House of DOGE Issues 2025 Shareholder Letter: 730M Treasury, NASDAQ Listing, Payments Launch

Dogecoin DOGE $0.12 24h volatility: 3.3% Market cap: $18.48 B Vol. 24h: $1.62 B price found support near $0.12 on Dec. 22, buoyed by the bullish tone of House of DOGE’s 2025 shareholder letter.

The treasury and corporate arm of the Dogecoin Foundation outlined its expansion into regulated finance, payments, and sports partnerships ahead of a planned NASDAQ listing in early 2026.

House of DOGE Expands Treasury, Targets NASDAQ Listing

According to the shareholder update, House of DOGE has signed a definitive merger agreement with Brag House Holdings (NASDAQ: TBH), positioning it to become one of the first publicly traded Dogecoin-focused corporations.

The firm confirmed its Official Dogecoin Treasury has surpassed 730 million DOGE, managed under a 10-year asset agreement with CleanCore Solutions (NYSE: ZONE), ranking it among the largest institutional holders of Dogecoin globally.

CEO Marco Margiotta highlighted that 2025 marked a year of “deliberate, foundational progress,” emphasizing that 2026 will focus on execution and commercialization. The company’s roadmap includes launching a rewards debit card, an embeddable Dogecoin wallet, and merchant acceptance tools to drive real-world adoption.

House of DOGE is also looking to expand institutional access through partnerships with 21Shares, enabling ETP and ETF exposure to Dogecoin across European and US markets.

The firm’s sports investments, in the Italian football clubs US Triestina Calcio 1918 and HC Sierre also aim to integrate Dogecoin into fan engagement, ticketing, and tokenization initiatives.

Despite the strong fundamentals, Dogecoin continues to trade 2.5% lower at $0.127, with CoinMarketCap data showing a 29% rise in daily volumes, signaling persistent sell-side activity. Bitcoin BTC $84 798 24h volatility: 1.0% Market cap: $1.69 T Vol. 24h: $55.38 B inability to reclaim $90,000 has weighed on memecoins, keeping speculative demand subdued.

Dogecoin Price Forecast: Can DOGE Reclaim $0.14 or Slip Below $0.12?

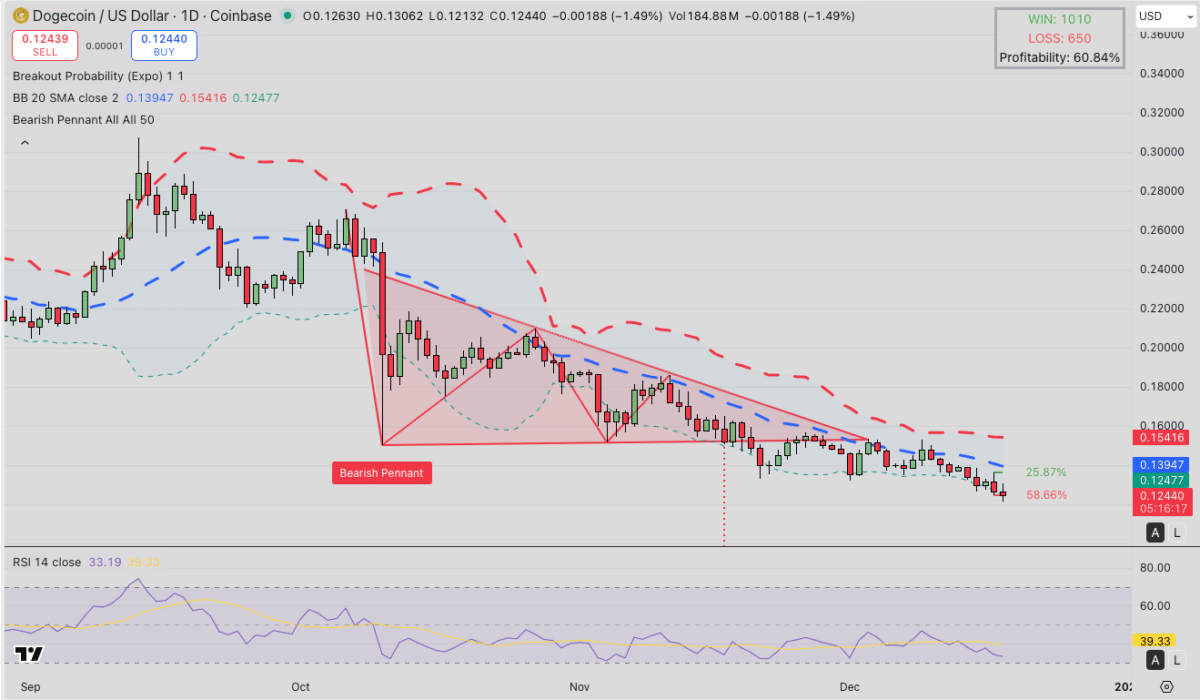

Dogecoin’s daily chart shows a clear bearish pennant formation, signaling continued downside pressure after repeated failures to break the descending resistance line near $0.14. The pattern has unfolded under the upper Bollinger Band (BB) resistance at $0.154, with prices now consolidating near the lower BB at $0.124.

The Relative Strength Index (RSI) sits at 33.09, hovering in oversold territory. This reflects exhaustion among short-term sellers but has yet to trigger meaningful accumulation signals. Historically, RSI levels near 30 often precede mild bounces, especially when accompanied by rising volume as observed on Dec. 19.

Dogecoin (DOGE) Technical Price Analysis, Dec. 18, 2025 | Source: TradingView

If buyers defend the $0.12 support, a short-term recovery could lift DOGE toward $0.135, aligning with the midline of the Bollinger Band and the 20-day SMA at $0.139.

A decisive breakout above $0.14 would invalidate the bearish pennant, exposing resistance at $0.16, the level required to confirm a trend reversal.

On the downside, a daily close below $0.12 could accelerate a drop toward $0.10, the measured move target from the pennant breakdown. With 58.64% downside probability, Dogecoin remains at risk of setting new weekly lows, unless macro sentiment improves.

nextThe post House of DOGE Issues 2025 Shareholder Letter: 730M Treasury, NASDAQ Listing, Payments Launch appeared first on Coinspeaker.

You May Also Like

Unleashing A New Era Of Seller Empowerment

CME Group to launch Solana and XRP futures options in October

SEC flags Bitcoin miner hosting services as subject to securities laws

In a lawsuit, the SEC says some hosted Bitcoin mining services could trigger