Bitcoin Mining Stocks Rally: Bitfarms Surges 162%, Cipher Mining 40% in September

Bitfarms and Cipher Mining emerged as standout performers in September’s Bitcoin mining stock surge, with both companies posting remarkable gains as the sector outpaced Bitcoin itself by significant margins.

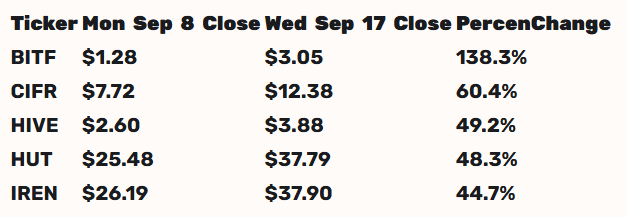

Bitcoin mining stocks experienced exceptional momentum throughout September 2025, with major players posting gains between 44% and 138% while Bitcoin declined more than 3% during the same period. Bitfarms (NASDAQ: BITF) and Cipher Mining (NASDAQ: CIFR) led this rally, showing strong investor appetite for Bitcoin mining companies.

Table of change in Bitcoin mining companies’ stock prices in September | Source: BlockSpace

Bitfarms Stock Activity Shows Great Momentum

Bitfarms stock reached a one-year high of $3.20 on September 18, marking ten consecutive days of gains and more than doubling in value over the past week. The stock closed at $3.19 with trading volume reaching nearly 174 million shares, compared to the three-month average of approximately 37.2 million shares, according to Yahoo! Finance.

Trading data from September shows Bitfarms gained more than 132% from its monthly opening price of $1.34 to its current level around $3.18. The company’s market capitalization has risen to approximately $1.769 billion, representing a more than 94% increase from its closing value at the end of 2024.

This year, they sold a BTC mining site in Paraguay to Hive Digital, and they reported selling 1,052 BTC in August 2025, which means they currently have a substantial amount of liquid assets. According to Blockspace, it has recently re-rated its Panther Creek site production, and the company has recently agreed to advance campus development with T5 Data Centers. This announcement could be part of this positive activity in its shares.

Cipher Mining Demonstrates Operational Growth

Cipher Mining advanced approximately 40% in September, with the stock reaching new 52-week highs at $12.66. The company’s shares have delivered an impressive 313% return over the past six months, positioning it as a key beneficiary of the AI infrastructure pivot trend, according to Yahoo! Finance.

Recent trading data shows CIFR’s daily volume averaging 35.4 million shares throughout September. The stock closed at $11.85 with a market capitalization of $4.66 billion, reflecting strong institutional interest in its dual mining and high-performance computing strategy.

In the case of Cipher, they presented an operational update on September 4, where they stated the addition of new capacity in production. Furthermore, their CEO, Tyler Pager, has kept market expectations for a significant deal by the end of 2025, likely related to Bitcoin mining or a pivot to AI.

Industry Pivot Drives Market Performance, Despite Increasing Mining Difficulty

The mining sector’s outperformance stems from companies diversifying beyond traditional Bitcoin mining into artificial intelligence and high-performance computing services. Hive Digital is accelerating its transition into AI data center infrastructure, while Iris Energy is ramping up operations with Blackwell GPUs.

Despite the sector’s strong performance, Bitcoin mining fundamentals remain under pressure. The Bitcoin network’s subsequent difficulty adjustment is projected to rise between 0.2% to 7.24%, marking the first epoch with an average hashrate above the zetahash mark. Transaction fees have slipped under 0.8% of monthly rewards, indicating weaker on-chain activity. Over time, it will become increasingly complex to acquire more BTC, which is the principal reason these companies are diversifying their investments.

nextThe post Bitcoin Mining Stocks Rally: Bitfarms Surges 162%, Cipher Mining 40% in September appeared first on Coinspeaker.

You May Also Like

Horror Thriller ‘Bring Her Back’ Gets HBO Max Premiere Date

VivoPower To Load Up On XRP At 65% Discount: Here’s How