Bitcoin whales have accumulated 136,670 BTC since March 3, 2025, despite a 2.2% drop in large-holder wallets, indicating strategic consolidation amid market caution and potential volatility.

-

Wallets holding over 1 BTC decreased from 996,320 to 974,380, a 2.2% reduction, per Santiment data.

-

Whales added significant holdings, signaling confidence in Bitcoin’s long-term value despite price fluctuations.

-

Analysts predict possible price moves to $70,000 or warn of sustained sideways trading, with reduced wallets potentially tightening supply.

Bitcoin whales accumulate more BTC amid fewer wallets in 2025, showing cautious optimism. Discover how this impacts market volatility and what it means for investors—explore key insights now.

What Does the Decrease in Bitcoin Whale Wallets Mean for the Market?

Bitcoin whale wallets have seen a notable decline in numbers, dropping 2.2% from 996,320 on March 3, 2025, to 974,380 by December 22, according to data from Santiment. Despite this reduction, these large holders have collectively increased their Bitcoin reserves by 136,670 BTC over the same period, suggesting a pattern of strategic accumulation rather than widespread selling. This behavior reflects cautious optimism among major investors, who appear to be consolidating positions in anticipation of future market developments.

How Are Bitcoin Whales Responding to 2025 Price Fluctuations?

The fluctuations in large wallet counts throughout 2025 have mirrored Bitcoin’s price movements, with periods of accumulation alternating with selective sell-offs. Santiment’s on-chain metrics reveal that while the number of addresses holding more than 1 BTC has contracted, the total BTC balance in these entities has expanded substantially, underscoring a commitment to holding amid volatility. This trend may indicate that some whales are diversifying into other assets temporarily, but the net effect points to a tightening of Bitcoin supply at higher price levels. Expert analysis from blockchain research firms like Glassnode supports this, noting that long-term holders, or “HODLers,” now control over 70% of the circulating supply, which historically correlates with reduced selling pressure during uncertain times. Such dynamics could heighten short-term volatility, as fewer participants hold a larger share, amplifying the impact of any trades. For instance, in similar consolidation phases in past cycles, Bitcoin has experienced sharper rallies once supply absorption reaches critical levels, though exact outcomes depend on broader economic factors like regulatory news and macroeconomic shifts.

Frequently Asked Questions

What caused the 2.2% drop in Bitcoin wallets holding over 1 BTC in 2025?

The decline from 996,320 to 974,380 wallets since March 3, 2025, stems from market consolidation, where smaller holders merge or exit while larger ones absorb more BTC, as tracked by Santiment. This 2.2% reduction reflects strategic portfolio adjustments amid price swings, not a mass exodus, preserving overall network strength.

Will Bitcoin whale accumulation lead to higher prices in the coming months?

Bitcoin whale accumulation, with 136,670 BTC added despite fewer wallets, suggests building pressure for upward movement, but it remains tied to market sentiment and external catalysts like institutional adoption. Analysts note this could support prices above $60,000, though sideways trading persists until key resistance levels break, offering a balanced view for voice search queries on crypto trends.

Key Takeaways

- Strategic Accumulation: Whales added 136,670 BTC amid a wallet count drop, indicating confidence in Bitcoin’s fundamentals over short-term dips.

- Supply Tightening: Fewer large wallets concentrating holdings may reduce available supply, potentially fueling volatility and future price surges.

- Analyst Caution: While some see a path to $70,000, others highlight range-bound action, urging investors to monitor on-chain data closely for entry points.

Conclusion

In summary, the paradox of Bitcoin whales accumulating more BTC while large wallets decrease in 2025 highlights a maturing market driven by long-term conviction amid cautious moves. Data from sources like Santiment illustrates this consolidation, potentially setting the stage for increased volatility and renewed bullish momentum. As institutional interest grows, investors should stay informed on whale behaviors to navigate upcoming opportunities effectively, positioning for Bitcoin’s evolving role in the digital asset landscape.

Bitcoin’s major investors, often referred to as whales, continue to demonstrate resilience and strategic foresight in their holdings. The observed trends suggest that despite the contraction in wallet numbers, the underlying commitment to Bitcoin remains robust. This accumulation phase, coupled with divided analyst opinions, underscores the need for vigilant market monitoring.

Delving deeper into the mechanics, the reduction in wallet counts is not merely a sign of distress but a reflection of efficient capital allocation. Whales, who control substantial portions of the supply, are likely optimizing their positions by consolidating under fewer addresses, which enhances security and reduces operational complexity. This process, while reducing the visible number of entities, amplifies their influence on price discovery.

From a broader perspective, such on-chain activity aligns with historical patterns observed during Bitcoin’s maturation cycles. For example, during previous halvings and post-halving periods, similar whale behaviors preceded significant price appreciations. Although past performance is not indicative of future results, the current data points to a parallel narrative of supply scarcity being engineered by top holders.

Market participants should note the interplay between whale actions and retail sentiment. As whales accumulate, it often counters the fear-driven selling from smaller investors, stabilizing the floor price. This dynamic has been evident in 2025, where despite geopolitical tensions and regulatory uncertainties, Bitcoin’s price has held firm above key support levels.

Turning to expert insights, blockchain analysts emphasize the importance of metrics like the Realized Cap HODL Waves, which show an increasing proportion of coins unmoved for over a year. This metric, derived from tools like those provided by Glassnode, reinforces the thesis of long-term holding dominating the landscape. Quotes from industry veterans, such as those from CryptoQuant’s research team, highlight that “whale consolidation is a precursor to liquidity events that can propel Bitcoin forward.”

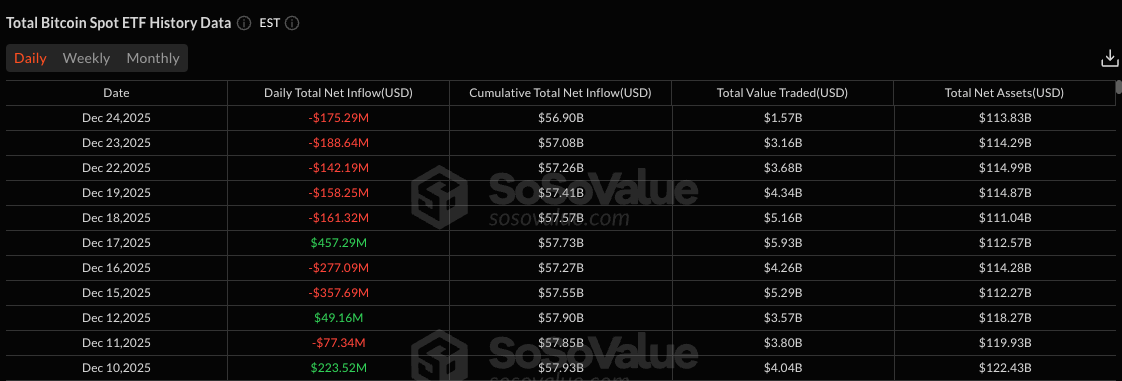

In terms of implications for volatility, the fewer number of whale wallets could mean that any coordinated movement—buying or selling—will have outsized effects. With supply tightening, even moderate demand inflows from ETFs or corporate treasuries could ignite rallies. Conversely, if whales begin distributing at higher prices, it might cap upside potential, leading to the range-bound scenarios some analysts predict.

The contrasting views from analysts like Crypto | Stocks | Freedom and Guru encapsulate the polarized yet informed debate within the crypto community. The former’s fractal analysis, drawing from 2021 patterns, suggests a technical setup for $70,000, while the latter’s emphasis on range trading serves as a reality check against over-optimism. Both perspectives, grounded in technical and sentiment indicators, provide a comprehensive framework for understanding current conditions.

As 2025 draws to a close, the Bitcoin ecosystem shows signs of evolution, with whale activities playing a pivotal role. Investors are advised to integrate on-chain analytics into their strategies, focusing on metrics that track large holder behavior. By doing so, they can better anticipate shifts and capitalize on the opportunities arising from this cautious accumulation trend.

Ultimately, the story of Bitcoin whales in 2025 is one of calculated patience. Their actions not only influence immediate price action but also shape the narrative for the asset’s long-term trajectory. Staying attuned to these developments will be crucial for anyone engaged in the cryptocurrency space.

Source: https://en.coinotag.com/bitcoin-whales-add-holdings-despite-fewer-wallets-signaling-potential-volatility-ahead