Crypto Market Volatility Intensifies Following Bitcoin and Ethereum Options Expiry

- The expiry of nearly $8.5B in BTC and ETH options triggered market fluctuations and volatility.

- Bitcoin recorded total liquidations of $790.27 million, while Ethereum’s liquidations reached $419.84 million.

As the broader crypto market tumbles today, down around 5.31% with the total market capitalization falling to $2.83 trillion, major cryptocurrencies are seeing sharper losses. The selling pressure has been further intensified by the expiry of billions of dollars’ worth of Bitcoin and Ethereum options contracts, which have added to market volatility.

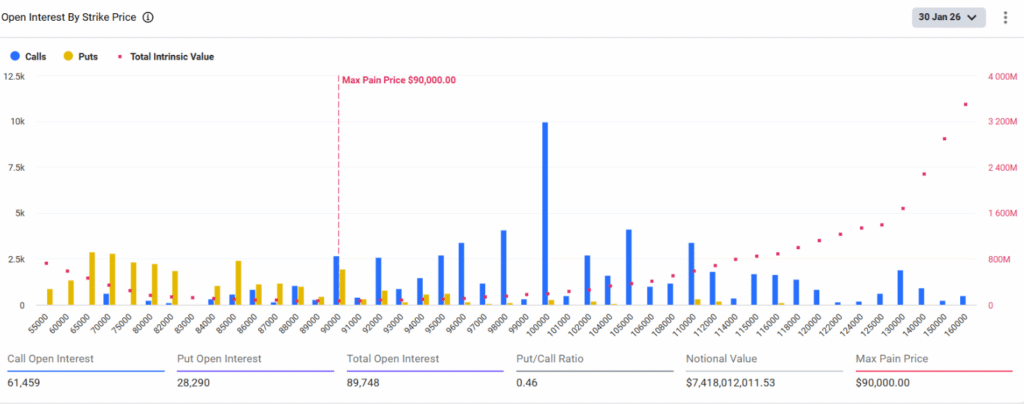

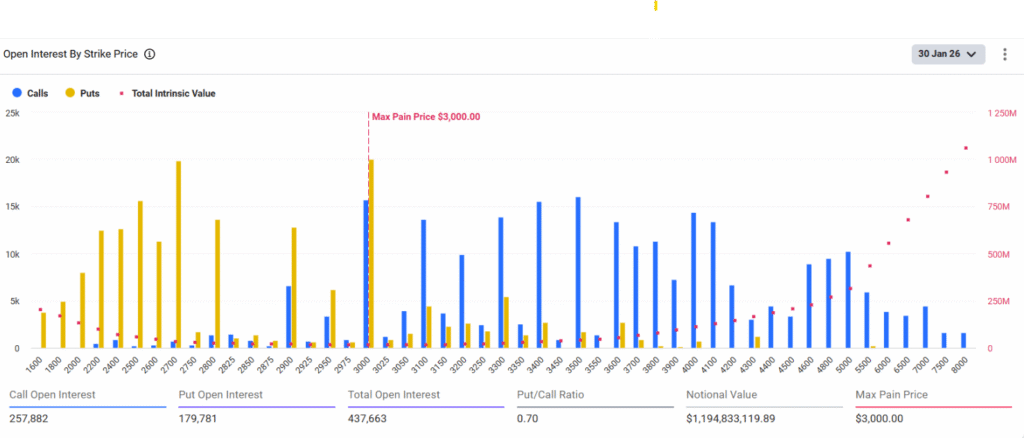

As per the crypto derivatives exchange Deribit data, over $8.5 billion worth of Bitcoin and Ethereum options expired today. Where the Bitcoin options account for $7.4 billion in notional value, while Ethereum options account for $1.2 billion.

Source: Derbit

Source: Derbit

With that, Bitcoin’s put/call ratio was at 0.46, indicating a higher number of call options compared to puts. After that, currently, the 24-hour put/call ratio stands at 1.35, which indicates the downward sentiment after the wider market decline. Meanwhile, the max pain price stands at $90,000, suggesting that most options traders would face maximum losses, as per the data.

Source: Derbit

Source: Derbit

Crypto Market Faces Intensifying Pressure

While Ethereum is trading below its $3,000 max pain level, before the January 30 options expiry showed a put/call ratio at 0.70, but over the last 24 hours, Ethereum put volume has climbed higher than call volume, and the put/call ratio is 1.79 at the time of writing, which signals bearish sentiment.

Bitcoin is trading at $82,370, a decline of about 6.5% in the past 24 hours, and the total liquidations are standing at $790.27 million. Ethereum is trading at $2,735, down by 6.5% over the past 24 hours, and the total liquidations are $419.84 million, as per Coinglass data.

In addition, President Trump is expected to nominate Kevin Warsh as Federal Reserve Chair, with Polymarket indicating more than 90% probability for Warsh. With that, the comments on his previous hawkish crypto policy might have further intensified the selling pressure in Bitcoin and the broader cryptocurrency market.

Highlighted Crypto News Today:

Binance Eyes South Korea Lead via Gopax, GoFi Push

You May Also Like

Weakness concerns amid intervention – BNY

Willdan Announces Date of Fourth Quarter and Fiscal Year 2025 Earnings Release and Conference Call