Crypto News: $2.56B Liquidation Hits Bitcoin Market

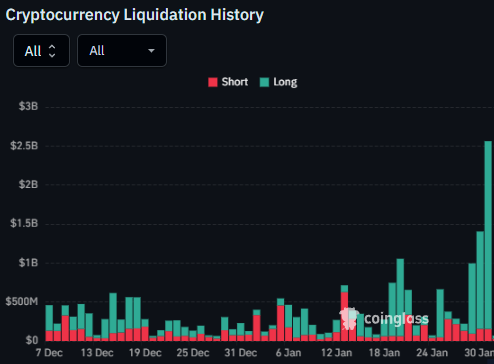

According to reports, there was a steep sell-off in the digital asset market as Bitcoin and Ethereum came under heavy liquidation pressure. Data provided by X account indicates that Bitcoin momentarily dipped below $76,000, and Ethereum followed suit in the overall decline. This resulted in over $2.56 billion in liquidations in a span of 24 hours, which indicates intense leverage on prominent trading platforms. Market observers were closely watching both digital assets as volatility escalated in the markets.

Largest Liquidation Event Since October Crash Reported

As reported in crypto news, the information provided by @coinbureau on X revealed that the amount of $2.56 billion was the largest amount of leverage wiped out since the market crash on the 10th of October. The previous market crash resulted in the wiping out of more than 19 billion dollars in leveraged positions on the 10th of October. Current statistics reveal that the losses were borne by the long positions, as depicted by the liquidation charts provided by the account.

Statistics reveal that the leverage was concentrated as the price declined. The price of Bitcoin was the first to decline, while the price of Ethereum reacted in the same way due to the correlated nature of the assets. The trading volume was high during the decline.

Source: X/coinbureau

Source: X/coinbureau

Bitcoin and Ethereum Tracked as Market Drawdown

Market watchers point out that the overall market has lost $1.64 trillion in capitalization over a period of four months. According to data provided by X account, the overall market capitalization decreased by around 38% as compared to the 2025 high. Bitcoin contributed a large part to this decrease, and Ethereum also followed a similar trend.

Price action indicates that the market is revisiting levels that were previously touched due to the “Liberation Day” tariff shock. Bitcoin and Ethereum touched consolidation zones.

Source: X/coinbureau

Source: X/coinbureau

Reports Notes Leverage as Key Driver of Sell-Off

In a tweet by the crypto news account, they cites findings that leverage played a part in the downward correction. The tweet explains that the leverage did not only make the fall in the prices steeper but also caused the forced sales. Liquidation rates on the major exchanges were triggered by the liquidation thresholds.

The liquidation rates have shown a constant rise in January, with the last one going beyond $2.5 billion.

Market Conditions Monitored After Liquidation Wave

Market participants are still monitoring market behavior following the liquidation event. Bitcoin and Ethereum prices are still reacting to adjustments in leverage as investors assess their risk exposure. Analysts are monitoring derivatives funding rates and open interest metrics.

Current market focus is on supporting levels following a forced selling phase. Data-driven market updates by different sources continue to be key in monitoring current market conditions.

You May Also Like

How A 130-Year-Old Course Reimagined The Golf Experience

The Era of Great Rotation: What Does the Historic Gold Crash Mean for Bitcoin?