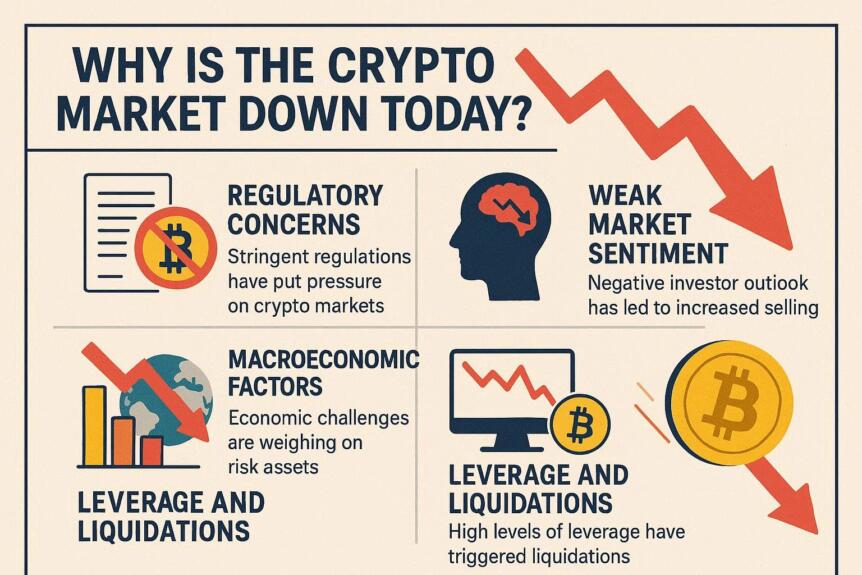

Why Is the Crypto Market Down Today? Key Crypto Crash Reasons Explained

Key Insights

- Cross-market selloff hit crypto, equities, and metals, signaling broad liquidity tightening.

- Over $1.7B in liquidations accelerated declines as leveraged long positions were closed rapidly.

- Regulatory developments may influence sentiment as markets assess structural reforms.

The cryptocurrency market recorded a sharp decline over the past 24 hours, reflecting a wider risk-off move. Total market capitalization fell near $3 trillion as investors search for reasons why the crypto market is down today.

Bitcoin dropped below recent support levels, while Ethereum and major assets, including gold and silver, fell in tandem. This signaled that market participants responded to broader external liquidity stress rather than project-specific developments. It was not a gradual pullback, but a rapid, system-wide collapse fueled by fear, excessive leverage, and global liquidity stress.

Why is Crypto Market Down Today? BTC and Altcoin Charts Turn Red

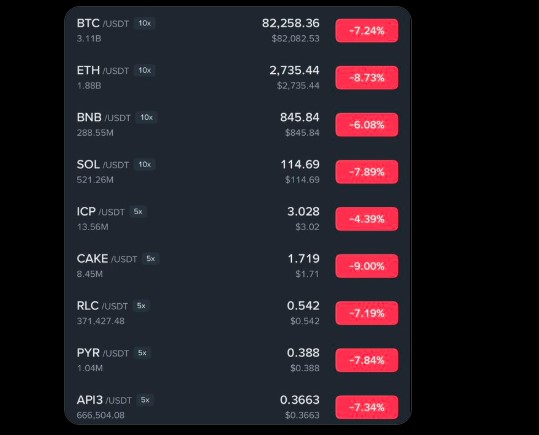

Investors first witnessed the crash on the price charts. Bitcoin slid 7.24% to around $82,258, while Ethereum dropped 8.73% to near $2,735. The selling quickly spread across the market, with BNB falling 6.08%, and Solana sliding 7.89%.

Why Is The Crypto Market Down Today? Key Crypto Crash Reasons Explained

Why Is The Crypto Market Down Today? Key Crypto Crash Reasons Explained

This uniform red across Bitcoin, Ethereum, and other assets confirms that the market is falling due to an industry-wide selloff, not a single project failure.

Gold and Silver Crash Triggers Global Liquidity Shock

The primary trigger behind the crypto market crash today came from outside the digital asset space. Gold and silver experienced historic selloffs, triggering a high-volatility global liquidity shock.

Why Is The Crypto Market Down Today? Key Crypto Crash Reasons Explained

Why Is The Crypto Market Down Today? Key Crypto Crash Reasons Explained

Silver Price Crash

As per TradingView chart, Silver plunged sharply from the 118–120 zone to near 104 on the 15-minute interval, erasing weeks of gains within minutes. The RSI dropped into the low-30s, signaling aggressive panic selling and forced exits across the asset markets.

Gold Price Crash

Gold followed with a more severe move, collapsing from above 5,500 to near 5,100 and wiping out nearly $3 trillion in market value. The MACD printed one of its sharpest negative expansions on record, confirming large-scale institutional selling rather than retail-driven profit-taking.

Altogether, safe-haven assets erased over $3.75 trillion, while U.S. equities intensified the pressure as the S&P 500 and Nasdaq shed more than $1.5 trillion intraday. This massive capital drain explains why gold and silver prices dropped today—and why cryptocurrencies became the next casualty in the liquidity unwind.

Leverage Liquidations Accelerate Crypto Market Crash

Once traditional markets cracked, cryptocurrency leverage unraveled rapidly. Over the past 24 hours, more than $1.72 billion in positions were liquidated, affecting 274,442 traders. Long positions absorbed the majority of the damage, with over $1.60 billion in bullish bets wiped out—highlighting how overcrowded the long side had become before the crypto crash.

Coinglass data show that Bitcoin liquidations were 786.5 million and Ethereum 422.7 million. XRP, Solana, and other altcoins were also liquidated. This cascading liquidation spiral explains both the speed and severity of today’s market-wide decline.

Conclusion: Will Crypto Recover?

In summary, why the crypto market is down today does not have much to do with digital assets alone. A historic decline in gold and silver caused a liquidity reset to the world, and spilled over to equities and crypto alike. The shock can still be felt in the short term; high volatility could continue over the next 3–4 days.

But the market-structure bill set to be signed today, according to analysis, could provide a stabilizing catalyst. The law aims to curb manipulation and enhance regulatory transparency, which may help regain investor trust and stabilize prices.

This article was originally published as Why Is the Crypto Market Down Today? Key Crypto Crash Reasons Explained on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

The Channel Factories We’ve Been Waiting For

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip