Why Platforms Like BMIC Matter More During Bear Market Conditions – Best Crypto Presale to Buy Now?

Bear markets change how people think about crypto. When prices grind lower and rallies fail, short-term trades lose their appeal. Volatility dries up, confidence fades, and capital becomes more selective. In these conditions, many traders stop chasing momentum and start looking for projects that are built to last.

That may be one of the reasons why a crypto presale can sometimes get more attention during a downturn than during a euphoric market.

Instead of competing with hundreds of fast-moving tokens, early-stage projects with real infrastructure and long-term relevance stand out more clearly. BMIC ($BMIC) is one of those projects. The crypto market focuses on price recovery, but BMIC is doing something deeper: preparing crypto for a future where security risks look very different from today.

As uncertainty grows, platforms that prioritize protection, utility, and durability often start to look like a smarter crypto to buy than short-lived narratives.

What BMIC Is Building and Why It Fits Bear Markets

BMIC is building the first complete quantum-secure finance stack. That includes a wallet, staking system, and payment layer, all protected by post-quantum cryptography and signature-hiding smart accounts. Instead of patching old designs, BMIC is built from the ground up for a quantum-era threat model.

This matters more in bear markets than many realize. During downturns, assets tend to be held longer. Long-term holding increases exposure to future risks, including “harvest now, decrypt later” attacks. BMIC is created specifically to prevent that by removing public-key exposure entirely.

In contrast to traditional wallets, BMIC uses ERC-4337 smart accounts combined with hybrid post-quantum signatures and private routing. Public keys are never exposed on-chain, which removes the main attack surface quantum computers are expected to target. That makes BMIC structurally safer, regardless of short-term price movements.

Another key reason BMIC fits bear markets is scope. It does not secure just one part of the crypto experience. Storage, staking, and payments all follow the same quantum-secure rules. There are no weak links created by moving assets between tools or services.

This “all-in-one” security system is rare in crypto and helps explain why some investors are starting to view BMIC as an altcoin to buy based on real usage rather than the ongoing (bearish) market sentiment.

Why BMIC’s Features Matter When Capital Is Cautious

Bear markets reward platforms that reduce risk instead of amplifying it. BMIC’s feature set aligns closely with that mindset.

Staking is a good example. In most systems, long-term staking exposes classical public keys continuously, making patient holders more vulnerable over time. BMIC introduces quantum-secure staking that removes classical key exposure entirely. Users can earn yield without increasing their future attack surface.

Payments follow the same logic. BMIC’s payment and card layer uses post-quantum authentication and signature-hiding routing. This protects users from cloning, key recovery, and future quantum-based fraud, while keeping everyday usage simple. In uncertain markets, that kind of reliability matters.

AI plays a supporting role across the platform. BMIC uses AI to monitor activity, detect threats early, and optimize cryptographic performance. Security upgrades happen automatically as standards evolve, without forcing users or institutions to migrate systems or rotate keys.

BMIC also extends beyond retail users through its Quantum Security-as-a-Service model. Banks, fintech companies, healthcare providers, and governments can integrate custody, key management, and secure communication through BMIC’s APIs. This creates real, ongoing demand that is not dependent on market hype.

Looking ahead, BMIC’s Quantum Meta-Cloud aims to decentralize access to quantum compute resources. Instead of corporate gatekeeping, access is transparent, permissionless, and rewards contributors through the network. This adds another layer of long-term utility tied directly to token usage.

Together, these features support the idea that BMIC is one of the best crypto presales to buy now. Its infrastructure is built to remain relevant across market cycles.

BMIC Presale Structure and Bear-Market Timing

BMIC’s token sale has a goal to raise up to €40,000,000 as it rolls through a multi-stage presale model. Instead of a single fixed price, BMIC uses a demand-based tier system that can span as many as 50 phases, starting at $0.048485 and stepping higher until it reaches $0.058182.

What matters for early participants is how the pricing is set up. The team has stated that the public launch price will sit above the final presale tier, creating a built-in advantage for those who enter earlier rather than waiting for listings.

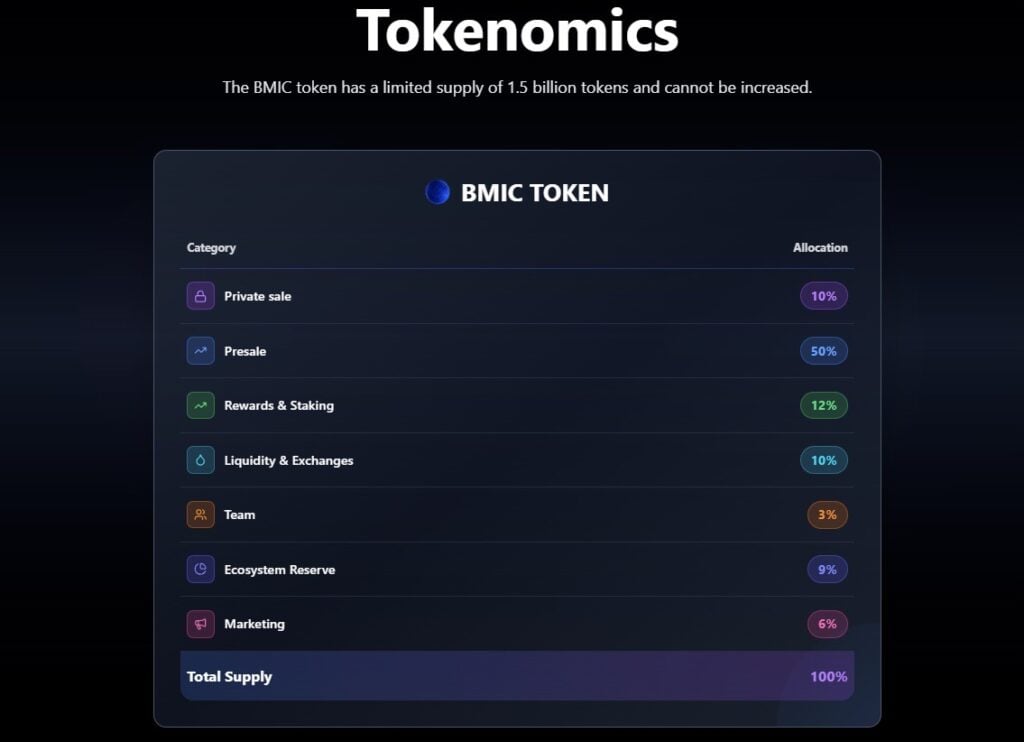

BMIC’s total supply is capped at 1,500,000,000 tokens, with half reserved for presale distribution. The rest is allocated across staking incentives, liquidity provisioning, ecosystem development, marketing, and a modest team share. Token demand is linked directly to real platform usage, including wallet functionality, staking participation, governance rights, enterprise security services, and future access to decentralized quantum compute.

Despite cautious market conditions, the presale has already crossed $300,000 raised.

Why BMIC Stands Out as a Bear-Market Crypto to Buy

Bear markets tend to expose weak ideas and reward preparation. BMIC is built around preparation. It addresses a real and growing risk, offers a complete security stack, and targets both individual users and institutions.

By removing public-key exposure, securing staking and payments, integrating AI-driven protection, and planning for decentralized quantum compute, BMIC positions itself as infrastructure rather than speculation.

For those looking for the best crypto to buy during uncertain conditions, BMIC offers a different kind of thesis. It is not about timing the next rally. It is about owning exposure to technology designed for what comes next.

With the BMIC presale still offering discounted pricing and momentum building quietly, early access may not remain available for long if broader awareness grows.

Discover the future of quantum-secure Web3 with BMIC:

Presale: https://bmic.ai

X (Twitter): https://x.com/BMIC_ai

Telegram: https://t.me/+6d1dX_uwKKdhZDFk

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

UK inflation stays high, potentially pausing interest rate hikes

UK and US Seal $42 Billion Tech Pact Driving AI and Energy Future