Comparing Griffain and Neur: Which is the Best Solana AI Assistant?

Author: Wheaties , Crypto KOL

Compiled by: Felix, PANews

Griffain and Neur are both AI assistants built on Solana. Which of the two similar platforms will win? This article will give you a comparative analysis.

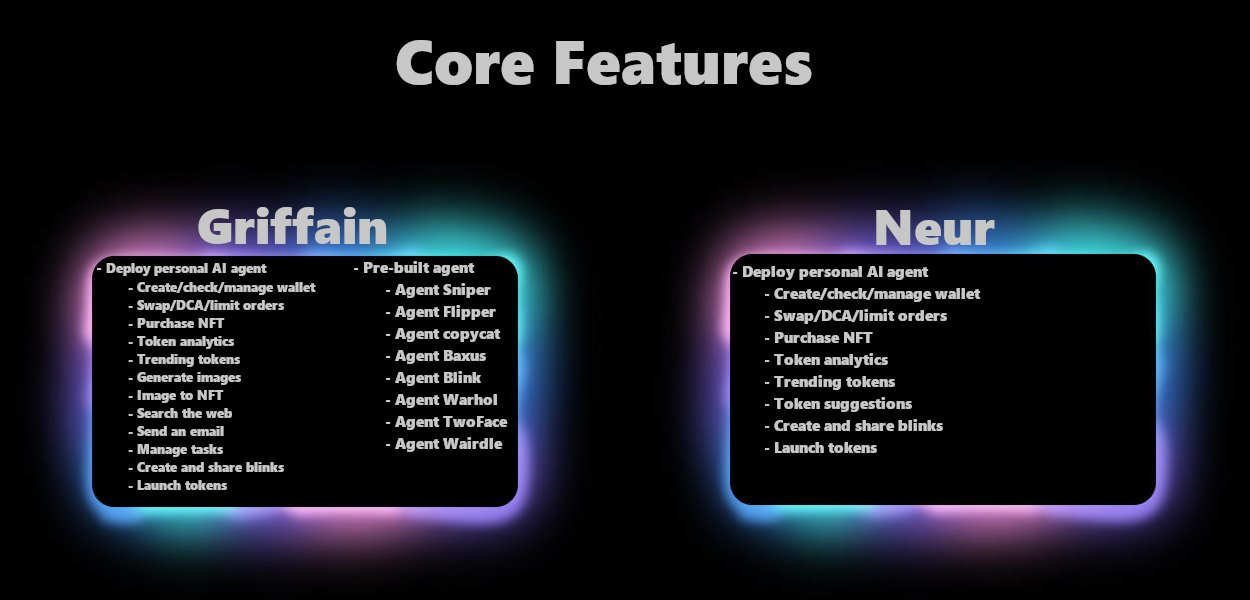

Core Features

First, explore the different features provided by each platform. As shown in the figure below, Griffain provides users with more and broader features. However, the features provided by Neur are relatively more detailed.

Griffain :

- Create/check/manage wallets

- Swap/DCA/Limit Order

- Trading NFTs

- Token Analysis

- Popular Tokens

- Generate image

- Convert images to NFT

- Search the web

- Send Email

- Administrative tasks

- Create and share Blink (Related reading: Detailed explanation of Solana’s latest Blink feature: the launch triggered a great discussion in the community, killer application or just fancy tricks? )

- Launch Token

Neur :

- Create/check/manage wallets

- Swap/DCA/Limit Order

- Trading NFTs

- Token Analysis

- Popular Tokens

- Token Proposal

- Create and share Blink

- Issuing Tokens

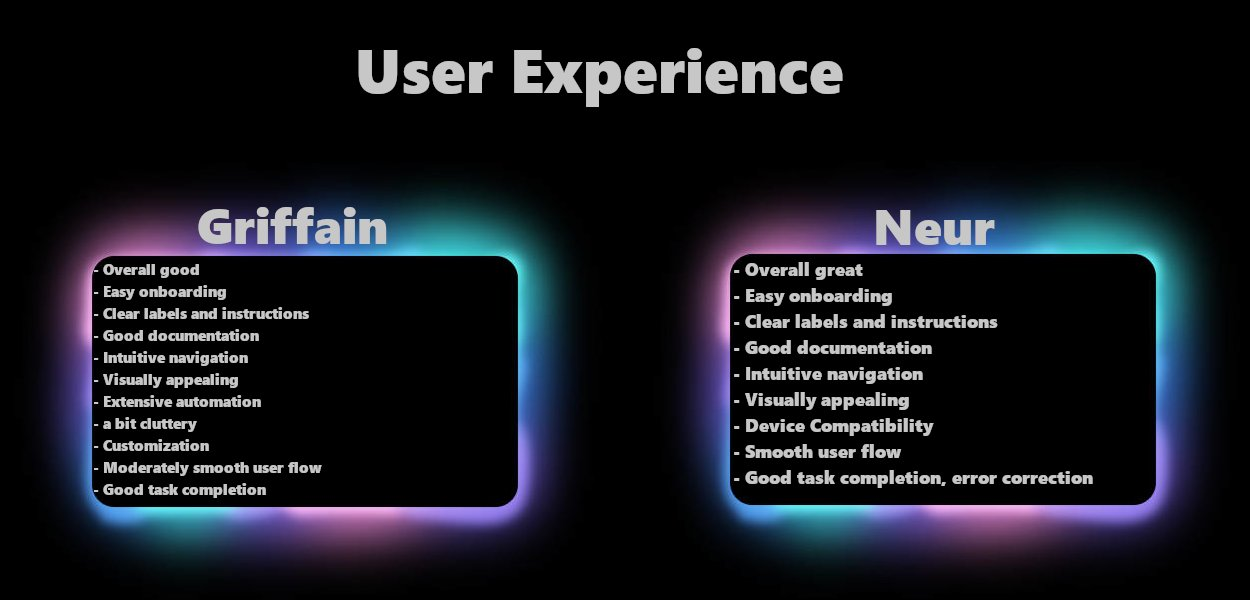

User Experience

The overall experience with both Neur and Griffain is good, but Neur is smoother and faster.

That said, the two apps serve different purposes. If you’re looking for a friendlier user experience, smoother user flow, and multi-device compatibility, consider Neur.

If you're looking for powerful presets and more customization, Griffain might be a better fit.

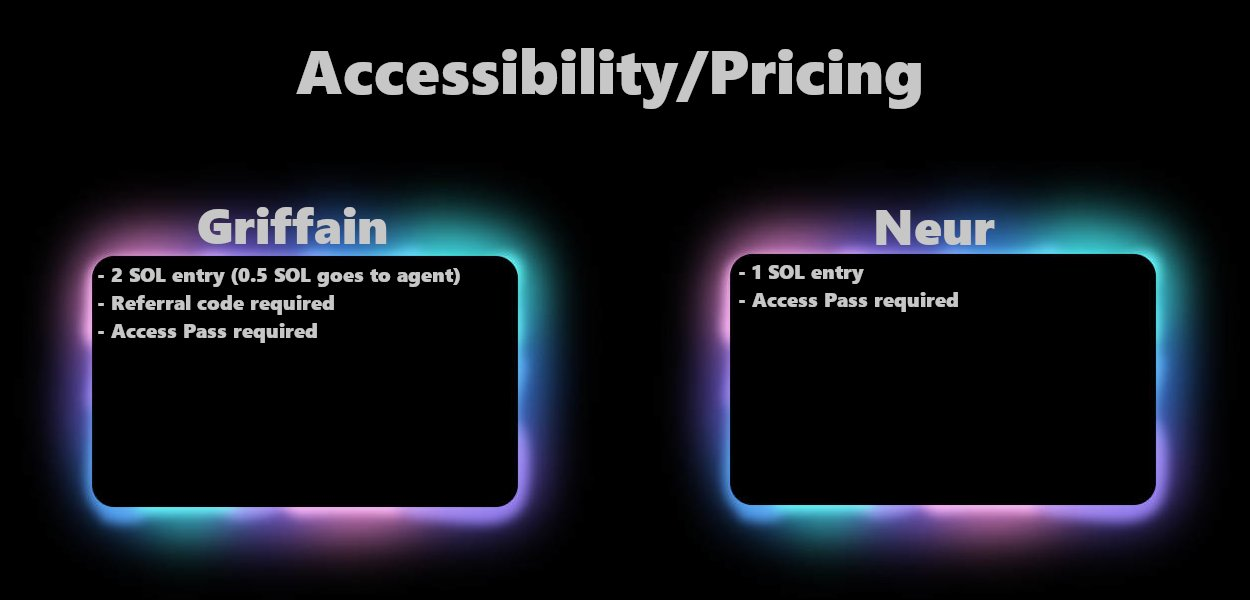

Accessibility / cost

Both apps are extremely accessible, with Griffain forgoing the usual invite link and Neur being accessible with just a single click.

The biggest difference is the fee, Griffain charges an upfront fee of 2 SOL, while Neur only charges an upfront fee of 1 SOL. However, Griffain will deposit 0.5 SOL of it into the user's proxy wallet, so the actual fee of Griffain is about 1.5 SOL.

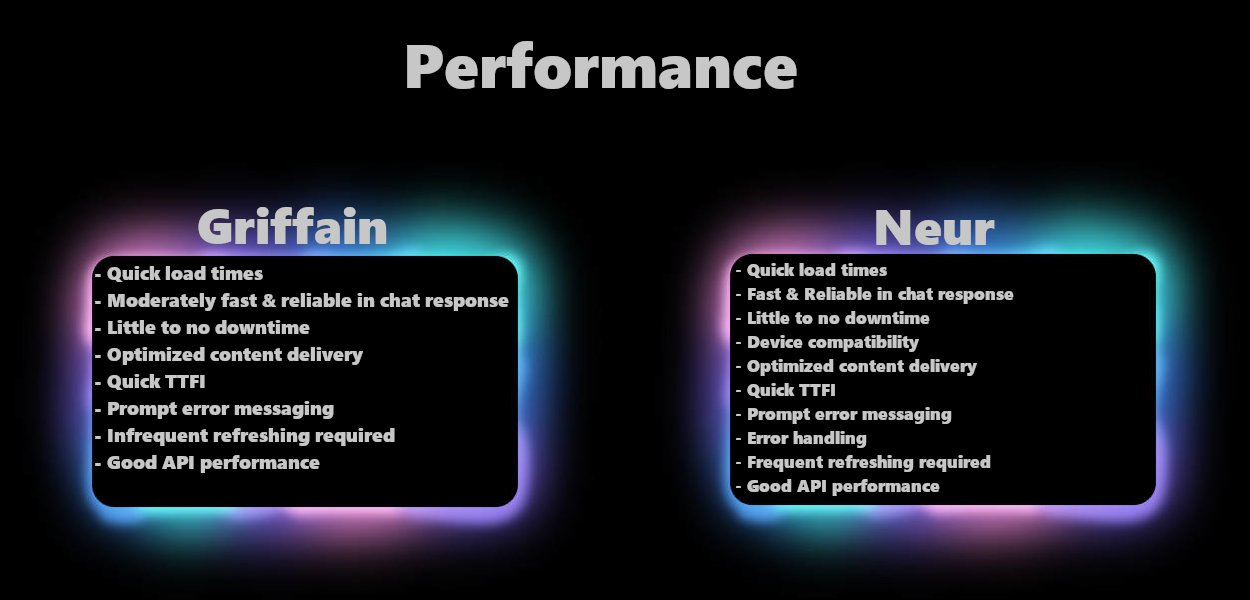

performance

In terms of performance, both Griffain and Neur performed well, but in terms of overall performance, Neur performed slightly better. As mentioned above, although Griffain provides a wider range of functions, Neur's functions are more detailed. The most outstanding feature of Neur is the ability to correct errors instantly.

Griffain :

- Fast loading

- Chat response time is moderate and reliable

- Virtually no downtime

- Optimize content delivery

- TTFI is fast (Note: Time to First Interaction, which measures the time it takes for all resources on a page to load successfully and be able to reliably respond to user input quickly)

- Timely error notification

- No need to refresh frequently

- API performance is good

Neur :

- Fast loading speed

- Chat response is fast and reliable

- Minimal or no downtime

- Device Compatibility

- Optimize content delivery

- Fast TTFI

- Timely error notification

- Error handling

- Need to refresh frequently

- Good performance of APl

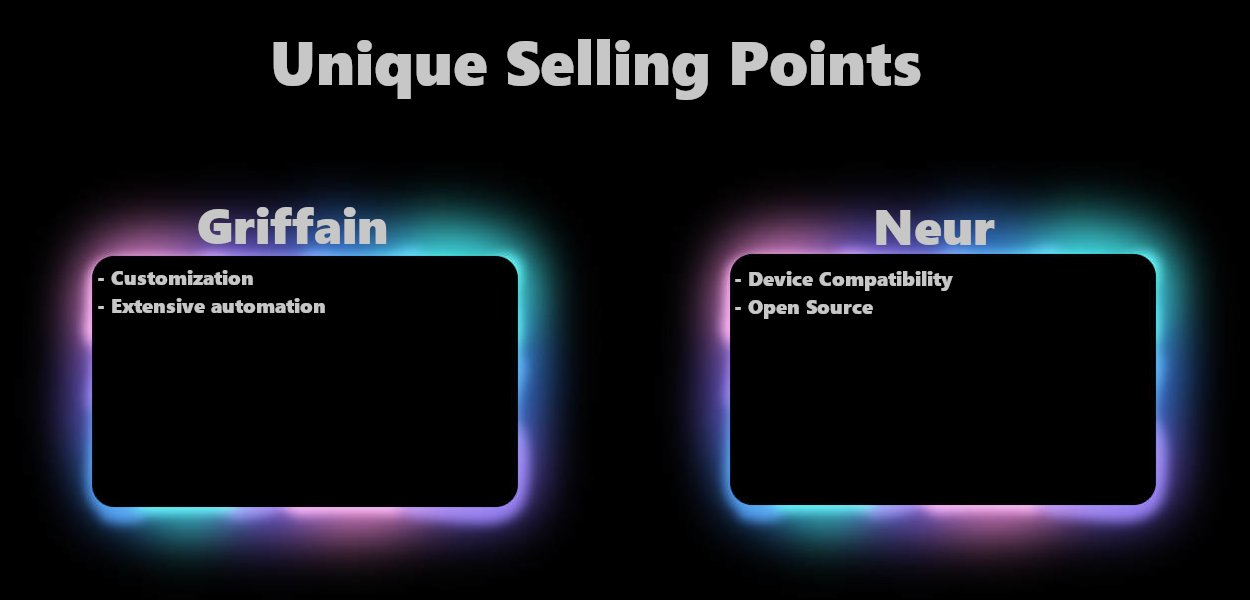

Unique Features

For Neur, it stands out for its fully open source multi-device compatibility, while Griffain stands out for its extensive autonomy and customization capabilities.

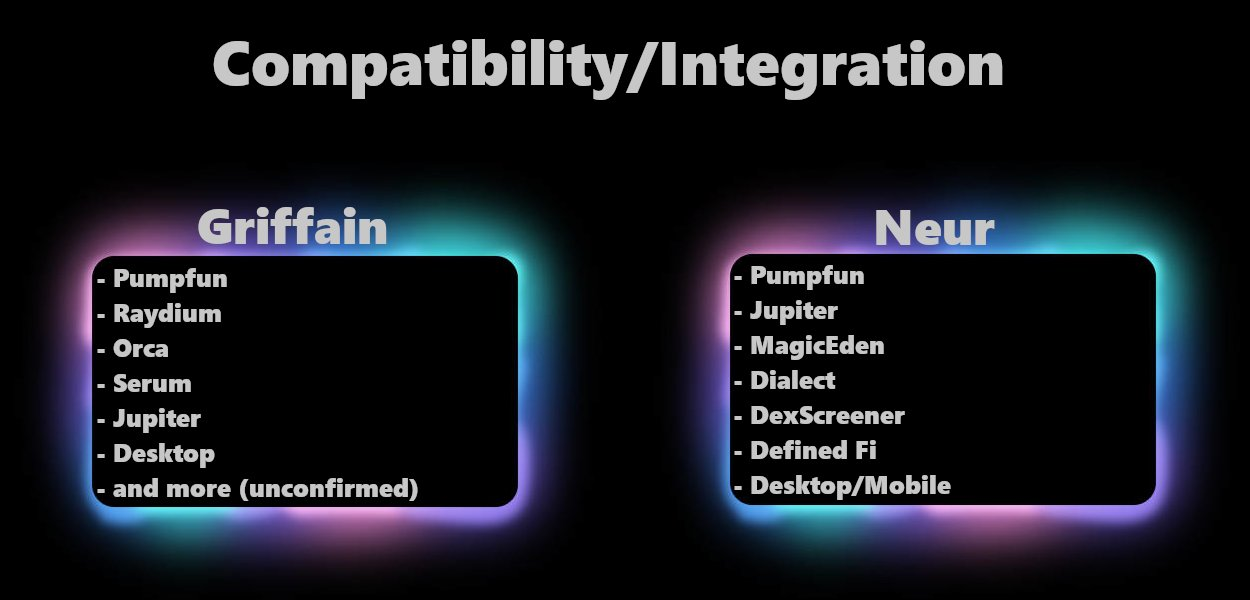

Compatibility / Integration

While it is not possible to confirm all integrations available on Griffain, the two platforms are integrated enough to provide all the basic functionality required for a nearly complete Solana experience.

Griffain :

- Pumpfun

- Raydium

- Orca

- Serur

- Jupiter

- desktop

- and more (unconfirmed)

Neur :

- Pumpfun

- Jupiter

- MagicEden

- Dialect

- DexScreener

- Defined Fi

- Desktop/Mobile

in conclusion

While it may seem like the article is saying that Neur is the better application, and maybe for the average user it is, for users who want a more automated, customized experience, Griffain stands out in this regard.

In other words, if you really want to dig in and optimize your search, Griffain is the app for you. If you want a simpler, more direct approach, Neur is a better fit.

Related reading: A horizontal comparison of the four major AI agent frameworks: adoption status, advantages and disadvantages, and token growth potential

You May Also Like

Unlocking Opportunities: Coinbase Derivative Blends Crypto ETFs and Tech Giants

Crossmint Partners with MoneyGram for USDC Remittances in Colombia