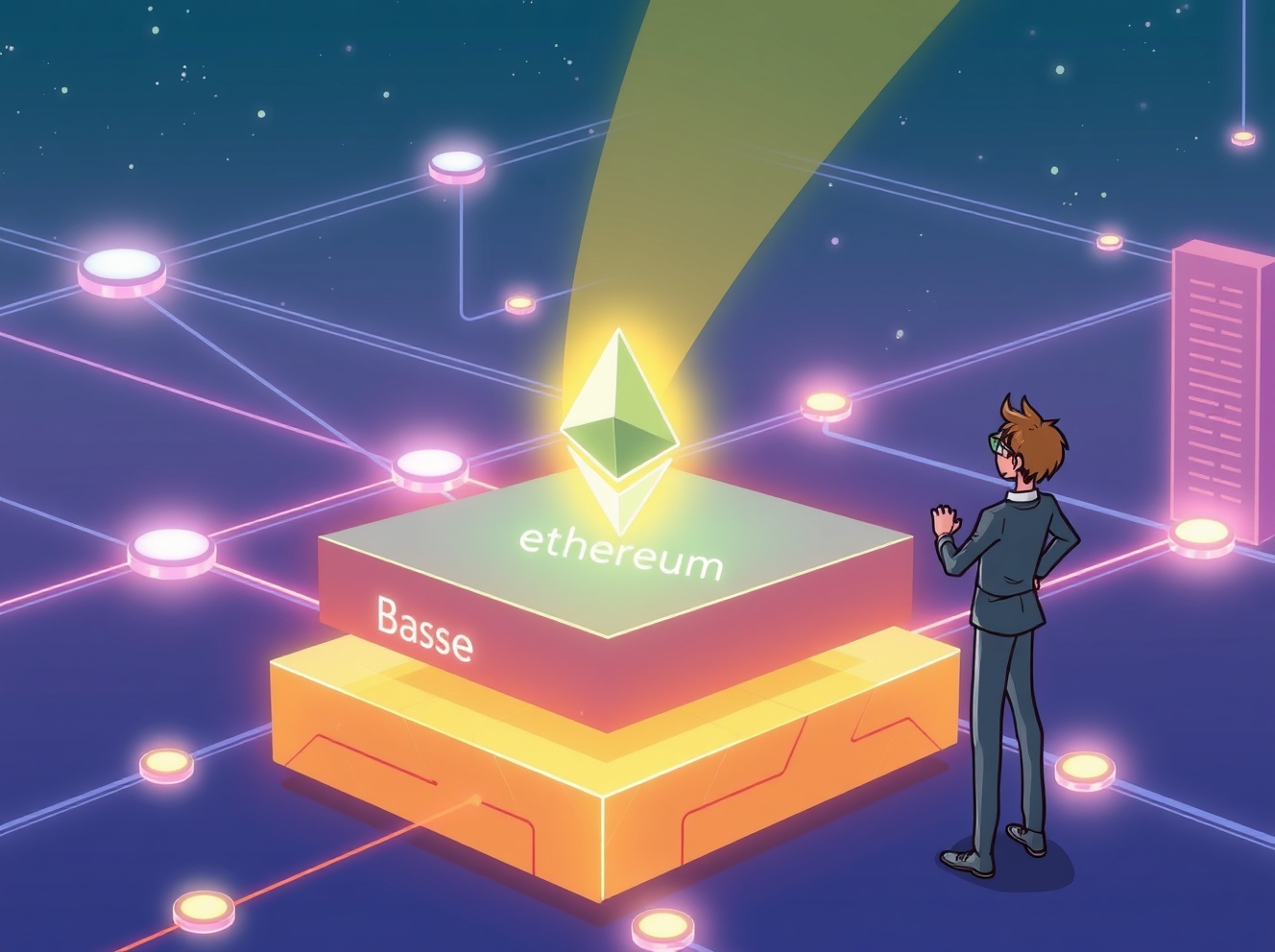

In the fast-evolving world of cryptocurrency, few voices carry as much weight as Ethereum founder Vitalik Buterin. His recent endorsement of Coinbase’s Base Layer 2 network has sparked considerable interest, signaling a significant vote of confidence. Buterin views Base not just as another scaling solution, but as a Layer 2 built “in the right way,” perfectly aligning with Ethereum’s core philosophy. This perspective offers crucial insights into the future of decentralized applications and how they can achieve mainstream adoption while maintaining foundational security.

Why is Base Layer 2 ‘Built the Right Way’?

Vitalik Buterin’s praise for Base stems from its unique design philosophy. He highlighted that while Base incorporates centralized features to enhance user experience, its fundamental security architecture remains firmly rooted in Ethereum’s robust, decentralized base layer. This distinction is vital for understanding why Base stands out.

Buterin emphasized that Base does not directly hold user funds. This non-custodial approach means that, unlike some centralized platforms, Base cannot unilaterally seize assets or block withdrawals. Such a design choice significantly bolsters trust and security, reassuring users that their digital assets remain under their control, even when interacting with a faster, more user-friendly Layer 2 solution.

Balancing User Experience with Decentralized Security

One of the persistent challenges in blockchain technology has been the trade-off between scalability, user experience, and decentralization. Many solutions often sacrifice one for the others. However, Buterin sees Base Layer 2 as a compelling example of finding a harmonious balance.

- Enhanced User Experience: Base leverages certain centralized aspects to deliver a smoother, faster, and more intuitive experience for users and developers. This can include faster transaction finality and lower fees, which are critical for mass adoption.

- Ethereum’s Security Backbone: Crucially, these centralized elements do not compromise the underlying security. Base’s security guarantees are inherited directly from Ethereum. This means that even if parts of Base were to face issues, the integrity of user funds and transactions is ultimately protected by Ethereum’s battle-tested blockchain.

- Non-Custodial Design: As Buterin pointed out, the inability of Base to seize funds or block withdrawals is a cornerstone of its “right way” design. This principle is fundamental to the ethos of decentralization, ensuring users retain sovereignty over their assets.

Understanding Ethereum’s Layer 2 Philosophy

Ethereum’s long-term vision for scalability heavily relies on Layer 2 solutions. These networks process transactions off the main Ethereum chain, bundling them together and then submitting a compressed proof or summary back to the mainnet. This approach dramatically increases transaction throughput and reduces costs without burdening the core blockchain.

Buterin’s endorsement of Base Layer 2 reinforces the idea that L2s should complement, not compete with, Ethereum. They extend its capabilities, allowing it to handle a global scale of users and applications. Base’s commitment to relying on Ethereum for security and finality perfectly embodies this collaborative philosophy, making it a valuable addition to the ecosystem.

The Crucial Role of Non-Custodial Design

Why is the non-custodial nature of Base so significant? In the world of finance, custodianship implies control over assets. For a Layer 2 network, being non-custodial means that even if the L2 operator experiences technical difficulties or malicious intent, they cannot prevent users from accessing their funds on the underlying Ethereum network. This is a critical trust factor for any scaling solution.

This design choice for Base Layer 2 provides a strong guarantee of user autonomy. It distinguishes it from centralized exchanges or platforms that do hold user funds, making it a more resilient and censorship-resistant option for decentralized applications and users alike. This commitment to user sovereignty is what makes Base a truly Ethereum-aligned scaling solution.

What Does Base Layer 2 Mean for Ethereum’s Future?

The success and design principles of Base have significant implications for the broader Ethereum ecosystem. As more users and developers flock to Layer 2 solutions, networks like Base demonstrate that it is possible to achieve high performance and user-friendliness without sacrificing the core tenets of decentralization and security that define Ethereum.

This positive validation from Vitalik Buterin encourages other Layer 2 developers to adopt similar best practices. It fosters a healthier, more secure, and ultimately more scalable environment for decentralized finance (DeFi), NFTs, and other Web3 applications. The continued growth of robust Layer 2s like Base is essential for Ethereum to realize its full potential as the world’s leading programmable blockchain.

In conclusion, Vitalik Buterin’s praise for Coinbase’s Base Layer 2 is a powerful affirmation of its design and alignment with Ethereum’s foundational principles. By prioritizing security through Ethereum’s base layer and adopting a non-custodial approach, Base offers a compelling model for future scaling solutions. It shows that we can achieve a superior user experience while upholding the core values of decentralization and user sovereignty, paving the way for a more accessible and robust Web3 future.

Frequently Asked Questions (FAQs)

1. What is Base Layer 2?

Base is an Ethereum Layer 2 network developed by Coinbase. It aims to provide a secure, low-cost, and developer-friendly environment for building decentralized applications, leveraging Ethereum’s security while offering enhanced scalability.

2. Why did Vitalik Buterin praise Base?

Vitalik Buterin praised Base because its design aligns with Ethereum’s philosophy. He noted its reliance on Ethereum’s decentralized base layer for security and its non-custodial nature, meaning it cannot seize user funds or block withdrawals, despite offering a stronger user experience through some centralized features.

3. How does Base ensure user fund security?

Base ensures user fund security by relying on Ethereum’s decentralized network. While Base handles transactions off-chain for speed, the ultimate security and finality of assets are guaranteed by Ethereum. Furthermore, its non-custodial design means Base itself does not hold user funds, preventing asset seizure.

4. What does ‘non-custodial’ mean for a Layer 2 network?

For a Layer 2 network like Base, ‘non-custodial’ means that the network operator does not have direct control over users’ digital assets. Users retain full ownership and control of their funds, and the network cannot prevent them from withdrawing their assets back to the main Ethereum chain.

5. How does Base contribute to Ethereum’s scalability?

Base contributes to Ethereum’s scalability by processing transactions off the main Ethereum blockchain, thereby reducing congestion and lowering transaction costs on the mainnet. It bundles these off-chain transactions and periodically settles them on Ethereum, allowing the overall ecosystem to handle a much higher volume of activity.

Did you find this article insightful? Share your thoughts and help spread the word about the exciting developments in the Ethereum ecosystem! Share this article on your social media to inform your network.

To learn more about the latest Ethereum trends, explore our article on key developments shaping Ethereum price action.

This post Crucial Base Layer 2: Vitalik Buterin Hails Coinbase’s Network as Ethereum-Aligned first appeared on BitcoinWorld.

You May Also Like

Next Big Crypto? 11B Tokens Sold as APEMARS Stage 7 Closes in 24 Hours – Top 100x Meme Coin 2026 Poised to Outshine Cyber and Floki

BlackRock Increases U.S. Stock Exposure Amid AI Surge