Digitap ($TAP) vs. $2 XRP vs. $134 SOL: Which is the Best Crypto to Buy in 2026?

The post Digitap ($TAP) vs. $2 XRP vs. $134 SOL: Which is the Best Crypto to Buy in 2026? appeared first on Coinpedia Fintech News

Crypto is entering a different phase. The next cycle is not just about charts and hype. It is about what people actually use. As 2026 is progressing, investors are looking less at promises and more at systems that fit real life.

This is why comparisons between projects like XRP, Solana, and Digitap ($TAP) are becoming more serious. Each represents a very different idea of what crypto should become.

XRP focuses on institutions and large financial rails. Solana is built for developers and high-speed applications. Digitap is aiming for everyday people who just want money to work better. For long-term thinkers trying to choose the best crypto to invest in, the real question is simple: which of these models fits how people will actually use money in 2026?

Three Coins, Three Very Different Directions

XRP at around $2 represents the institutional path. It was designed to help banks and financial companies move money faster across borders. Its success depends heavily on regulation, partnerships, and slow-moving systems.

Solana is around $134, representing the builder’s path. It is fast, cheap, and designed for developers who want to build apps, games, DeFi platforms, and NFTs. Its growth depends on how many strong applications its ecosystem creates.

Digitap represents a third path. It is not chasing banks or developers first. It is built for people who move money every day. Workers, freelancers, families, online sellers, and small businesses. This makes its growth depend on daily behavior rather than on institutions or technical communities.

All three can succeed. But they grow in very different ways.

Digitap’s Approach to Everyday Money

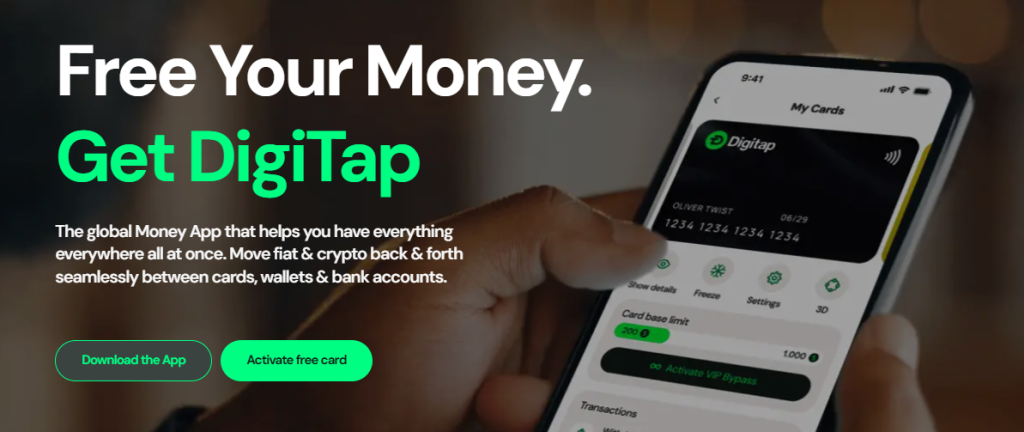

Digitap is trying to become something simple: a place where money just works. Most people today use banks for fiat, apps for transfers, wallets for crypto, and cards for spending. Digitap wants to remove that separation and put everything into one system.

- Users can hold both fiat and crypto in a single account. They can send money across borders without waiting days.

- Users can receive funds without losing a large share to hidden fees or bad rates. They can spend using card-based systems that work in real shops and online stores.

- Behind the scenes, smart routing chooses efficient transfer paths automatically, so users do not have to think about technical steps. This design is not about looking advanced. It is about feeling normal. The easier money feels to use, the more often people use it. And the more often people use it, the more value flows through the system.

Digitap is still early. It is currently in its presale stage, now in Round 3, with the token priced around $0.0439 per $TAP. Each presale round increases the price, which means early participants enter at lower levels than those who come later. This stage-based structure rewards belief in the system before it becomes crowded.

That is why many long-term participants are starting to describe Digitap as a strong best crypto presale opportunity. Not because tomorrow’s price matters, but because this is the stage where habits, users, and real usage begin forming.

What matters is not just the presale. It is what happens after. If people use Digitap for daily payments, remittances, and online work, demand grows naturally and value follows real behavior, not hype.

This is different from projects that rely on trading alone, where volume can vanish when sentiment changes. Daily use is harder to replace once it becomes routine. Digitap’s focus on everyday money gives it a stronger growth path, built on habits rather than headlines.

How XRP and Solana Compare to Digitap

XRP and Solana are strong projects, but they are built for different users. XRP focuses on institutions, helping banks and large financial systems move money more efficiently. Its growth depends on regulation and partnerships, which makes progress steady but slow. It is not designed for everyday personal spending like groceries, freelancing, or small business use.

Solana is built for developers. It is fast, low-cost, and supports many apps, games, and DeFi platforms. But most people do not interact with blockchains directly. They use apps built on them. This means Solana’s success depends on builders first, not everyday users.

Digitap takes a different path. It is built for people who already move money daily. It does not wait for banks or developers. It grows when users like using it. For anyone looking for an altcoin to buy based on real-life use, this difference matters. If people keep using it, the value grows naturally.

Digitap: A Platform Built for Daily Use in the 2026 World

By 2026, crypto will not feel new anymore. It will not impress people just by existing. It will have to fit into life quietly, like email or mobile banking does today. XRP will still matter for institutions, and Solana for builders, but most people are neither. They are workers, parents, sellers, freelancers, and small business owners who just want money to move easily.

That is the world Digitap is already building for. People do not think about chains or protocols. They focus on sending, receiving, saving, and spending without friction. The most valuable platforms are not the loudest. They are the ones people use without thinking.

Digitap does not need to beat others at their own game. It is already changing how everyday money works. Early users are not chasing noise. They are stepping into a system while it is still forming. For anyone seeking the best altcoin to invest in 2026 with a long-term vision, being part of that shift now has the potential to be highly lucrative.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

You May Also Like

21Shares Launches JitoSOL Staking ETP on Euronext for European Investors

Digital Asset Infrastructure Firm Talos Raises $45M, Valuation Hits $1.5 Billion