Ethereum (ETH) Momentum Check: Will $2.9K Hold or Break?

- Ethereum is currently trading in the $2.9K range.

- ETH’s daily trading volume has increased by over 44%.

A brief 1.19% uptick in the market cap has triggered it to reach $2.97 trillion. This has resulted in mixed signals across the crypto assets, sending the prices up and down. The largest asset, Bitcoin (BTC), is attempting to enter the bullish zone and escape from the bear grip. Meanwhile, Ethereum (ETH), the largest altcoin, has been under prolonged downside pressure.

The asset has posted a gain of over 3.73% in the last 24 hours. Today’s low and high ranges of ETH were marked at around $2,777.12 and $2,994.55. If the bulls steadily gained strength, they could form a bullish trend line. On the attempts failing, the price movement may end up losing more momentum in the market.

At the time of writing, Ethereum traded within the $2,959 range, with the market cap at $356.61 billion. Additionally, the daily trading volume of the asset has soared by over 44.72%, reaching the $37.15 billion mark. As per Coinglass data, the market has experienced a 24-hour liquidation of $158.28 million worth of Ethereum.

Can Ethereum Flip Momentum and Break Higher?

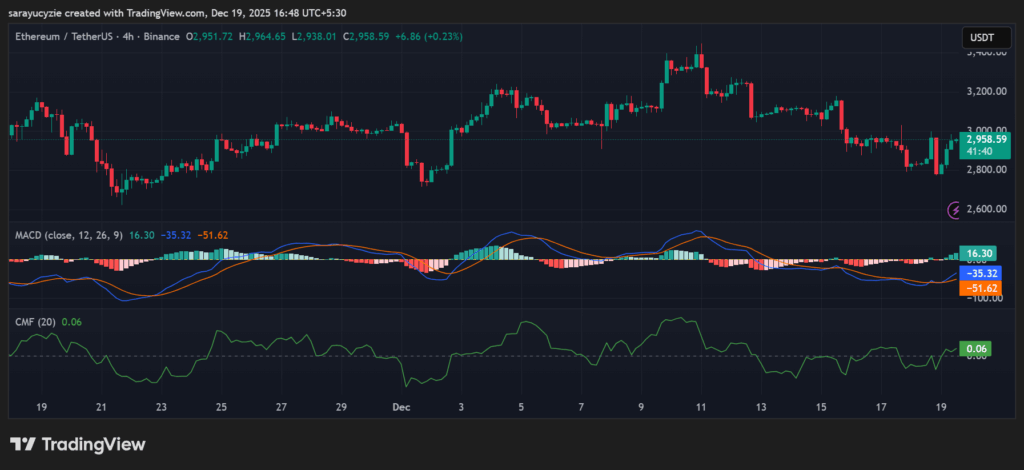

Ethereum’s Moving Average Convergence Divergence (MACD) line and the signal line are below the zero line, pointing out bearish momentum. Notably, the short-term price trend is weaker than the longer-term trend. Besides, the Chaikin Money Flow (CMF) indicator at 0.06 hints at mild buying pressure in the ETH market. The money is flowing into the asset, showing early accumulation, but not strong enough to confirm a solid uptrend.

ETH chart (Source: TradingView)

ETH chart (Source: TradingView)

With the ongoing downside correction, the Ethereum price could retrace to the support zone at $2,947. A potential bearish pressure might trigger the death cross to take place, and send the price below the $2,935 range. Conversely, if Ethereum momentum turns bullish, it might rise and find the resistance at the $2,971 level. A breakout could likely initiate a strong upside shift, and the golden cross would unfold to drive the price toward $2,983.

Moreover, the Bull Bear Power (BBP) reading of ETH at 101.29 indicates strong bullish dominance in the market, reflecting upside momentum. Higher readings can signal the overextension condition. Ethereum’s daily Relative Strength Index (RSI) resting at 52.40 suggests neutral momentum. Significantly, neither the buyers nor the sellers are in clear control, but this is often seen during the consolidation phases.

Top Updated Crypto News

Bitcoin Cash (BCH) Momentum Builds: Could $600 Be Hit by Day’s End?

You May Also Like

Whales keep selling XRP despite ETF success — Data signals deeper weakness

Top Solana Treasury Firm Forward Industries Unveils $4 Billion Capital Raise To Buy More SOL ⋆ ZyCrypto