Ripple CEO Celebrates 30 Days of XRP ETF Inflows as Price Drops Below 2 USD

- US spot XRP ETFs recorded over $1 billion in net inflows since November, achieving 30 consecutive days of positive growth.

- XRP’s performance contrasts with major outflows in Bitcoin and Ethereum ETFs, driven by expanded institutional access from firms like Vanguard and Bitwise.

- Despite strong fund inflows, the XRP token price remains 47% below its all-time high amid a broader market drawdown.

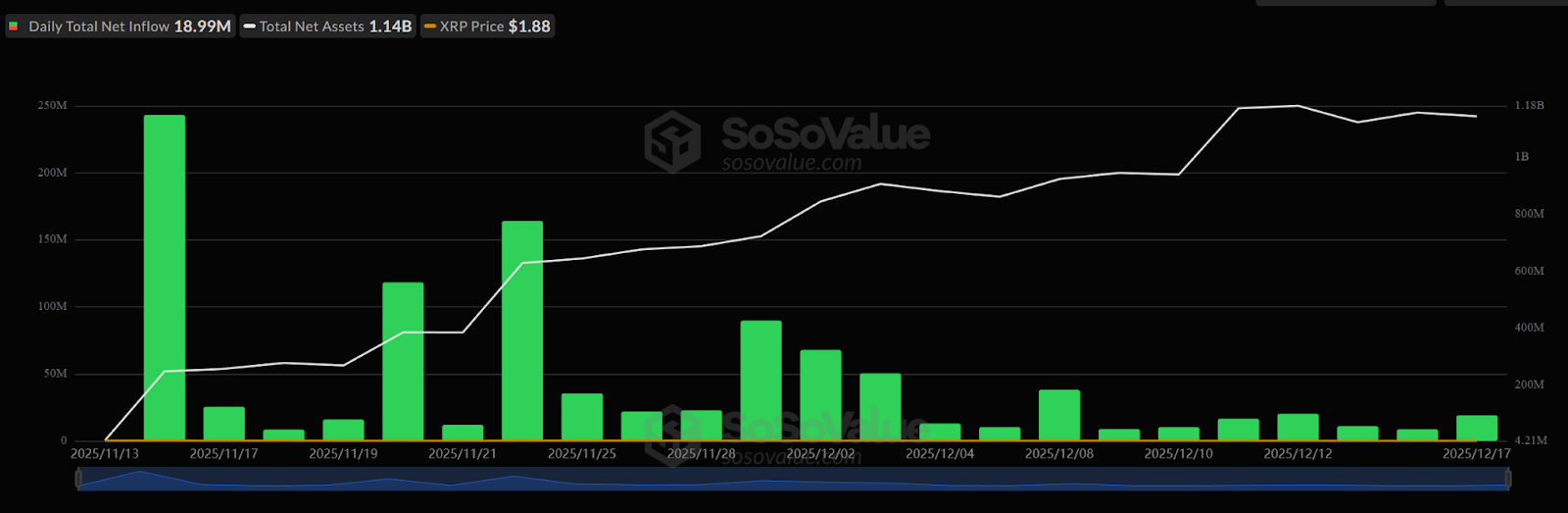

US spot XRP exchange-traded funds have attracted more than US$1 billion (AU$1.53 billion) in net inflows since launching in November, with no daily net outflows recorded over the period, according to SoSoValue data.

Source: SoSo Value.

Source: SoSo Value.

The flow pattern contrasts with other major crypto ETF categories over the same window. Bitcoin ETFs posted US$2.9 billion (AU$4.44 billion) in net outflows, while Ethereum products saw US$930 million (AU$1.42 billion) leave, according to DefiLlama.

Ripple CEO Brad Garlinghouse highlighted the streak on X, citing 30 straight days of net inflows.

Sygnum Bank CIO Fabian Dori described the XRP ETF demand as a practical signal of institutional access expanding, arguing that ETFs can improve market structure by making exposure simpler for traditional investors.

Read more: Strategy Scoops $980M in Bitcoin as BTC Slides Toward Annual Lows

Issuers Continue to Add XRP Products

Canary Capital’s XRP ETF launch on Nov. 13 drew US$250 million (AU$382.5 million), and its CEO previously projected US$5 billion (AU$7.65 billion) of first-month flows across XRP ETFs.

Vanguard, which manages about US$11 trillion (AU$16.83 trillion), opened access to crypto ETF trading in December, including XRP. Bitwise and Grayscale have also launched XRP ETFs, while DTCC listings indicate additional products from Franklin Templeton, 21Shares, ProShares and CoinShares.

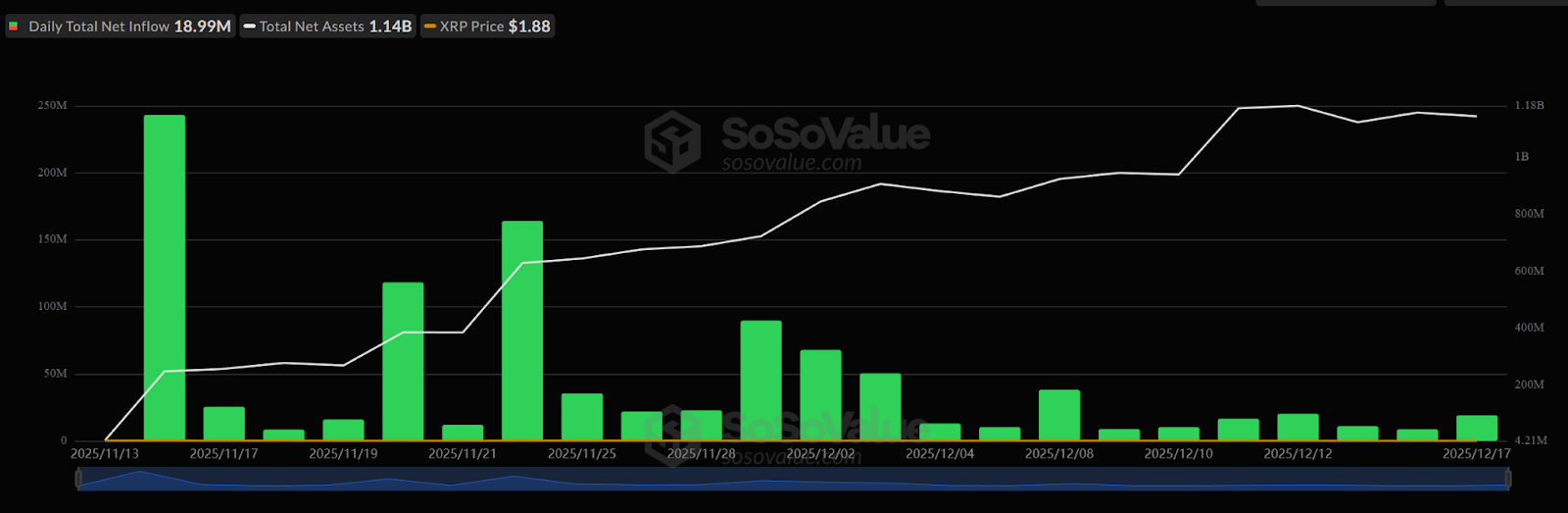

However, the ETF demand has not particularly boosted XRP’s price. The token slipped from fourth to fifth by market value, with BNB moving ahead, and remains about 47% below its US$3.65 (AU$5.58) all-time high set in July, during a broader crypto market drawdown of roughly US$1.4 trillion (AU$2.14 trillion).

XRP/USD. Source: TradingView.

XRP/USD. Source: TradingView.

Read more: US$4 Trillion JPMorgan Pushes Deeper Into Crypto With Ethereum Money-Market Fund

The post Ripple CEO Celebrates 30 Days of XRP ETF Inflows as Price Drops Below 2 USD appeared first on Crypto News Australia.

You May Also Like

US Ranks #1 in CoinGecko Global Meme Coin Interest Report

Tether CEO Delivers Rare Bitcoin Price Comment