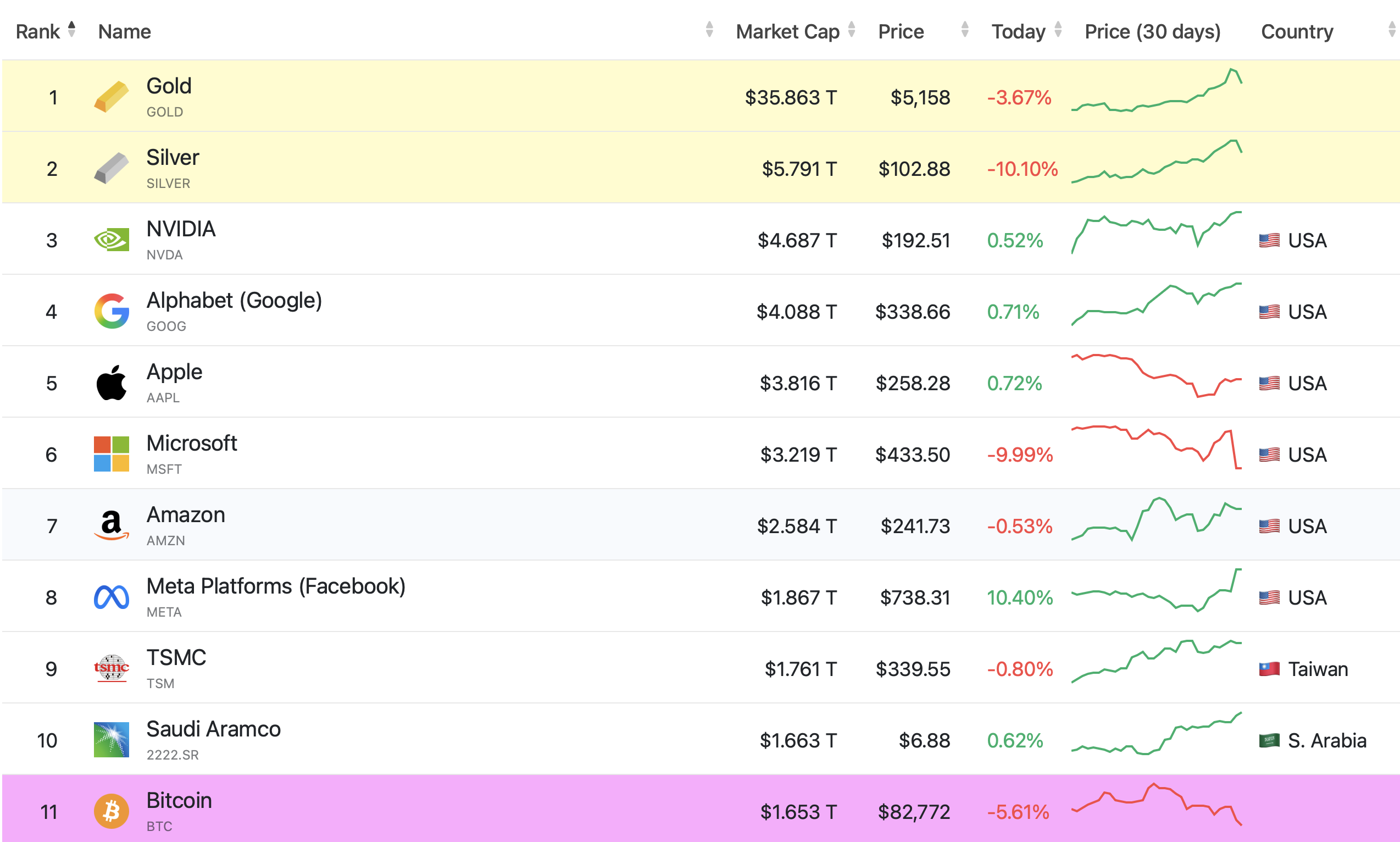

Bitcoin Slips Out of Top 10 Global Assets by Market Capitalization

Bitcoin has fallen out of the top 10 global assets by market capitalization, now ranking 11th according to the latest data.

The shift comes as traditional assets and major technology companies continue to dominate the upper ranks, while Bitcoin’s market value contracts alongside a notable short-term price decline.

At the time of the snapshot, Bitcoin is valued at $1.653 trillion, with a price of $82,772, posting a –5.61% daily change.

Gold and Silver Reclaim the Top Positions

The top two global assets by market capitalization are Gold and Silver, both firmly ahead of equities and cryptocurrencies.

-

Source: https://companiesmarketcap.com/assets-by-market-cap/

Source: https://companiesmarketcap.com/assets-by-market-cap/

Gold leads the rankings with a market capitalization of $35.863 trillion, trading at $5,158, despite a –3.67% daily decline. Silver follows with a market cap of $5.791 trillion, priced at $102.88, and showing a sharper –10.10% daily drop. The strong positioning of precious metals highlights their continued dominance during periods of broader market uncertainty.

Technology Giants Dominate the Equity Rankings

U.S. technology companies occupy the majority of the remaining top 10 slots. NVIDIA ranks third globally with a market cap of $4.687 trillion, followed by Alphabet at $4.088 trillion.

Apple and Microsoft hold the fifth and sixth positions, with market caps of $3.816 trillion and $3.219 trillion, respectively. Notably, Microsoft shows a significant –9.99% daily decline, making it one of the weakest performers among the top-ranked equities in the snapshot.

Bitcoin Falls Just Below Saudi Aramco

Bitcoin’s move to 11th place places it just behind Saudi Aramco, which holds the 10th position with a market capitalization of $1.663 trillion. The narrow gap between the two assets underscores how sensitive Bitcoin’s ranking is to short-term price movements.

The visual comparison also shows Bitcoin as the only cryptocurrency listed within the top 15 global assets, reinforcing its unique position as the largest digital asset by market value despite recent weakness.

Market Snapshot Signals a Rotation in Leadership

The current rankings illustrate a clear rotation in global asset leadership. Precious metals remain at the top, mega-cap technology stocks continue to command investor attention, and Bitcoin’s position has weakened amid recent downside price action.

While the image reflects only a moment-in-time snapshot, Bitcoin’s exit from the top 10 highlights how closely its global standing remains tied to short-term market volatility relative to slower-moving traditional assets.

The post Bitcoin Slips Out of Top 10 Global Assets by Market Capitalization appeared first on ETHNews.

You May Also Like

The Channel Factories We’ve Been Waiting For

XRP Escrow Amendment Gains Momentum, Set for February 2026 Activation