Crypto Sell-Off Deepens as Bitcoin Briefly Dips Below $84K

- The total crypto market cap fell 6% to $2.9 trillion in a single day, marking one of the steepest declines since October 2025.

- Over $1 billion in leveraged positions were liquidated, predominantly longs, as Bitcoin fell below $84,000 and Ethereum slipped under $2,800.

- A potential US government shutdown is fueling the panic, after lawmakers failed to advance a funding package ahead of the January 31 deadline.

Things are not looking very good in Washington, and the markets are feeling the pressure.

Late Thursday, most tech assets crashed, which spilled over to cryptocurrencies, equities, and precious metals at the same time as investor sentiment deteriorated through the US trading session.

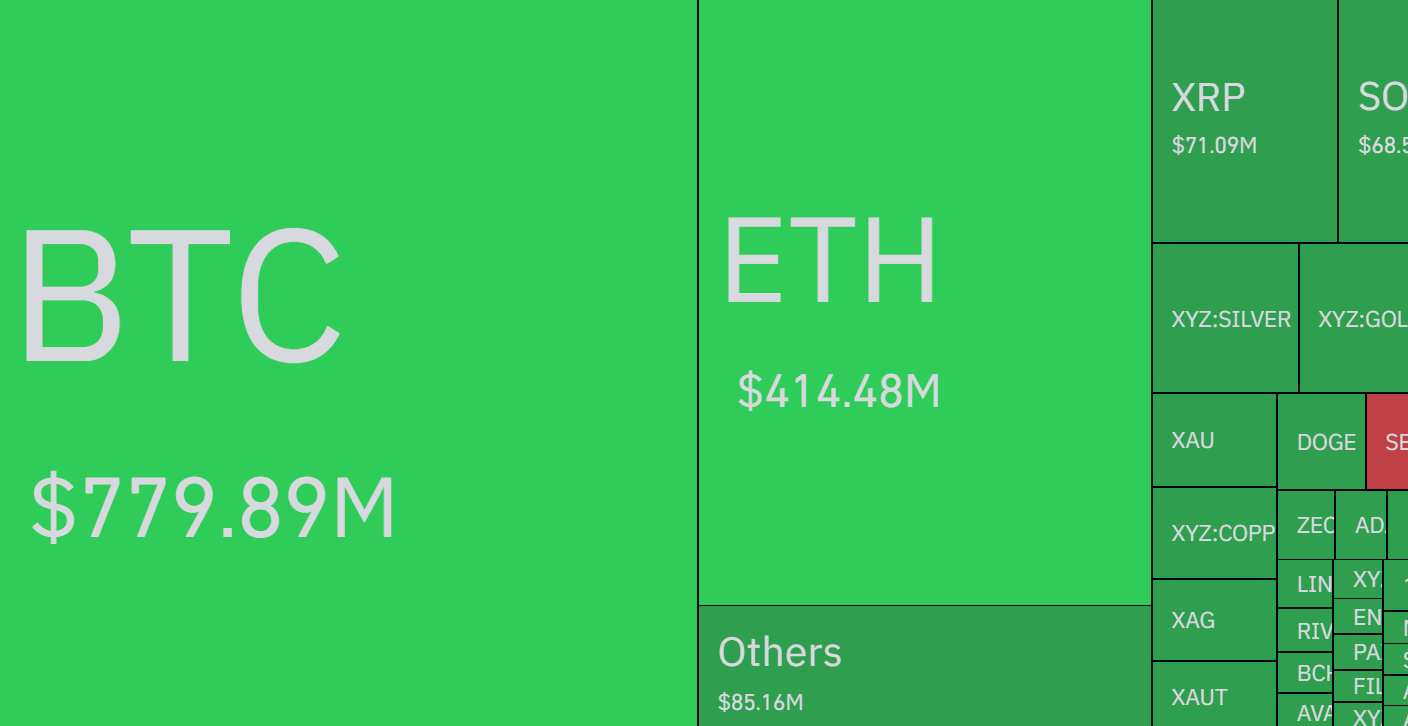

Of course, crypto had led the decline early. Total cryptocurrency market capitalisation fell from around US$3.1 trillion (AU$4.4 trillion) to just over US$2.9 trillion (AU$4.2 trillion), a drop of roughly 6% in a single day.

By scale, the move ranked among the steepest one-day declines since the Oct. 10 liquidation episode triggered by tariff threats from US President Donald Trump, when close to half a trillion dollars was erased from crypto markets in little more than 24 hours.

Read more: Australia’s Regulator Trains Its Sights on Crypto’s Regulatory Grey Zones

Leverage Unwinds as Prices Slip

Liquidations played a central role. As prices fell, more than US$1 billion (AU$1.43 billion) in leveraged crypto positions were wiped out over 24 hours, according to Coinglass, with long positions accounting for most of the losses. The forced selling highlighted how sensitive the market had become after weeks of uneven trading and limited upside follow-through.

Source: CoinGlass.

Source: CoinGlass.

Only two of the top 20 crypto assets posted double-digit gains over the past week, and that’s Hyperliquid’s HYPE and Canton’s CC.

As Crypto News Australia reported, Hyperliquid rose about 54% over the period, while Canton gained roughly 12%. These, and a few other altcoins like River, were the only large-cap assets showing any positive performance, leaving the broader market vulnerable once selling pressure accelerated. Bitcoin and Ethereum are down 6.3% and 5.9%, respectively, and over 8% in the weekly chart, as per data from CoinMarketCap.

Source: TradingView.

Source: TradingView.

Concerns centered on Washington after lawmakers failed to advance a procedural vote on a government funding package, increasing the odds of a shutdown if no agreement is reached before the weekend.

The prospect added to an already cautious backdrop and revived memories of earlier disruptions. During the 43-day shutdown that began in October, Bitcoin fell by roughly 15% as uncertainty dragged on and risk appetite faded across markets.

Related: Analyst: Gold’s Surge Signals a Trust Crisis – and Crypto’s Moment

The post Crypto Sell-Off Deepens as Bitcoin Briefly Dips Below $84K appeared first on Crypto News Australia.

You May Also Like

How to Pair Pearl Necklaces with Your Bridal Neckline

Shell (SHEL) Stock; Falls Modestly on U.S.-Iran Thaw and Lower Crude Prices

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more