XRP and Solana ETFs Gain Momentum as BTC, ETH Face Heavy Withdrawals

This article was first published on The Bit Journal.

Crypto ETF flows are quietly reshaping the crypto investment landscape at a time when price charts offer mixed signals. While daily price movements dominate social feeds, ETF flow data reveals where serious money is repositioning. Last week’s numbers point to a clear rotation rather than a market retreat.

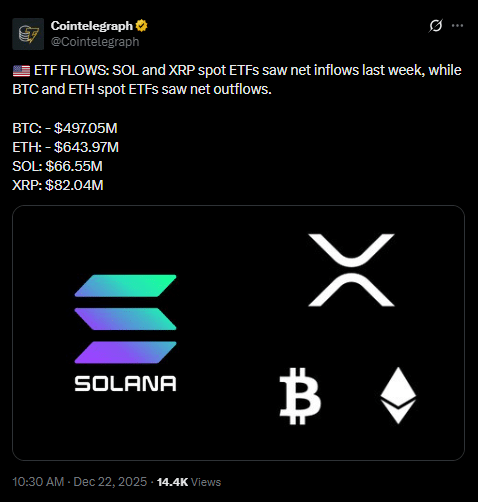

According to the source, weekly ETF flow data shows that capital moved out of Bitcoin and Ethereum funds while selectively entering altcoin-linked products. This pattern suggests strategic reallocation, not declining trust in crypto markets. Investors appear to be adjusting exposure instead of exiting entirely.

Bitcoin and Ethereum ETFs Face Heavy Withdrawals

Recent crypto ETF flows show that Bitcoin spot ETFs recorded net outflows of about 497 million dollars, while Ethereum spot ETFs experienced even larger withdrawals of nearly 644 million dollars. These figures reflect a cooling phase following earlier rallies rather than panic-driven selling.

Verified market data shows Bitcoin trading near $88,800 with a market cap above $1.7 trillion, while Ethereum trades close to $2,900, based on updated figures.

Large-cap assets often see profit-taking during uncertain macro conditions. ETF investors tend to reduce exposure before volatility appears in spot markets, making crypto ETF flows an early signal of sentiment change.

Source: X (Formerly Twitter)

Source: X (Formerly Twitter)

Crypto ETF Flows Highlight Growing Altcoin Interest

While Bitcoin and Ethereum faced outflows, crypto ETF flows into select altcoins told a different story. Solana-linked ETFs attracted roughly 66 million dollars in net inflows during the same period. Even stronger momentum appeared in XRP ETFs, which recorded inflows of approximately 82 million dollars.

This divergence shows that capital did not leave crypto. It moved within it. XRP ETFs appear to be gaining favor as investors search for assets with defined use cases and improving regulatory clarity. Payment-focused networks tend to attract interest during periods when speculation cools.

Why XRP ETFs Are Gaining Institutional Confidence

The steady inflows into XRP ETFs suggest rising institutional comfort. XRP’s role in cross-border payments offers a familiar narrative for traditional finance participants. ETF structures also remove custody and compliance hurdles, making XRP ETFs easier to integrate into regulated portfolios.

Market research often notes that ETF flows reflect medium-term expectations rather than short-term trades. A widely referenced financial stability analysis explains how diversified digital asset exposure can reduce portfolio concentration risk, a trend discussed in this global market review:

That framework helps explain why XRP ETFs are drawing attention during a period of rotation.

What the Rotation Says About Market Maturity

Another layer of crypto ETF flows lies in where capital did not go. Funds exiting Bitcoin and Ethereum did not move to cash. They shifted toward alternative crypto ETFs. This behavior signals a more mature market where investors rebalance instead of reacting emotionally.

For financial students and analysts, crypto ETF flows now serve as a practical case study. Prices reflect emotion. Flows reflect intent. Developers should also watch ETF trends closely, as institutional exposure often precedes ecosystem investment.

Conclusion

The latest crypto ETF flows confirm that the crypto market is evolving beyond simple price speculation. Capital is becoming more selective, guided by structure, regulation, and utility. As crypto ETF flows continue to shape sentiment, understanding where money moves may offer clearer insight than watching prices alone.

Glossary of Key Terms

Crypto ETF flows: It refer to net capital moving in or out of crypto exchange traded funds.

Spot ETF: It means a fund backed by actual crypto assets, not derivatives.

Altcoins: They are cryptocurrencies other than Bitcoin.

Institutional investors: They include funds, banks, and large financial firms.

FAQs About Crypto ETF Flows

What do crypto ETF flows indicate?

They show real investor commitment beyond price movement.

Why are XRP ETFs gaining inflows?

Utility, regulation clarity, and diversification demand support growth.

Do ETF flows affect prices?

Flows often lead price trends rather than follow them.

Are altcoin ETFs riskier?

They carry higher volatility but offer growth potential.

Sources and References

Coinmarketcap

BISorg

Federalreserve

Read More: XRP and Solana ETFs Gain Momentum as BTC, ETH Face Heavy Withdrawals">XRP and Solana ETFs Gain Momentum as BTC, ETH Face Heavy Withdrawals

You May Also Like

Sandbrook Capital Announces Acquisition of United Utility Services from Bernhard Capital Partners

TRUMP Struggles Below $5 as Unlock Adds Downside Pressure